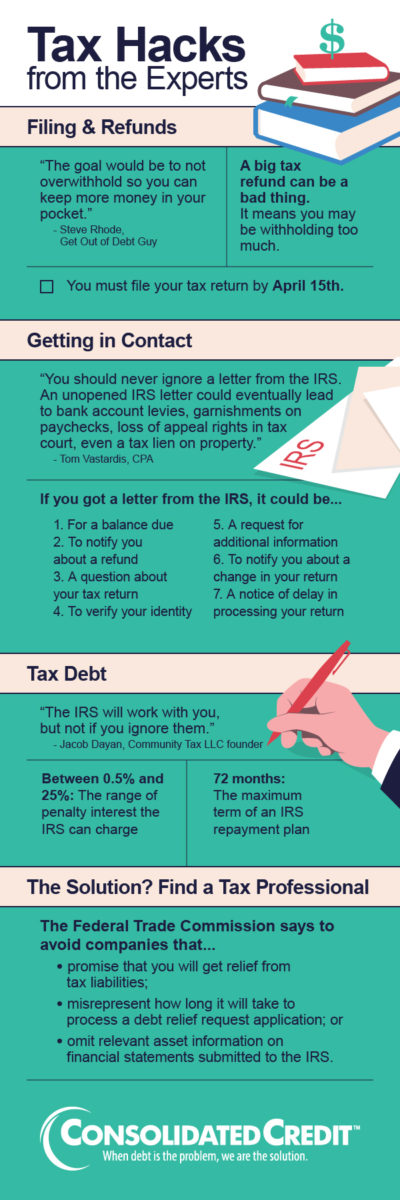

Tax season is almost upon us. The earlier you file, the sooner you can get your refund. But is a big refund every year really the right thing? This infographic offers some helpful tips for tax season. Whether you just need to file or you think you might owe, here’s what you need to know…

Tax Hacks From the Experts Filing and Refunds “The goal would be to not overwithhold so you can keep more money in your pocket.” Steve Rhode, Get Out of Debt Guy A big tax refund can be a bad thing. It means you may be withholding too much. You must file your tax return by April 15th. Getting in Contact “You should never ignore a letter from the IRS. An unopened IRS letter could eventually lead to bank account levies, garnishments on paychecks, loss of appeal rights in tax court, even a tax lien on property.” Tom Vastardis, CPA If you got a letter from the IRS, it could be… 1. For a balance due 2. To notify you about a refund 3. A question about your tax return 4. To verify your identity 5. A request for additional information 6. To notify you about a change in your return 7. A notice of delay in processing your return Tax Debt “The IRS will work with you, but not if you ignore them.” – Jacob Dayan, Community Tax LLC founder Between 0.5% and 25%: The range of penalty interest the IRS can charge 72 months: The maximum term of an IRS repayment plan. The Solution? Find a Tax Professional The Federal Trade Commission says to avoid companies that… ● promise that you will get relief from tax liabilities; ● misrepresent how long it will take to process a debt relief request application; or ● omit relevant asset information on financial statements submitted to the IRS.