English speakers 4x more likely to spend over $1,000 on the holidays than Spanish speakers.

English and Spanish-speaking Americans have similar holiday shopping plans this year. Of the 1,060 U.S. consumers people polled by Consolidated Credit, most prefer shopping online rather than in-store for the holidays. People polled said they make an average of 1-5 online monthly purchases, primarily using their smartphones.

Despite these similarities in their holiday shopping habits, English speakers spend more money on the holidays, make more online purchases, and have less credit card debt than Spanish-speaking holiday shoppers, who spend less and at a lower frequency.

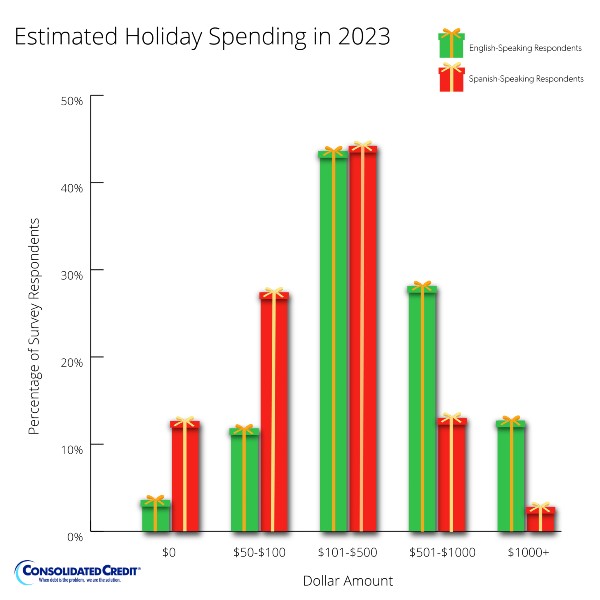

Most of the polled anticipate spending at least $50 for the winter season’s festivities: 96% of English speakers and 87% of Spanish speakers. What’s more surprising than there being people who don’t plan on spending anything at all for the holidays, is that those who fall into this group are 3.5 times more likely to be Spanish speakers.

At the other end of the spectrum, the opposite is true. English-speaking shoppers are 4 times more likely to spend over $1,000 on the holidays than Spanish speakers) and over a third plan on spending more than $500.

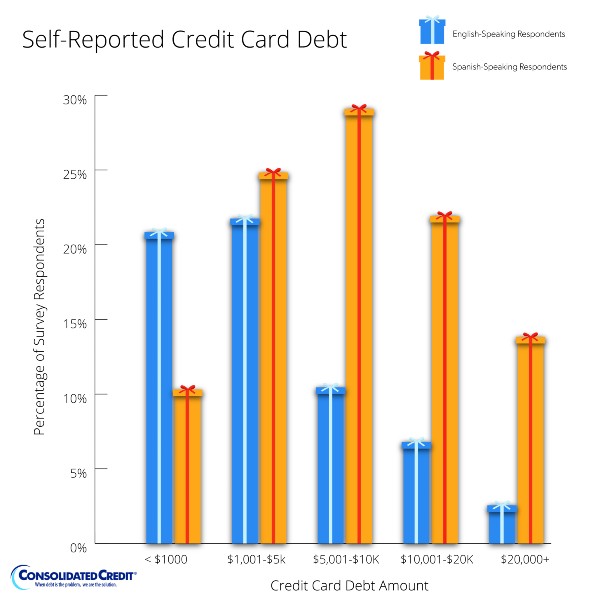

One possible reason for this disparity: Spanish speakers appear to have far more financial baggage than their English-speaking counterparts. This same Consolidated Credit poll found that the majority of English speakers have between $1,000 and $5,000 in credit card debt (34.9%). Spanish speakers have twice as much; with 29.1% reporting to be carrying $5,000 – $10,000 in balances.

But it’s not just shoppers with pre-existing debt who need to be mindful of their spending this holiday season. Unrelenting inflation means that most of the touches that make the season merry and bright are more expensive than ever. And with average credit card APRs of 22%, relying on credit cards to cover these holiday costs can quickly snowball into a pile of troublesome debt into the new year.

Consolidated Credit believes that language shouldn’t be a barrier to financial wellness and offers free budget and debt counseling in both English and Spanish. Contact us today to speak to a certified credit counselor for a free and confidential debt analysis.