Credit cards seen as a curse and a blessing by Hispanics.

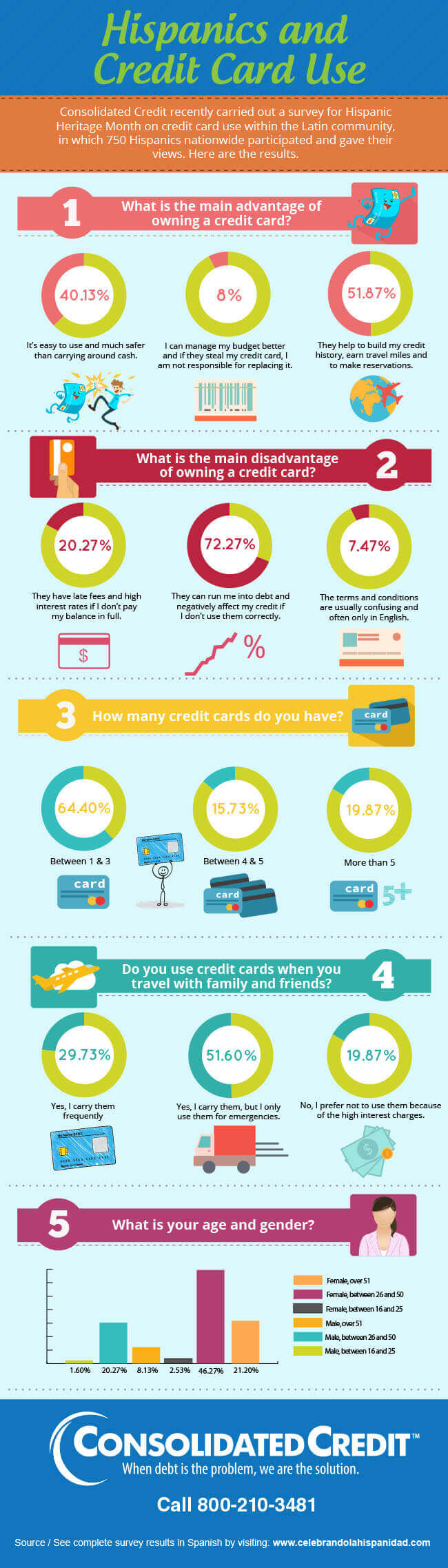

Consolidated Credit polled 750 Hispanic credit users nationwide to learn about their views on credit and how they use credit cards every day.

Credit card use is one of the easiest methods of building credit to achieve a good credit score. A credit card is also more convenient and often much safer than carrying around cash. However, if misused, credit cards can cause stress, financial problems and debt.

For Hispanics, this double-edged sword can be particularly problematic – especially for members of the community who are new to the U.S. Credit systems work differently in different countries, so it can be hard to adapt to the system used here. As a result, Latinos have trouble building credit quickly and often encounter trouble with debt.

Here are a few tips to help avoid falling into the credit card trap…

Avoid taking on more credit cards than you can handle

Although there is no magic formula for the number of credit cards that a person should have, if you’re new to credit, a great starting point would be having two major bank cards and a store card. Don’t fall for the enticing incentives on new accounts. Pay your bills on time, and in full to avoid interest and late fees.

Avoid credit cards with high interest rates

When you first start using credit, don’t be enticed by credit cards that offer special rewards like travel miles or cash back. Focus instead on finding a credit card with the lowest interest rate possible. The lower your interest rate the less money will build up if you carry a balance over from one month to the next. Remember though, it’s always best to pay your balances off in full every month to avoid interest charges. However, a low interest rate will help you avoid financial distress if you can’t pay the balance off because you have an “expensive month.”

Budget for the holidays, avoid using credit cards

The holidays are a time of gift-giving and celebration, so people tend to spend more. A great way to avoid overspending is by planning ahead. Budget for parties, get-togethers, gifts, and holiday travel to avoid running up debt on your credit cards. For more tips on having a debt-free holiday, Consolidated Credit offers a free Holiday Survival Guide that will help you plan.

If you’re struggling with high credit card debt, Consolidated Credit may be able to help. Dial (844) 276-1544 to speak with one of our certified credit counselors. You may also complete an online application to request a free, confidential debt and budget evaluation.