Average Americans with similar pandemic money woes have contrasting outlooks on their financial futures, and it has less to do with earnings than it has to do with learning.

FORT LAUDERDALE, Fla. , Jan. 6, 2021 /PRNewswire/ — A new survey from Consolidated Credit, one of the nation’s largest credit counseling agencies, polled two groups of Americans with one set of questions. The nonprofit asked its clients, and non-clients, about how they’re financially persevering during the pandemic.

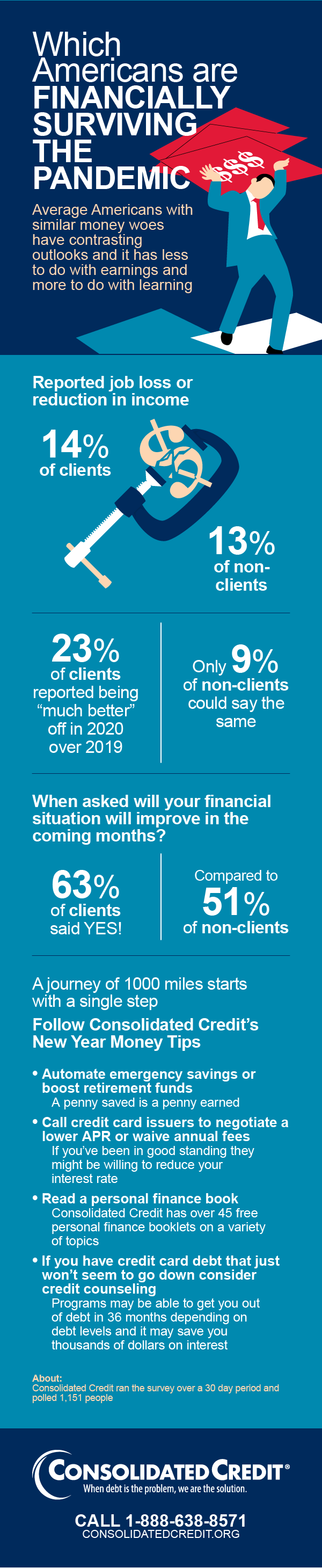

Both groups struggled with the same debts. A similar number of clients (14 %) and non-clients (13%) reported “job loss or reduction in income.” Twelve percent of both groups said they had “less savings” due to the pandemic-related shutdowns.

Which Americans are Financially Surviving the Pandemic Average Americans with similar money woes have contrasting outlooks and it has less to do with earnings and more to do with learning Reported job loss or reduction in income 14% of clients 13% of non-clients (13%) 23% of clients reported being “much better” off in 2020 over 2019 While Only 9% if non-clients could say the same When asked will your financial situation will improve in the coming months? 63% of clients said YES! Compared to 51% of non-clients A journey of 1000 miles starts with a single step Follow Consolidated Credit’s New Year Money Tips Automate emergency savings or boost retirement funds A penny saved is a penny earned Call credit card issuers to negotiate a lower APR or waive annual fees If you’ve been in good standing they might be willing to reduce your interest rate Read a personal finance book Consolidated Credit has over 45 free personal finance booklets on a variety of topics If you have credit card debt that just won’t seem to go down consider credit counseling Programs may be able to get you out of debt in 36 months depending on debt levels and it may save you thousands of dollars on interest About: Consolidated Credit ran the survey over a 30 day period and polled 1,151 people

Yet, when they were asked to compare their financial situation today to the same time last year, almost three times as many clients (23%) over non-clients (9%) reported being “much better” off. When asked if their “financial situation will improve in the coming months,” the numbers revealed a significant gap. Sixty-three percent of clients agreed to that statement compared to 51% of non-clients.

While the survey of more than 1,000 American adults did not narrow down the reasons for these discrepancies, those reasons are obvious to Consolidated Credit president Gary Herman. “Credit counseling agencies like ours help millions of Americans every year. We’ve been around for nearly three decades, and we’ve seen how help from a certified credit counselor can literally make people’s lives better.”

Consolidated Credit’s New Year Money Tips:

- If you rung in the new year with credit card debt, consider credit counseling or a debt management program. Programs may be able to get you out of debt in 36 months depending on your debt levels and can save you thousand of dollars on interest payments.

- Read a personal finance book. Consolidated Credit has over 45 free, personal finance publications on a wide variety of topics.

- Call credit card issuers to negotiate a lower APR or waive annual fees.

- Automate emergency savings or boost retirement funds .

- Get a free credit report at annualcreditreport.com.

Herman compared maintaining financial health to taking care of one’s physical health. “If you get sick, you go to a doctor. You might know what’s wrong with you, and you might be able to treat it with over-the-counter medications, but it’s good to know for certain what you’re suffering from,” Herman said. “The same goes for financial woes. We can tell you what you have, and we can give you a prescription for recovering.”

About: Consolidated Credit, a non-profit organization, has helped more than 10 million people overcome debt and financial challenges in 27 years. Their mission is to assist families throughout the United States to end financial crises and solve money management issues through education and counseling.