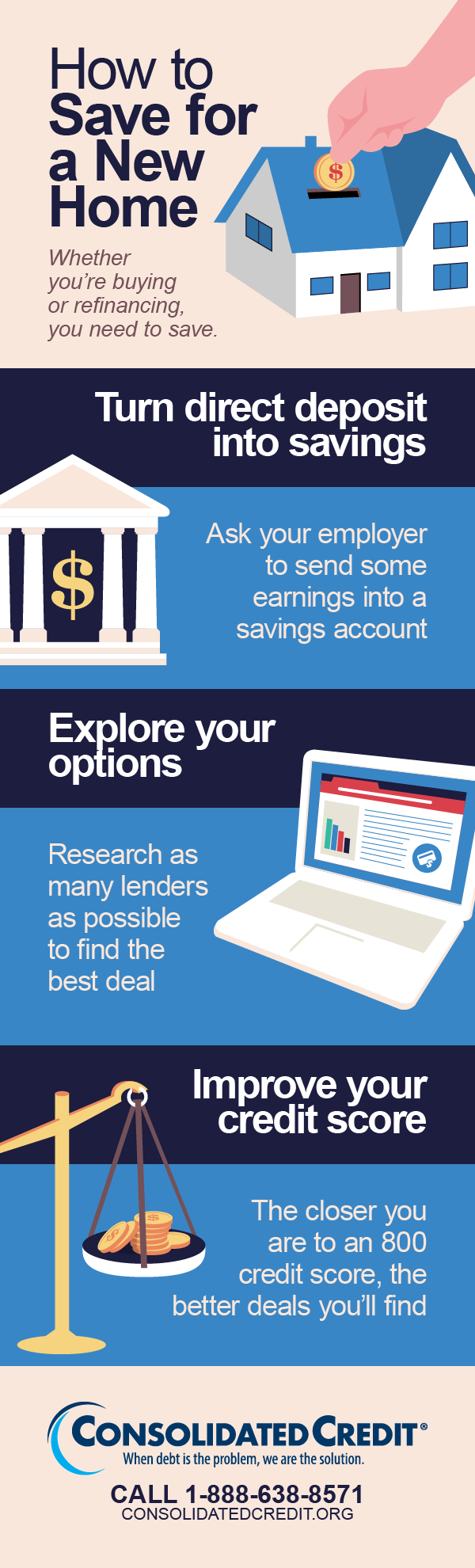

Whether you’re buying a new home or refinancing your current one, your finances need to be in shape.

Mortgage interest rates are at a historic low—making it the perfect time for first-time homebuyers and current homeowners to save money. And considering the mortgage debt in the U.S. is nearly $16 trillion according to HousingWire, it’s a good idea to save as much as you can.

Buying or refinancing can be overwhelming and frustrating. That’s why Consolidated Credit put together a free webinar, Buy or Refi: Which is Best for You? It will answer commonly asked questions like when the best time to refi is and what credit score you need to buy a home.

Buy or Refi: Which is Best for You?

A home is most people’s most valuable asset. Learning how to manage mortgage debt is essential. This free webinar will teach you how to weigh your options as a homeowner.

Before you buy or refi, talk to a certified credit counselor at Consolidated Credit. We can help lower your debt-to-income ratio and boost your credit score, which will make you significantly more likely to be approved for a mortgage.