Protecting your identity from personal data doppelgangers.

Identity theft is a serious problem in the U.S. and new technology is only making it easier to steal your data. Here’s what you need to know if you want to keep your identity safe in 2018.

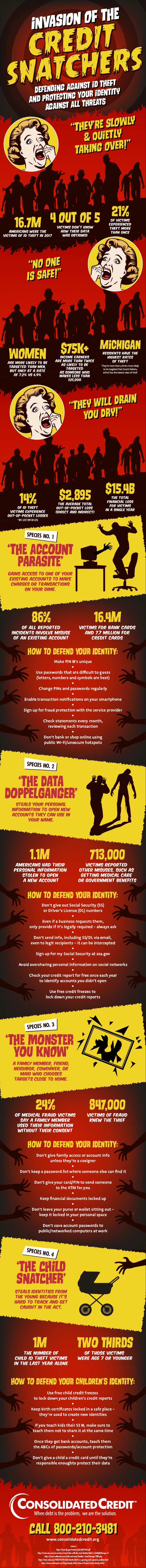

Invasion of the Credit Snatchers Defending against ID theft and protection your identity against all threats. “They’re slowly and quietly taking over!” 16.7 million Americans were the victims of ID theft in 2017 4 out of 5 victims don’t know how their data was obtained 21% of victims experienced theft more than once “No one is safe!” Women are more likely to be targeted than men, but only at a rate of 7.2% vs 6.9% $75K+ income earners are more than twice as likely to be targeted as someone who makes less than $25,000 Michigan residents have the highest rates of theft They’re more than 3 times more likely to be targeted than South Dakota, which has the lowest rates of theft “They will drain you dry!” 14% of ID theft victims experience out-of-pocket losses *49% lost $99 or less $2,895 the average total out-of-pocket loss (direct and indirect) $15.4 billion the total financial loss for victims in a single year Species No 1: The Account Parasite Gains access to one of your existing accounts to make charges or transactions on your dime. 86% of all reported incidents involve misuse of an existing account 16.4 million victims for bank cards and 7.7 million for credit cards How to defend your identity: • Make PIN #’s unique • Use passwords that are difficult to guess (letters, numbers and symbols are best) • Change PINs and passwords regularly • Enable transaction notifications on your smartphone • Sign up for fraud protection with the service provider • Check statements every month, reviewing each transaction • Don’t bank or shop online using public Wi-Fi / unsecure hotspots Species No. 2: The data doppelganger Steals your personal information to open new accounts they can use in your name 1.1 million Americans had their personal information stolen to open a new account 713,000 victims reported other misuses, such as getting medical care or government benefits How to defend your identity: • Don’t give you Social Security (SS) or Driver’s license (DL) numbers • Even if a business requests them, only provide if it’s legally required – always ask • Don’t send info, including SS/DL via email, even to legit recipients – it can be intercepted • Sign up for my Social Security at ssa.gov • Avoiding oversharing personal information on social networks • Check your credit reports for free once each year to identify account you didn’t open • Use free credit freezes to lock down your credit reports Species No. 3: The monster you know A family member, friend, neighbor, coworker or maid who chooses targets close to home. 847,000 victims of fraud knew the thief 24% of medical fraud victims say a family member used their information without their consent How to defend your identity: • Don’t give family access or account info unless they’re a cosigner • Don’t keep a password list where someone else can find it • Don’t give your card/PIN to send someone to the ATM for you • Keep financial documents locked up • Don’t leave your purse or wallet sitting out – keep it locked in your personal space • Don’t save account passwords to public/networked computers at work Species No. 4: The child snatcher Steals identities from the young because it’s hard to track and get caught in the act. 1 million the number of child ID theft victims in the last year alone Two thirds of those victims were age 7 or younger How to defend your children’s identity: • Use free child credit freezes to lock down your children’s credit reports • Keep birth certificates locked in a safe place – they’re used to create new identities • If you teach kids their SS #, make sure to teach them not to share it at the same time • Once they get bank accounts, teach them the ABCs of passwords/account protection • Don’t give a child a credit card until they’re responsible enough to protect their data Sources: https://www.bjs.gov/content/pub/pdf/vit14.pdf https://www.msn.com/en-us/news/crime/states-with-the-most-identity-theft/ss-AAvRgI8#image=51 https://www.creditcards.com/credit-card-news/familiar_fraud-damage-1282.php https://www.cnbc.com/2018/04/24/child-identity-theft-is-a-growing-and-expensive-problem.html https://www.creditrepair.com/blog/identity-theft/victim-of-friends-family-identity-theft/

The range of ways that identity thieves can get their hands on your personal information and credit data is only getting wider and more varied. As technology makes it easier for consumers to access and use financial accounts and credit, it also increases the potential for ID theft.

What to do if your identity is snatched

Take these ten steps if you find your personal information has been compromised:

- If you believe any specific accounts have been compromised, contact those credit issuers and financial institutions to let them know.

- When possible (usually for credit cards), place alerts on those accounts so the creditor will be required to call you to verify those purchases.

- In the case of debit cards or credit cards that you know for certain are in use by someone else, cancel those cards and have new ones issued.

- If you have incurred any losses from the theft, file a police report – you may need it to mitigate the losses and if you file an ID theft claim with the FTC.

- You should also contact each credit bureau to report the issue so you can place a fraud alert on your credit report. You can access each bureau’s identity theft portal using the following links: Experian, Equifax, TransUnion.

- By placing an initial fraud alert any creditor, lender, or other financial institution must verify new account creation with you before the account can be opened; you will also be blocked from any pre-screened credit offers. The alert will remain in place for 90 days.

- You only have to contact one bureau – they will contact the other two bureaus to report the alert request.

- Note that by placing a fraud alert, you are entitled to receive an additional free copy of your credit report from each credit bureau. This way, you can check for fraud.

- If an account is opened in your name – even if it happens before you can place the alert – you are permitted to request a copy of the credit or loan application; the business must respond within 20 days.

- You should also report the theft through the FTC website.