How to start the New Year on the right financial foot.

It’s all too easy to overspend during the holidays. Even worse, many will still be paying off those bills by the time the holidays roll around again.

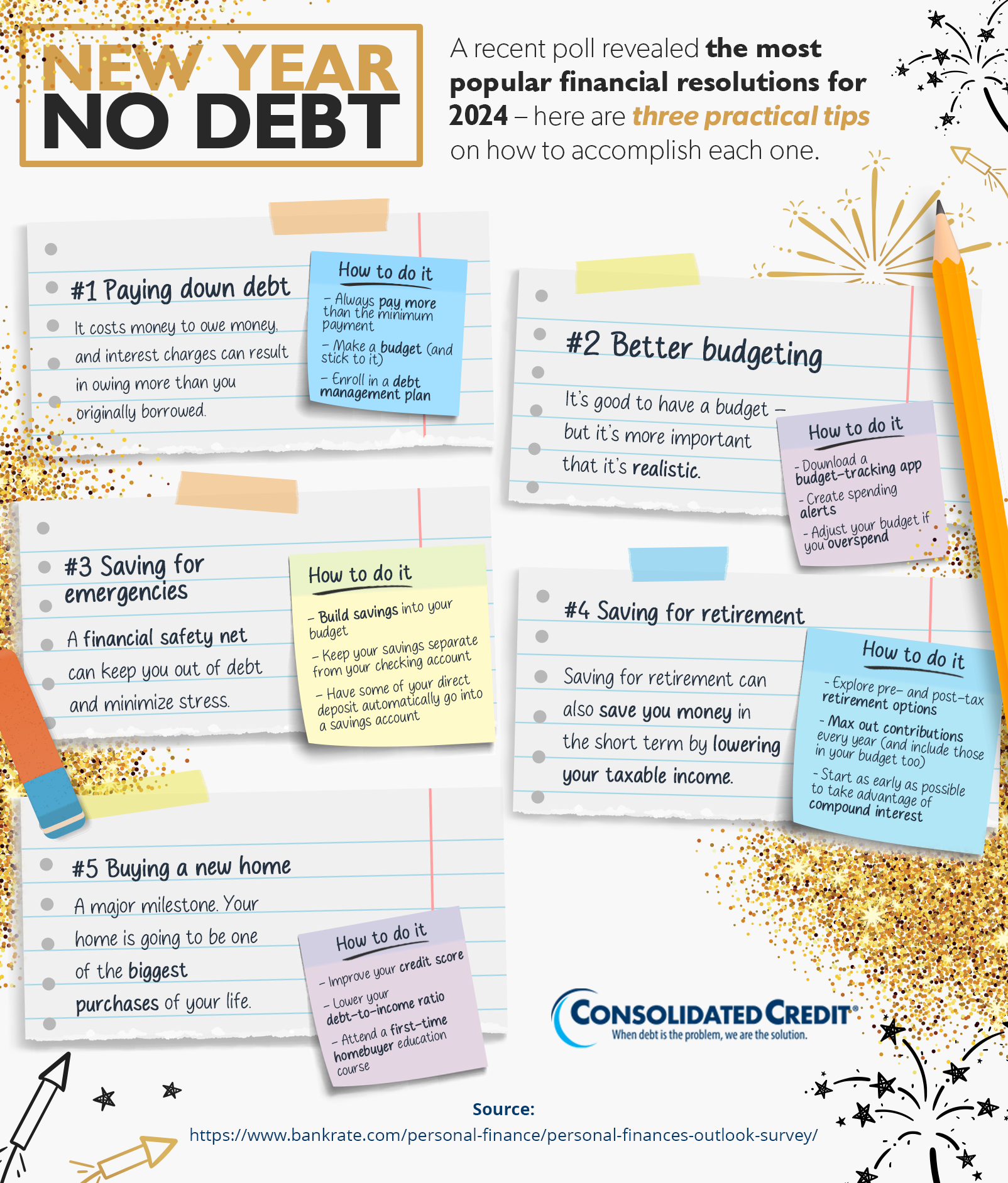

How to Become Financially Stable in 2025

Most Americans don’t get into holiday debt because they’re irresponsible or frivolous. The real culprits are high balances and high interest rates. Despite inflation squeezing people’s budgets and making it harder to get ahead of debt. it is possible to pay off holiday debt and get on the right financial foot in the New Year. The first step is understanding the spending traps that most people fall into. Next? Taking steps to rectify those pitfalls as quickly as possible.

Budgeting

The first rule of personal finance is that you can’t save money if you don’t know how much you’re spending. If you’ve survived this long without a monthly budget, it’s not too late to start.

Write down the exact amount of money you receive from each of your paychecks. If you’ve got any side hustles or if you do any freelance work, write down approximately how much you make from those gigs every month. Make sure to be practical and list the income you actually receive not what you expect to receive.

List all debts and their interest rates

From there, you’ll want to make a four-column chart that lists each of your debts: the total amount you owe, the interest rate, and the monthly payment. Add up all the monthly payments to see how much you are losing to debt every month.

And then you can start making the necessary cuts to luxury items like costly subscriptions or cable and satellite TV. Maybe you’ll even consider cutting back to a cheaper phone plan or a slower internet connection.

Cut back to survival expenses

Start by figuring out how much you spend each month. Go through your credit card and bank statements from the previous month and check to see how much you spent. Did you splurge on food or stick to your grocery list? Did you buy a luxury item that you didn’t really need?

What you’ll want to do is cut back to your basic needs. Make sure you’re covered with food, shelter, and water. Then you’ll want to make sure you’ve got the mortgage or rent covered along with utilities. Your health should also be a priority, so make sure you add up your prescriptions or medical expenses. Finally, you’ll want to have a little safety net in case you have a car breakdown or a leaky roof.

Get credit counseling to improve the new year

If you have steep and stubborn holiday bills, it may be time you consult the professionals. You’ll first need to get a debt diagnosis. At nonprofit credit counseling agencies, a counselor will give you a free debt analysis. They’ll give you a list of debt-busting options!

So, if you or someone you know is looking for a means of getting out of credit card debt as quickly as possible, call Consolidated Credit.

Get a free debt and budget evaluation to discuss options for relief.