Debt Relief Louisiana

Residents find relief from credit card debt through consolidation.

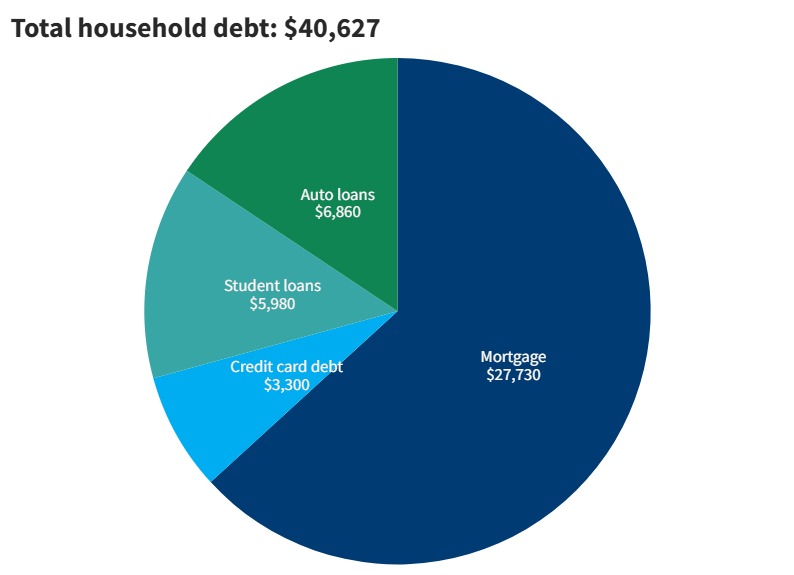

With an average credit utilization ratio over 35% and an average credit score of 677, Louisianans face an uphill battle with debt. The average credit user in Louisiana owes $6,514. Many residents are turning to balance transfer credit cards to get out of debt. But low credit scores and high utilization ratios mean that do-it-yourself debt solutions don’t always work effectively. This means many Louisiana cardholders will need help if they want to become debt-free.

The good news is that there’s a program available that can help people get out of debt, regardless of their credit score or how much they owe. Consolidated Credit has helped thousands of Louisianans find debt relief. Now we’re here to help you, too. If you’re working to eliminate debt and need help, call us at (844) 325-8087 for a free, confidential debt and budget evaluation from a certified credit counselor.