Debt Relief in Action: Vermont

Over $6.7 million of debt resolved in the past two years

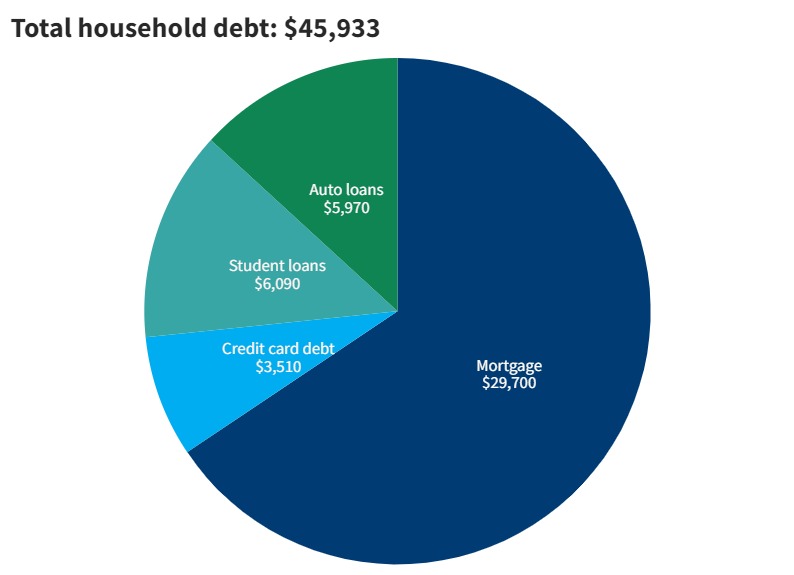

When it comes to personal debt, by and large residents of Vermont take the action they need to meet challenges head-on. So for instance, while Vermonters have student debt loads higher than the national average, they default at a much lower rate than the rest of the country. Residents also have lower rates of debts that lapse into delinquency with late payments, as well as debts that go into collections. Vermonters aren’t completely in the clear, though. The most popular type of credit card is balance transfer, which shows that many residents are still trying to eliminate debt.

One of the ways Vermonters with credit card debt have found to eliminate it is through credit counseling. The information below can help you understand how debt is impacting residents currently and how some have used credit counseling to find debt relief. If you’re facing your own challenges and need help, call us at (855) 973-0741 or complete an online application to request a confidential debt and budget analysis from a certified credit counselor at no charge.