Payday Loan Relief & Consolidation

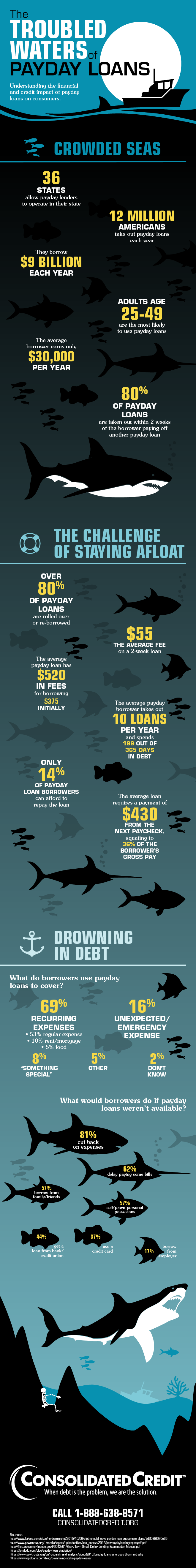

Payday loans are short-term loans. They’re convenient if you need cash quickly but come at a steep cost. They are marketed as being ideal for unexpected emergencies. Their name is derived from their short repayment deadline, usually around two weeks, which is the standard amount of time when a borrower would receive their next paycheck which, in theory, would then be used to pay off the loan.

Are payday loans bad?

There are several reasons why people turn to payday loans. Unlike traditional loans, payday loans allow borrowers to access small amounts of money, sometimes as little as $50. The approval process is fast—really fast—often providing borrowers with cash in hand that same day. And there’s usually no credit check involved either, making payday loans one of the few borrowing options available for people with bad or no credit.

However, payday loans are notorious for their high interest rates. They are considered what’s known as predatory loans because they’re intentionally structured to trap borrowers with expensive finance and interest charges. Some states have banned payday loans entirely.

How do payday loans cause debt?

Payday loans are often used to cover regular recurring expenses. That kind of budget imbalance usually signals larger financial troubles beneath the surface. In this case, the borrower may struggle to pay off their balance in the first billing cycle. Then interest charges are applied, and a cycle of debt starts. This can quickly turn into a downward spiral.

High interest rates

One of the leading reasons why payday loans put borrowers into debt is because of their astronomical interest rates. The average interest rate for a personal loan is around 12% and 23% for credit cards. The APR for payday loans? Try 400%.

Payday loans have upfront fees called finance charges which are tacked on to the total balance. Unlike credit cards, payday loans do not have grace periods that exempt borrowers from paying interest even if they repay the loan within the designated time frame.

The average payday loan finance charge is between 15% and 30%. If you were to borrow $100 with a finance charge at the low end of the spectrum, you would be charged $15. This doesn’t sound like much at first, but this $15 is equivalent to a 391% APR! Payday loans are one of the most expensive methods of borrowing money.

Lots of fees

In addition to the sky-high interest rates (a.k.a. finance charge) payday loans carry all sorts of other fees. The payday lender may charge late or returned checked fees if payment doesn’t arrive or doesn’t clear.

Short repayment periods

The real trouble with payday loans, however, arises when the borrower fails to repay the full amount within the first payment cycle. Payday loans usually have a 2-week term; meaning you are supposed to pay back what you borrow within a single paycheck cycle (hence the name “payday loan”). If you can’t repay the loan within the term, you can extend your due date—but it’s going to cost you. Rollovers, as they’re known, incur an additional fee that is usually the same amount as the finance charge. This fee is added to the total balance each time the loan is extended. Rolling over a payday loan can quickly incur more fees than the initial amount borrowed.

Automatic withdrawals

Payday loans can also cause problems with cash flow management due to the automatic ACH payment structure, meaning they automatically withdraw money directly from the borrower’s bank accounts. Payments are usually withdrawn automatically which can lead to non-sufficient fund fees and account overdrafts.

How to get out of payday loans with consolidation

Payday loan consolidation may be possible depending on two things: 1) the method of debt consolidation and 2) the payday loan lender.

Option 1: Debt consolidation loan

A personal debt consolidation loan is a do-it-yourself method of debt consolidation. It involves taking out a loan and using the funds to pay off your other debts in full. Consolidation is a fast way to halt the revolving door of fees that payday loans charge and a good idea if you have multiple payday loans or other types of high interest debt, like those from credit cards. However, qualifying for this option requires having good credit. This is not always a viable option for payday loan borrowers, many whom seek payday loans because of the no-credit-check benefit.

Option 2: Debt management program

A debt management program or DMP is when credit counselors contact your lenders to negotiate with them on your behalf to waive or reduce fees, interest rates, and sometimes have debts removed altogether. Payday loans can be included in a DMP as long as each lender agrees to participate, which is up to their discretion. Some credit counseling agencies may have stronger relationships with payday lenders than others. This will affect how effective the DMP option is at finding relief from payday loan debt.

If you’re facing challenges with payday loans, credit cards and other unsecured debt, talk to a credit counselor to see if a debt management program is right for you.

Sources:

https://www.bankrate.com/loans/personal-loans/average-personal-loan-rates/

https://wallethub.com/edu/cc/average-credit-card-interest-rate/50841

https://www.consumerfinance.gov/ask-cfpb/what-is-a-payday-loan-en-1567/