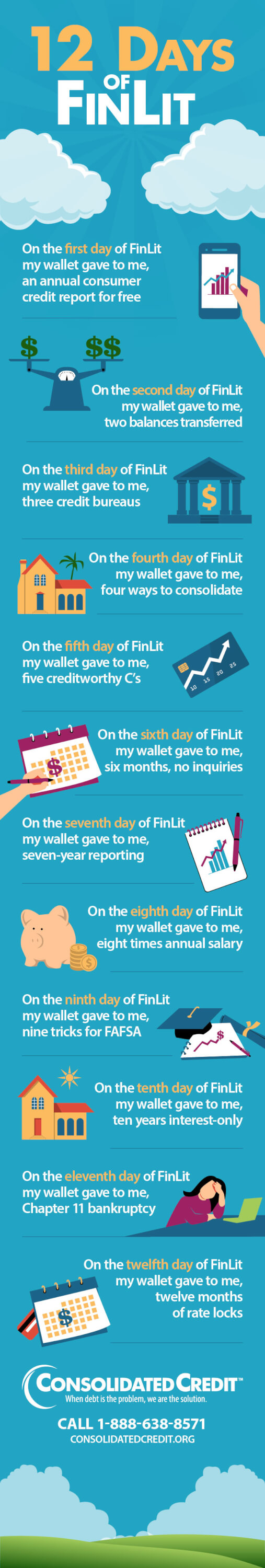

April is National Financial Literacy Month. To mark the occasion this year, we created the 12 days of FinLit. Each day features a key financial topic that people with good financial literacy can recognize. Do you know them all? If no, we give some helpful explanations of each day below the infographic.

12 Days of FinLit On the first day of Fin Lit my wallet gave to me, an annual consumer credit report for free On the second day of Fin Lit my wallet gave to me, two balances transferred On the third day of Fin Lit my wallet gave to me, three credit bureaus On the fourth day of Fin Lit my wallet gave to me, four ways to consolidate On the fifth day of Fin Lit my wallet gave to me, five creditworthy C’s On the sixth day of Fin Lit my wallet gave to me, six months no inquiries On the seventh day of Fin Lit my wallet gave to me, seven-year reporting On the eighth day of Fin Lit my wallet gave to me, eight times annual salary On the ninth day of Fin Lit my wallet gave to me, nine tricks for FAFSA On the tenth day of Fin Lit my wallet gave to me, ten years interest-only On the eleventh day of Fin Lit my wallet gave to me, Chapter 11 bankruptcy On the twelfth day of Fin Lit my wallet gave to me, twelve months of rate locks

Each of the 12 Days of FinLit explained

1st Day of FinLit

On the first day of FinLit, you get an annual consumer credit report for free. This refers to the free annual credit report that every consumer is guaranteed by federal law. The Fair Credit Reporting Act states that, by law, all the credit bureaus must make available a free copy of a consumer’s credit report to them once every twelve months.

To take advantage of this, you simply go to annualcreditreport.com to download your credit report each year.

2nd Day of FinLit

The second day of FinLit brings two balances transferred. This refers to debt consolidation and credit card balance transfers. A balance transfer is a type of debt consolidation where you take the balance from your existing credit cards and transfer them to a new card at low APR. Debt consolidation means combining multiple debts into a single monthly payment. So, you typically combine two or more balances when you consolidate.

3rd Day of FinLit

The third day of FinLit offers three credit bureaus. This one is fairly straightforward – there are three credit bureaus in the U.S. that maintain consumer credit reports. Those bureaus are:

- Experian

- Equifax

- TransUnion

4th Day of FinLit

Debt consolidation makes another appearance on the fourth day of FinLit, where you get four ways to consolidate. There are four ways to consolidate credit card debt. Three of them are recommended and the last should be used with caution.

- Balance transfer

- Debt consolidation loan

- Debt management program

- Using home equity

The first three methods can be extremely beneficial in reducing or eliminating interest charges. This allows you to pay off debt faster and get out of debt for less money total. Using home equity does the same thing, but it increases your risk because you convert unsecured debt to secured. If you don’t make the payments, the lender could foreclose on your home. That’s why we recommend sticking with the first three options.

5th Day of FinLit

On the fifth day of FinLit, your wallet brings the five creditworthy C’s. This refers to the 5 C’s that lenders and creditors use to assess a consumer’s “creditworthiness.” When you apply for financing, these are the five standards that determine whether you get approved.

- Character judges how responsible you are at repaying debt, based on your credit history

- Capacity evaluates your ability to repay a debt, based on your employment status and income

- Capital looks at what assets you have that could be used to cover the debt, based on your savings and assets

- Collateral only applies when you apply for secured credit; it’s the property used to back a loan or credit line

- Condition refers to outside factors that may affect your ability to pay, such as a weak economy

6th Day of FinLit

On the sixth day of FinLit you receive six months, no inquiries. This gives a nod to a credit scoring rule related to hard credit inquiries. Hard credit inquiries are created on your credit report when you authorize credit checks during credit and loan applications. Too many hard inquiries within a 6-month period can decrease your credit score. So, you want to spread inquiries out. Ideally, you should only apply for new credit or loans about every six months to avoid unwanted credit score damage.

7th Day of FinLit

The seventh day of FinLit also relates to credit reports with “seven-year reporting.” This refers to the seven-year credit reporting system, which applies to most negative credit report items. Things like missed payments, closed collection accounts and even Chapter 13 bankruptcy are all reported for seven years. So, most negative information on your credit report will drop off naturally once the seven-year clock expries.

8th Day of FinLit

The eighth day of FinLit features on a useful metric that you can use to measure your progress towards retirement – eight times annual salary. There are basically 10-year markers for how much annual income you should have saved for retirement. Starting at 35, you should have one times your annual salary saved. By 65 – two years before the standard retirement age – you should have eight times your salary.

9th Day of FinLit

The ninth day of FinLit offers nine tricks for FAFSA. This relates to nine relief options that are available to help borrowers working to repay federal student loan debt.

- Standard repayment plan

- Graduated repayment plan

- Extended repayment plan

- Income-based repayment plan

- Income-contingent repayment plan

- Income-sensitive repayment plan

- Pay as You Earn plan

- Revised Pay as You Earn plan

- Public Service Loan Forgiveness program

10th Day of FinLit

On the tenth day of FinLit, your wallet offers “10 years interest-only.” This is a reference to the interest-only draw period on a Home Equity Line of Credit (HELOC). When you take out a HELOC, you get ten years to “draw” from the credit line. During the draw period, you only pay interest charges. Principal repayment starts after ten years. This means that HELOC payments “balloon” after 10 years, because you go from interest-only to repaying principal plus interest.

11th Day of FinLit

On the eleventh day of FinLit, you get Chapter 11 bankruptcy. This is the bankruptcy filing that you use if you need to declare bankruptcy for a business. So, if you have a small business that needs to file, this is the type of filing that you use. Personal bankruptcy filings are Chapter 7 and Chapter 13.

12th Day of FinLit

On the twelfth and final day of FinLit, you get twelve months of rate locks. This refers to a law created by the Credit Card Accountability, Responsibility and Disclosure Act of 2009; it’s called the Credit CARD Act for short.

Much of the Credit CARD Act deals with what creditors can and can’t do when it comes to the interest rate applied on your credit card. Part of the regulation is that an introductory rate on a new account is locked in for 12 months. Basically, a credit card issuer cannot change the interest rate on a new credit card within the first 12 months.