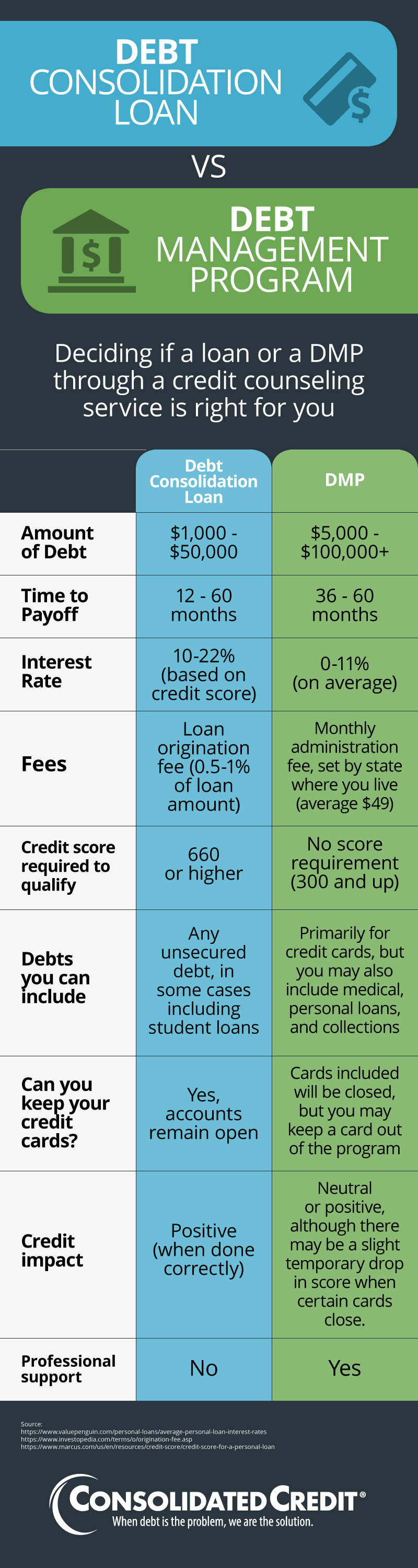

Consolidation loans and debt management programs both allow consumers to consolidate credit cards and other unsecured debts. They both can combine multiple bills into one, affordable monthly payment while minimizing interest. Here is how these two consolidation options compare:

Debt Consolidation Loan vs Debt Management Program: Deciding if a loan or DMP through a credit counseling service is right for you Amount of Debt: Debt Consolidation $1,000-$50,000, DMP $5,000-$100,000+ Time to Payoff: Debt Consolidation 12-60 months, DMP 36-60 months Interest Rate: Debt Consolidation 10-22% (based on credit score), DMP 0-11% (on average) Fees: Loan origination fee (0.5-1% of loan amount), DMP monthly administration fee, set by state where you live (average $49) Credit score required to qualify: Debt consolidation 660 or higher, DMP no score requirement (300 and up) Debts you can include: Debt consolidation any unsecured debt, in some cases including student loans, DMP primarily for credit cards, but you may also include medical, personal loans, and collections Can you keep your credit cards? Debt consolidation yes, accounts remain open, DMP cards included will be closed, but you may keep a card out of the program Credit impact: Debt consolidation positive (when done correctly), DMP neutral or positive, although there may be a slight temporary drop in score when certain cards close Professional support: Debt consolidation no, DMP yes Source:https://www.valuepenguin.com/personal-loans/average-personal-loan-interest-rateshttps://www.investopedia.com/terms/o/origination-fee.asphttps://www.marcus.com/us/en/resources/credit-score/credit-score-for-a-personal-loan

Want to know which option is right for you? Talk to a certified credit counselor for a free analysis.