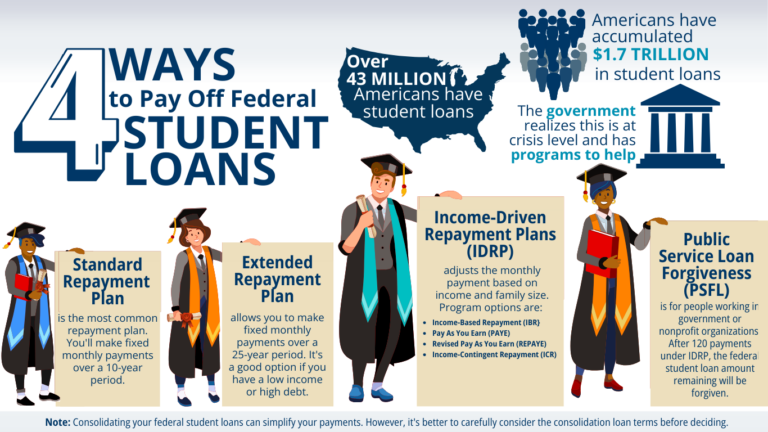

Navigating student loan rules can be overwhelming. The sheer volume of programs and ever-changing regulations makes it difficult to determine the best repayment strategy for your unique circumstances. Here are 4 of the most popular federal student loan repayment plans.