Daily Finance and Company News (Page 2)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Understanding the Latest Tax Law Changes for the 2024 Tax Year

The 2025 tax filing season is approaching, so it’s time to start thinking about tax preparation. We’ve compiled a quick…

How To Create a Realistic Budget You’ll Stick To in 2025

These 5 steps can help you master financial planning in the new year.

Should You Buy a House Now or Is It a Good Time to Refinance?

Helping homebuyers and homeowners get ahead of rising interest rates. After a prolonged period of aggressive interest rate hikes to…

4 Tips to Prevent Tax ID Theft

Take these four steps to help protect your tax refund this year. What is tax ID theft? Tax identity theft…

Data Privacy Day: A Reminder to Protect Your Personal Data

Tuesday, January 28th, 2025 is Data Privacy Day, an annual international event created to raise awareness about online privacy and…

Set the Right Plan to Pay Off Holiday Debt

How to start the New Year on the right financial foot. It’s all too easy to overspend during the holidays.…

Top 5 Financial Resolutions for 2025: Start the Year Right

Follow these five steps for a successful financial plan this year.

Revolver vs. Transactor: What Kind of Credit User are You?

Most credit users are revolvers, meaning they pay more to use credit. Credit card companies divide credit users into three…

What is Inflation and How Can You Get Ahead of Rising Costs?

It’s tough to keep up with costs when they continue to rise at exponential rates. Living paycheck-to-paycheck is stressful enough,…

Kickstart Your New Year’s Money Resolutions!

If you’re like most people, this time of year probably has you considering your New Year’s resolutions. One of the…

Scammed at Home for the Holidays

Know how to prevent your gifts and donations from being intercepted by scammers during the holidays.

Holiday Spending Stress

Most Americans will add debt and stress to their gift lists this year.

Smart Holiday Shopping Tips for 2024

Plan carefully so credit card debt and ID theft don’t dampen your holiday cheer.

Thanksgiving Weekend Smart Shopping Tips

Save money and avoid credit card debt over Thanksgiving Weekend.

Americans are Already Strapped for Cash Ahead of the Holidays

Credit card balances hit $1.17 trillion this fall, but that's not stopping holiday shoppers from racking up more debt.

What You Need to Know About the New “Click to Cancel” Rule and How It Impacts Your Finances

The FTC has made it easier for you to stop subscription services from draining your wallet.

Disaster Relief Hotline

Consolidated Credit sets up toll-free disaster relief hotline for hurricanes Helene and Milton survivors.

Are Consolidated Clients Born or Taught?

A new survey shows our clients are smarter online shoppers than the rest of the country. But why?

Clearing the Down Payment Hurdle

A new survey finds down payments have hit an unrealistic number that most average Americans can’t afford.

It’s Time for Your 2024 Fall Financial Checkup

8 Financial things to do before the end of the year

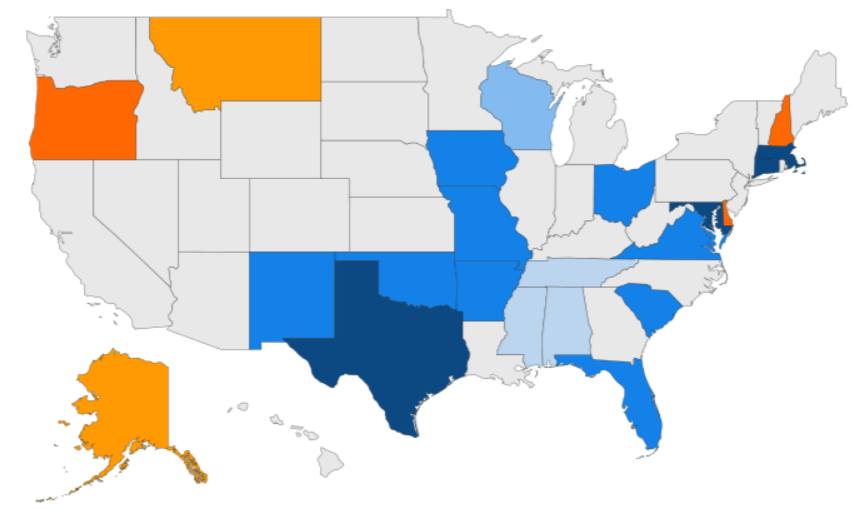

Find Your State’s Tax-Free Weekend for Back to School Savings

Tax-free weekends for back-to-school can help you save.

We’re Proud to Announce Our Story Contest Winners

Each year, dozens of Consolidated Credit’s clients and alumni enter our Story Contest. In a few words or in hundreds…

6 Tips to Avoid Financial Disaster During Hurricane Season

Hurricane season is here — are you financially prepared to weather the storm?

Making the Most of Your 401(k) Contributions

Only 13% of workers max out their 401(k) contributions, but more of us should be. When it comes to retirement…