Most Americans will add debt and stress to their gift lists this year.

The interesting studies

This time of year, pollsters love to ask Americans how much they’re spending on the holidays. A recent survey from the National Retail Federation projects that the average person will spend $890 on seasonal expenses like gifts, decorations, and food.

But how will shoppers cover the costs?

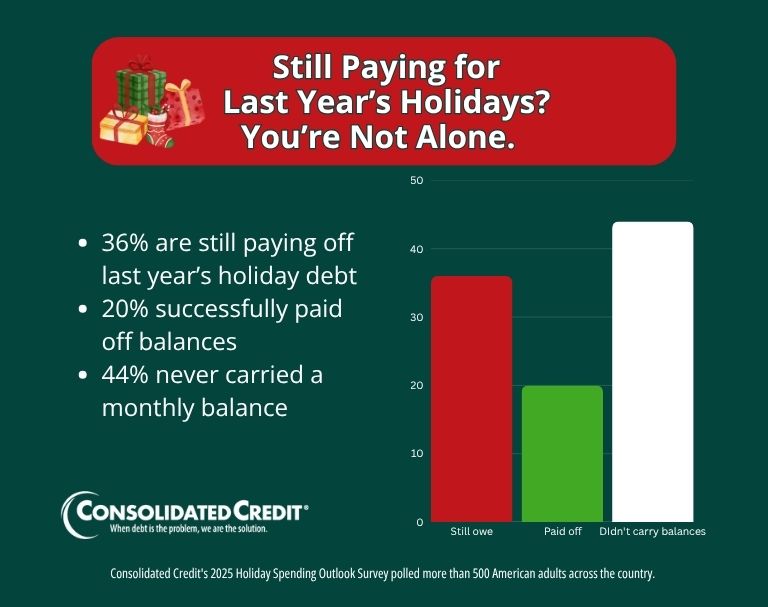

The unfortunate trend for this season points to a wave of shoppers financing their holiday purchases. According to another poll, many still haven’t paid down last year’s festivities.

The big results

Consolidated Credit’s latest holiday research confirms that more than 1 in 3 (36%) Americans are still paying for last year, while only 20% have paid it off.

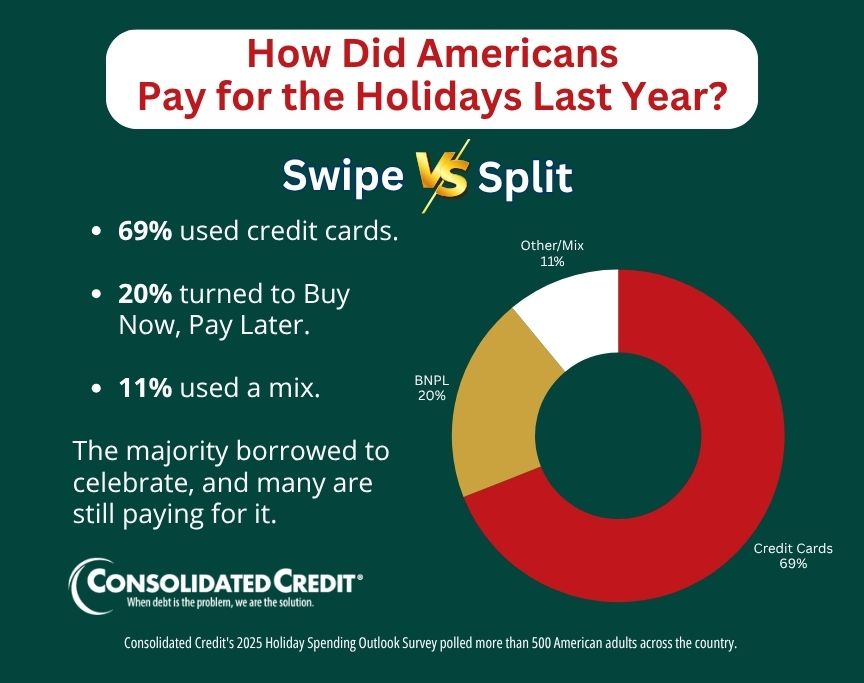

Nearly 7 in 10 used credit cards to pay for their holiday celebrations, while 20% financed with Buy Now, Pay Later. More than 30% are currently $500 or more in debt from the 2024 holiday season, and 17% are $1,000 in holiday debt as the 2025 holiday shopping season kicks off.

This year, half still plan on funding their holiday festivities with credit cards. One in three will use cash or their debit cards. The costs are contributing to stress. In a survey of 2,000 Americans commission by Fintech company Current, 70% say the holidays are “the most stressful time of the year.”

“The holidays are an expensive season for everyone, with costs piling up between gifts, food, travel and decor, but for Americans living paycheck to paycheck, the pressure is even greater,” said Erin Bruehl, vice president of communications, Current. “After a year with economic challenges, including people still feeling the effects of inflation on the prices of everyday essentials, many Americans are especially worried this year about how they can afford to celebrate within their already tight budgets.”

The effective solutions

One common reason for overspending is a self-imposed pressure to impress family, friends, and colleagues. This pressure can lead to broken budgets and financial woes.

Many Americans fear they are judged on the price tag of the gifts they give. Others feel they need to buy something for everyone they know. Keeping up with peers’ spending habits can also ruin holiday joy, especially for lower income households.

These distorted holiday beliefs (fed by incessant holiday marketing) need to be debunked before they bring overwhelming debt into the new year.

What you can do

It’s not too late to avoid the stress and the debt of holiday spending. Here are three easy steps to boost your budgeting power this season…

- Embrace technology. No, this doesn’t mean buying more high-tech presents. Use digital tools like Consolidated Credit’s Holiday Spending Planner to get your spending plan customized and organized before you shop.

- Budget online. Sign up for a secure and easy-to-use online budgeting tool. These apps let you easily categorize your income and expenses at the click of a button, simplifying the act of balancing your budget.

- Study up. Check out Consolidated Credit’s Holiday Survival Guide for a look at dozens of ways to save big. You can explore creative gift ideas that won’t hurt your wallet, and even find inspiration for new (and inexpensive) holiday traditions.