Millions of Americans fall victim to economic abuse each year.

Economic abuse can come in many forms. This infographic offers examples of economic abuse and tips on how victims can overcome their situation to find physical and financial freedom.

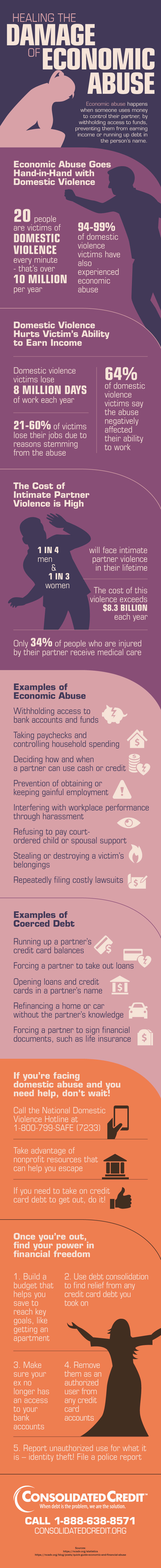

Healing the Damage of Economic Abuse Economic abuse happens when someone uses money to control their partner, by withholding access to funds, preventing them from earning income or running up debt in the person’s name. Economic Abuse Goes Hand-in-Hand with Domestic Violence 20 people are victims of domestic violence every minute – that’s over 10 million per year 94-99% of domestic violence victims have also experienced economic abuse Domestic Violence Hurts Victim’s Ability to Earn Income Domestic violence victims lose 8 million days of work each year 64% of domestic violate victims say the abuse negatively affected their ability to work 21-60% of victims lose their jobs due to reasons stemming from the abuse The Cost of Intimate Partner Violence is High 1 in 3 women and 1 in 4 men will face intimate partner violence in their lifetime Only 34% of people who are injured by their partner receive medical care The cost of this violence exceeds $8.3 billion each year Examples of Economic Abuse • Withholding access to bank accounts and funds • Taking paychecks and controlling household spending • Deciding how and when a partner can use cash or credit • Prevention of obtaining or keeping gainful employment • Interfering with workplace performance through harassment • Refusing to pay court-ordered child or spousal support • Stealing or destroying a victim’s belongings • Repeatedly filing costly lawsuits Examples of Coerced Debt • Running up a partner’s credit card balances • Forcing a partner to take out loans • Opening loans and credit cards in a partner’s name • Refinancing a home or car without the partner’s knowledge • Forcing a partner to sign financial documents, such as life insurance If you’re facing domestic abuse and you need help, don’t wait! • Call the National Domestic Violence Hotline at 1-800-799-SAFE (7233) • Take advantage of nonprofit resources that can help you escape • If you need to take on credit card debt to get out, do it! Once you’re out, find your power in financial freedom 1. Build a budget that helps you save to reach key goals, like getting an apartment 2. Use debt consolidation to find relief from any credit card debt you took on 3. Make sure your ex no longer has an access to your bank accounts 4. Remove them as an authorized user from any credit card accounts 5. Report unauthorized use for what it is – identity theft! File a police report Sources: https://ncadv.org/statistics https://ncadv.org/blog/posts/quick-guide-economic-and-financial-abuse

Economic abuse isn’t always extreme

As you can see from the infographic, there are a broad spectrum of actions that count as economic abuse. The extreme end involves a partner that completely controls the household finances. The other partner must give up their paychecks, can’t access bank accounts and must fight for money even for necessary expenses, like groceries.

But at the other end of the spectrum you have actions that are less extreme, but not less damaging the other partner’s finances. Making charges on a partner’s credit card without their authorization and making all the financial decisions without input from the other person are also forms of economic abuse. In some cases, the abusive partner may not see their actions as malicious – they’re handling all the finances to “save” their partner from the hassle.

However, even if these actions aren’t done with malicious intent, they are no less damaging.

Economic abuse is often a key reason why victims feel trapped

“When one partner has all the financial control, it can make it extremely tough to get out of a bad situation,” says Gary Herman, President of Consolidated Credit. “Abuse victims are often forced to try and stash money away so they can make their exit when the opportunity arises. The situation is even more complicated when there are children involved.”

Herman encourages anyone suffering in this type of situation to reach out for help. There are nonprofit organizations that offer financial support for victims that need help getting out. Start by calling the National Domestic Violence Hotline at 1-800-799-SAFE (7233).

“And while I usually don’t encourage people to take on credit card debt, in this case I do,” Herman says. “You can get help to solve your debt problems later once you’ve made it out. Even if you don’t know how you’ll pay the money back, don’t stay in a bad situation because of it. Get out immediately, use whatever means necessary and know that there are resources to help you on the other side.”

Ending a relationship isn’t always the end of economic abuse

There’s a common misconception that domestic abuse ends when a person gets out of their bad relationship. But like other forms of abuse, such as mental and emotional abuse, economic abuse can continue long after two people go their separate ways.

“Ugly breakups and divorces are a breeding ground for economic abuse,” Herman explains. “Even if there wasn’t economic abuse in the relationship, a bad breakup can push people over the edge. Partners can hold alimony and child support hostage if certain demands aren’t met. An ex can constantly file frivolous lawsuits to try and get back at you. So, you can’t assume that you’ll be free and clear just because you end the relationship.”