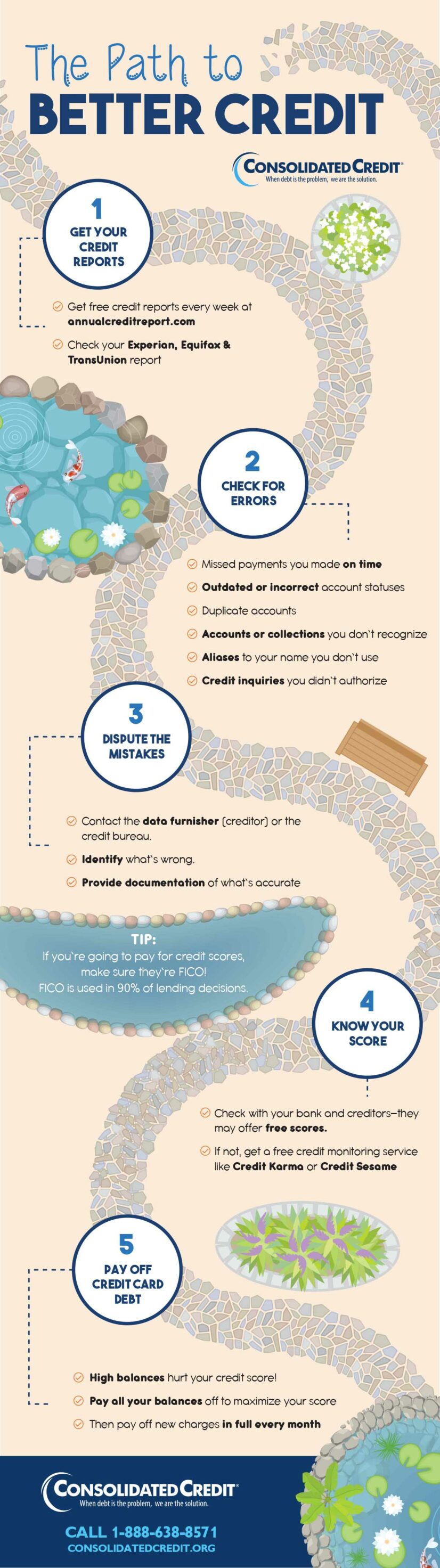

Achieving good credit may seem like an impossible journey, but the path to an excellent score can be easier than you think. This infographic walks you through the steps you need to take to get the credit you want.

The Path to Better Credit 1. Get your credit reports • Get free credit reports every week @ annualcreditreport.com • Check your Experian, Equifax & TransUnion report 2. Check for errors • Missed payments you made on time • Outdated or incorrect account statuses • Duplicate accounts • Accounts or collections you don’t recognize • Aliases to your name you don’t use • Credit inquiries you didn’t authorize 3. Dispute the mistakes 1. Contact the data furnisher (creditor) or the credit bureau 2. Identify what’s wrong 3. Provide documentation of what’s accurate 4. Know your score 1. Check with your bank and creditors— they may offer free scores 2. If not, get a free credit monitoring service like Credit Karma or Credit Sesame TIP: If you’re going to pay for credit scores, make sure they’re FICO! FICO is used in 90% of lending decisions. 5. Pay off credit card debt • High balances hurt your credit score! • Pay all your balances off to maximize your score • Then off new charges in full every month

Get a free debt evaluation from a certified credit counselor to discover credit-safe ways to pay off your debt.