As homeowners get older, they become eligible for a unique, low-risk borrowing option called a reverse mortgage. Yet, many don’t know how it works or if they would qualify. This month’s webinar will teach you the reality of reverse mortgages – and whether it’s right for you.

Why you should consider a reverse mortgage…

If you’ve owned your home for at least 10 years or more, you’ve likely built up a significant amount of equity, particularly if property values have risen in your area. A reverse mortgage allows you to use that equity without the usual risks of a home equity loan. Here are some reasons why you would consider getting one.

You meet the qualifications

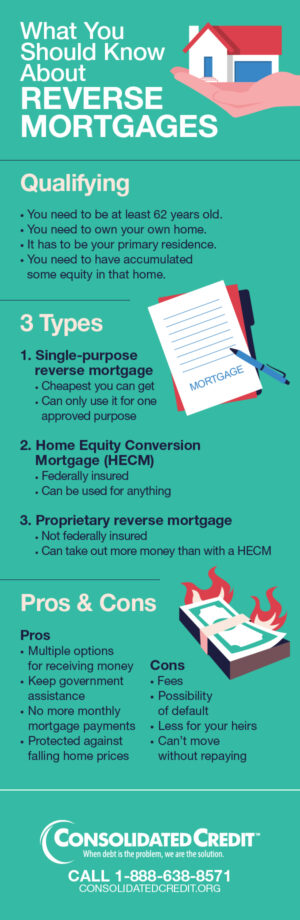

This is a reason to think about getting a reverse mortgage, but it’s also essential to the process. Meeting these qualifications is the only way to start the process:

- You need to own your own home.

- All owners listed on the title need to be at least 62 years old.

- It must be your primary residence.

- You need to have accumulated some equity in that home.

You need the extra money

A reverse mortgage can help you fund a project or simply act as supplemental income. If you meet the qualifications and want the extra cash, that’s a good reason to talk to your lender.

And don’t worry about losing your government benefits. Reverse mortgages don’t affect Supplemental Security Income (SSI) or Medicaid.

You want options

Reverse mortgages come in a few different varieties. You can get a line of credit that works like a home equity line of credit (HELOC). You could also get a lump sum of cash or get regular monthly disbursements. Or, you could even mix and match. If you want flexibility when using your home equity, a reverse mortgage could be a good choice.

Free Webinar: When to Use a Reverse Mortgage

Reverse mortgages are a financial tool available to senior homeowners. They can be extremely beneficial, but only when used correctly in the right situation. In this video, you’ll get a preview of what you can expect to learn in Consolidated Credit’s upcoming webinar. Join us August 12, 2020 at 1:00 PM (EST) to learn how reverse mortgages work and when it’s the right time and the wrong time to use one.

Maybe you’ve heard the term reverse mortgage, but do you know how it works? Like most financial ideas, reverse mortgages can save you money or cost you money. There’s a lot of hype about reverse mortgages these days. We’ll cut through it and show you when it will work for you. Tune in for our special reverse mortgage webinar. It’s free! Sign up now.

…And why a reverse mortgage could be a bad idea.

Accessing your home equity this way isn’t for everyone. In fact, there are some good reasons why you should be cautious.

Fees

Just like when you first got your mortgage, there are fees involved. They can be expensive, and could be a barrier to affording a reverse mortgage.

Possible default

Since you don’t make monthly payments on a reverse mortgage, there is a lower risk of default than other home equity options. However, if you don’t pay property taxes or fall behind on homeowner’s insurance, the bank won’t be happy. You could default and have your home repossessed.

Inheritance

With a reverse mortgage, passing your home down to your heirs may be more difficult. They will have to pay the remainder of what you borrowed (and then some) before they can have the home.

Not sure what’s right for you?

Gain a more thorough knowledge of reverse mortgages in our webinar on August 12, 2020, at 1 p.m.