You may not be able to anticipate these unexpected events, but you can prepare for them.

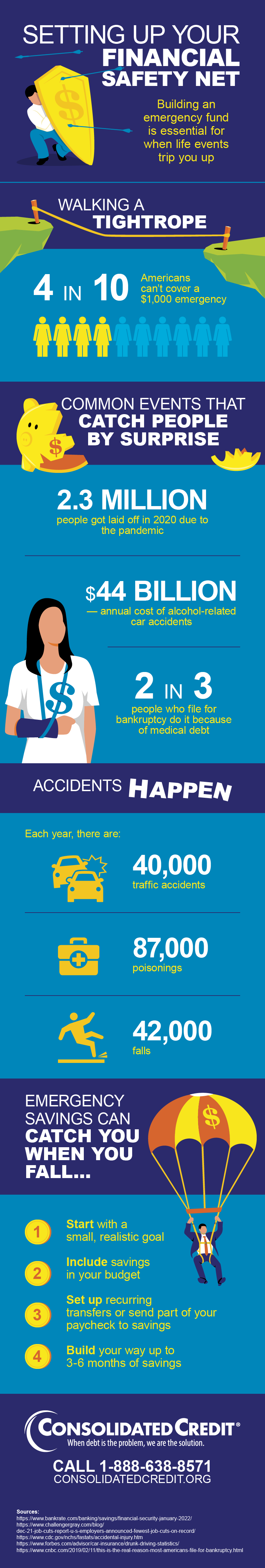

Major unexpected events like job loss, a death in the family, or a serious accident often drive people into debt. This is most evident when you consider over half of Americans owe medical debt, and one in four of those owe more than $10,000.[1]

While the worst of the economic fallout from the pandemic seems to be behind us, there are still concerning signs that the recovery could stall. Private U.S. employers posted their worst monthly job growth in over a year. There was a decrease of 301,000 jobs from December to January. So, what can you do to combat this uncertainty? It starts with this free webinar that will teach you practical planning for unexpected events.

Learn to be Financially Prepared When Life Takes You by Surprise!

Join Consolidated Credit on May 11th at 1pm, for our free new webinar, “Surviving the Unexpected: Preparation is Peace of Mind”. Learn to be resilient when life’s unexpected financial challenges catch you by surprise. If you feel that you are struggling with financial literacy or finances in general, head over to ConsolidatedCredit.org for a host of free resources we put together for Financial Literacy Month!

Life often takes you by surprise. Unforeseen circumstances occur. But what’s important is how resilient you can be when they do. Learn to be financially prepared for any situation with a little help from the certified coaches at Consolidated Credit. They’re hosting a free webinar “Surviving the Unexpected: Preparation Is Peace of Mind.” Sign up today and join in on May 11th.

Having the right financial plan for unexpected events

Even though job loss, accidents, and deaths aren’t rare occurrences, people often treat them like they are. If you don’t play for when disaster may strike, they can have devastating effects on your finances. That’s why we reiterate: A little planning for unexpected events goes a long way!

How to counteract financial troubles

There are a few ways you can enhance your savings to survive the unexpected. You’ll learn more about these in our free webinar on May 11th. But here are a few pointers to get you started.

Create an emergency fund

Ideally, you want to have an emergency fund with at least three to six months of living expenses worth of savings. This is what’s known as the gold standard. One of the best ways to reach this goal is to automate your savings. You can:

- split your paychecks to send part of each check directly to savings

- set up a recurring monthly transfer to your savings account

- try spare change apps, which round purchases up to the nearest dollar and save the spare change

Supercharge your saving strategy

If you find that your budget is tight and you can’t really afford to save up an emergency fund, there are a few proven ways you can squeeze some money from your paycheck.

1. Save money on your credit cards

Most people have credit cards and they can often be a troublesome source of debt, but they don’t need to be. Sometimes a simple phone call to your creditor can shave down your interest. Call the customer service line for your credit card companies and ask about options to lower your APR.

2. Automate and never be late again

We mentioned automating your savings earlier, but there’s more to it than just having your company split your paycheck. You can also automate credit card payments to make sure you avoid those pesky late fees.

3. Make a budget and stick to it

One of the big concerns that people have with putting credit card bills on AutoPay is that you can end up with fees if you don’t have funds in your account. But if you have a budget, you can be in control of your money and ensure funds get allocated where they need to be. If you don’t have a budget, it’s time to make one.

Get professional help

If you are having a hard time figuring things out on your own, you can always reach out to a nonprofit credit counseling agency for help. A certified credit counselor can help you set up a realistic budget and find solutions that can lower your total credit card payments, so it’s easier to stop living paycheck-to-paycheck and start saving.

Learn practical planning for unexpected events with our free webinar!

If you haven’t already done so, make sure to sign up for our free “Surviving the Unexpected: Preparation is Peace of Mind” webinar today. We’ll show you a few ways to streamline and kick start your emergency savings fund.

Sources:

[1] https://www.affordablehealthinsurance.com/1-in-4-americans-with-medical-debt-owe-more-than-10000/