Debt Relief in Action: Wyoming

Over $4.7 million of debt resolved in the past two years.

Usually getting ranked in the mid-to-low 30’s in a ranking of U.S. states is a bad thing, but when it comes to debt it’s good to be on the bottom. According to the Washington Post, Wyomingites rank 31st when it comes to high credit card debt balances.

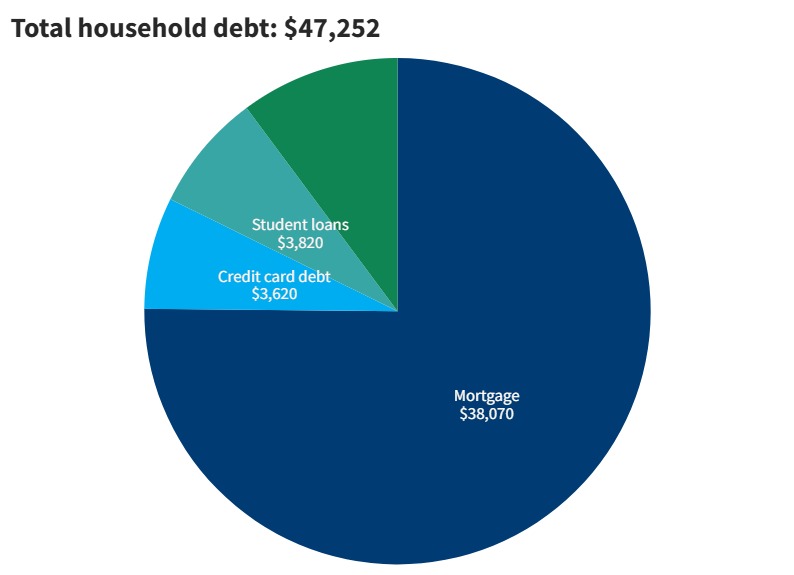

What’s more, those low rankings aren’t for a lack of financial challenges. In fact, the average credit user in Wyoming uses 34.88% of their available credit. Anything over 30% actually damages your credit score. The information below can help you understand the current state of debt in Wyoming and how some residents have used debt consolidation to take control. If you’re working to regain control, call (866) 448-1819 or complete an online application to schedule a free debt evaluation with a certified credit counselor.