Starbucks plans to launch a co-branded Visa rewards credit card, but is it the right choice for caffeine addicts on a budget?

These days, it seems like every company is jumping on the rewards credit card bandwagon. Both Uber and Lyft, for instance, have plans to launch ride hailing credit cards in the near future. Now Starbucks is jumping on the credit card rewards train, too. They recently announced plans to launch a credit card with Visa, featuring special coffee rewards strictly for the java lovers.

This co-branded Chase credit card will allow Starbucks fanatics to earn Starbucks rewards on purchases. They say that will include purchases made outside their stores. So, you can earn valuable coffee rewards on every purchase you make with the card. But is this really a strategic value or just another marketing ploy to get you in the doors?

Restrictions v. Rewards

In general, credit cards are more useful if they have less restrictions. For instance, that’s the whole marketing message that Capital One uses for their Venture card. It’s travel reward card that’s not limited to purchases from just one place. You earn double miles on every purchase, instead of just airline purchases. This typically makes the card more useful, because it’s not limited.

That’s the same concept they want to utilize for the Starbucks credit card. You can earn your coffee rewards with every purchase you make. The more you swipe the card, the more coffee you can get for free.

But purchase restrictions aren’t the only restrictions on a rewards credit card. You also have to consider redemption restrictions. Basically, the only place that you can redeem the rewards is Starbucks. So, if you happen to be travelling and stop in a Seattle’s Best Coffee, you’d be out of luck with this credit card.

This hits the nail on the head of why store-branded credit cards are often less recommended than general credit cards. If you have a Chase cash-back rewards credit card, then you can use the rewards you earn anywhere, including to buy coffee. It begs the question of the value of a credit card that can only be redeemed in one place.

Credit card selection is highly personal

“Store-branded credit cards aren’t always a bad choice,” explains April Lewis-Parks, Financial Education Director for Consolidated Credit. “If a credit card fits your purchasing habits and you can afford to manage the debt comfortably within your budget, one of these cards could be a wise choice. Of course, Starbucks is not always the wisest choice, itself, if you’re living on a tight budget.”

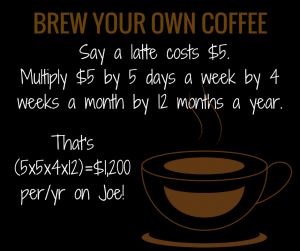

Consolidated Credit’s budget experts did the math. If you make your morning coffee at home instead of hitting Starbucks, you save an average of $1,200 per year. And that’s the savings if you drink a Grande Daily Brew. If you’re getting Venti Frappucinos or Pumpkin Spice Lattes every morning, you might even double those savings.

In fact, brewing coffee beverages at home is one of the ways that our certified credit counselors recommend when someone is struggling to make ends meet. That list also includes things like taking your lunch to work, and buying groceries instead of dining out. To put a frugal spin on an old adage, if you want something done for less money, you should do it yourself.

“That being said, deciding on what discretionary expenses to keep or cut really depends on your personal tastes,” Lewis-Parks says. “If you’re a true coffee addict, giving up your Starbucks may feel like cutting off a limb. And if so, you’ll be less likely to stick to your budget. In this case, you might be better off cutting something else that you’re not so attached to. And if daily trips to Starbucks are your ritual, then it might make sense to get a branded Starbucks credit card.”