Daily Finance and Company News

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Up NextCelebrating 30 Years of Financial Education

-

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

-

Homeownership: Your Path to Security & Stability

-

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

-

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Ready for a Financial Reset This New Year? Start Here

The start of a new year is the perfect moment to reset your habits, rethink your priorities, and build the…

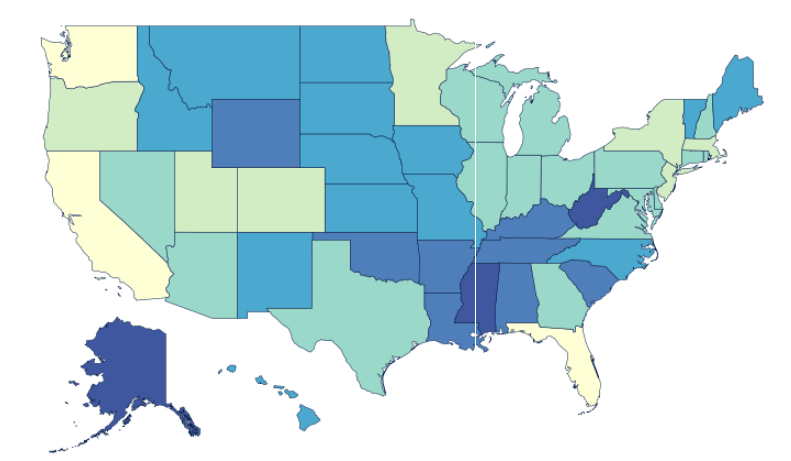

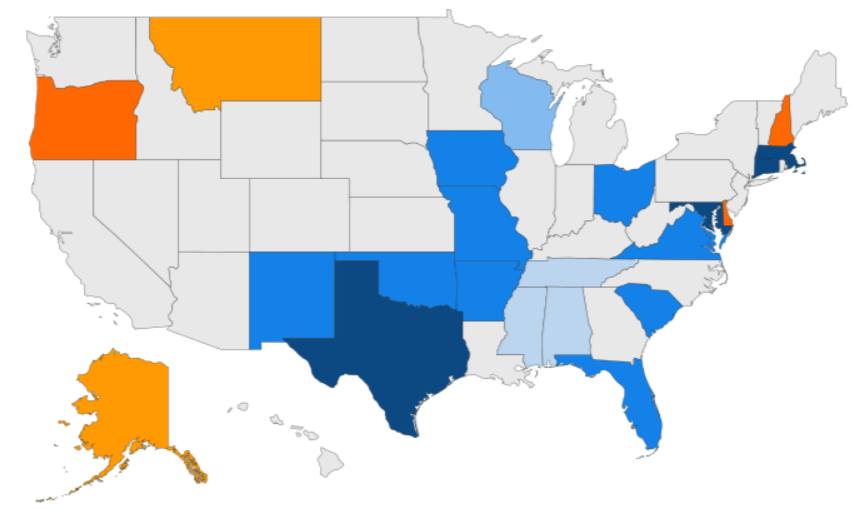

A Snapshot of Credit Card Debt by State – Updated With the Latest Data

Alaska leads the nation in average credit-card debt, and new Experian data shows balances rising in nearly every state. Experian…

Who Is the ‘Typical’ Consolidated Credit Client?

After decades, that’s hard to say. But their results are the same: They get out of debt.

Understanding Buy Now, Pay Later Plans: Pros and Cons

As the holiday season approaches, you might be hearing more about “Buy Now, Pay Later,” or BNPL. This payment method…

Avoiding Fraud During Holiday Shopping: Online Safety Tips

The holiday season is about to ramp up with black-friday and cyber monday about a month away. Holiday shopping online…

Holiday Spending Stress

Most Americans will add debt and stress to their gift lists this year.

Halloween Spending Statistics

Anticipation is high for the spookiest night of the year. About 73% of Americans say they plan to celebrate Halloween…

How to Monitor Your Credit Effectively

When was the last time you looked at your credit report? Having good credit impacts everything from the interest rates…

Budgeting for the Holidays: Avoid Debt This Festive Season

The holidays are coming! We know, we know, it’s barely October, and you’re probably still figuring out your Halloween costume.…

Understanding and Improving Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio simply shows how much of your income goes to debt each month, which is a big…

Financial Recovery After a Natural Disaster: Steps to Rebuild

As peak hurricane season arrives, many may be facing the difficult aftermath of a natural disaster. Beyond the immediate safety…

Life Insurance 101: Protecting Your Loved Ones’ Future

Imagine what would happen to your family’s dreams if you weren’t there to help make them a reality. Would they…

Emergency Fund vs. Savings Account: What’s the Difference?

September is National Preparedness Month, a perfect time to build your financial safety net. Having funds to fall back on…

Managing Medical Bills: How to Negotiate and Reduce Costs

More than half of Americans say they currently have outstanding medical bills or unpaid medical debt, according to a survey…

The National Housing Crisis Isn’t Really National

It depends on where you live – and what you do about it

Preparing Financially for Hurricane Season: Essential Steps

From insurance to an emergency fund, go through this checklist before peak storm season.

Retirement Planning Mistakes to Avoid at Every Age

Imagine reaching retirement only to find your savings aren’t enough. According to the Pew Research Center, this is a reality…

College Bound: Financial Tips for Students and Parents

College is a big step, and so is figuring out how to pay for it. With the fall semester just…

Side Hustles for Extra Income: Pros, Cons, and Tax Implications

How to use the summer to earn extra income to pay down credit card debt.

Find Your State’s Tax-Free Weekend for Back to School Savings

Tax-free weekends for back-to-school can help you save.

Understanding Interest Rates: How They Affect Your Loans and Credit Cards

Ever wonder what it really costs to borrow money for a car, a house, or even just using your credit…

Back-to-School Shopping: How to Save Money This Year

Learn how how budgeting and planning sets up your family for success – academically and financially.

Financial Independence Day: Steps to Achieve Debt Freedom

We celebrate Independence Day with thoughts of freedom, security, and the pursuit of happiness. Yet, for many, their financial situation…

Consolidating Debt: How to Simplify Your Payments This Year

Mid-year can be a good time to pause and look at your financial picture. If you’re like many people, you…