Making sure you hit key milestones on your road to retirement.

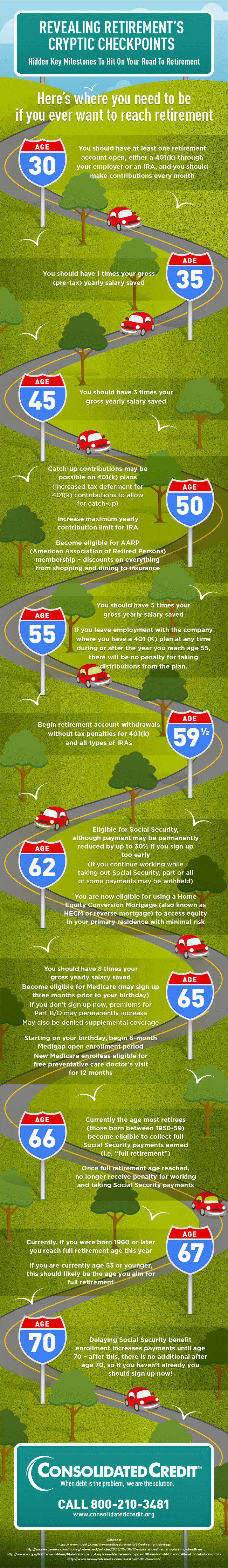

The road to retirement isn’t the same for everyone, but the infographic below provides key milestones you need to meet along the way if you want to retire on time in the way you want.

Those mid-decade milestones are the key to ensuring you’re on track with your retirement savings. If you see you aren’t quite at the level indicated for your age, then you need to be more aggressive with your saving strategy. This means finding ways to allocate more money each month so you can make larger contributions to your retirement plans, such as your 401(k) through your employer and/or your private IRA retirement accounts.

Steps to Increase Cash Flow for Savings

- Categorize and total up all financial transactions made in the past month

- Compare those totals to the spending targets set in your budget

- Identify spending leaks – this is anywhere you’re spending more than intended

- Close the leaks by cutting extra discretionary spending you may have for that expense. For instance, if your food costs are too high, you may be eating out too much.

- Once spending leaks are closed, continue to increase cash flow by cutting out on other discretionary expenses that may be nice to have but not necessary, like magazine subscriptions, gym memberships, or weekly trips to the salon.

Of course, your ability to save effectively for retirement may also be dependent on how much of your income is currently being used to pay off debt. The higher your credit card bills, the less money you’ll have available for retirement savings. With that in mind, if you’re too strapped for cash to save for your golden years, we can help. Call Consolidated Credit today at (844) 276-1544 or complete an online application to request a free, confidential debt and budget evaluation from a certified credit counselor.