We use debit more often, but credit covers higher costs.

Each week, Consolidated Credit searches for financial research that can help you deal with your debt and budget. This week…

The interesting study

The Federal Reserve released their Payments Study for 2016. This explores how Americans prefer to make payments. It looks at both the total number of transactions made and the dollar value of those purchases.

The big result

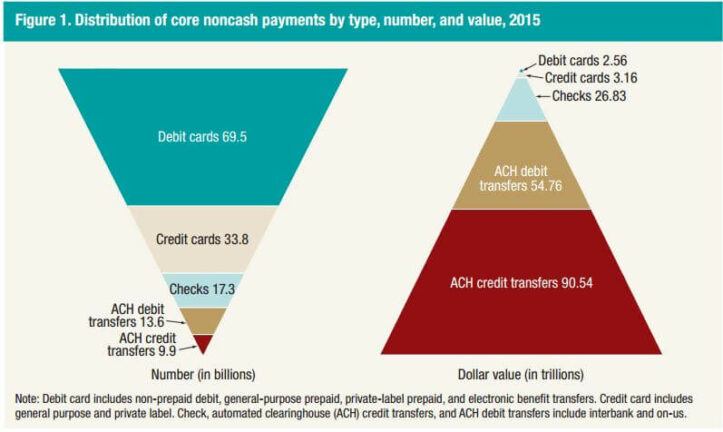

Of all payment methods, debit cards have the highest usage. Americans used debit cards to make 69.5 billion payments in 2015. Americans only used credit cards to make 33.8 billion payments in the same year.

However, the total value of debit transactions only added up to $2.56 trillion. Credit cards totaled up to $3.16 trillion. So while credit cards were used less, they paid for more.

The fascinating details

Interestingly enough, both of payment methods were beaten in total value by ACH payments. ACH refers to automatic transfers that you set up directly from your bank account. This is how many Americans prefer to pay bills, which may explain why ACH accounts for $90.54 trillion spent in 2015. However, the number of transactions was low – only 9.9 billion payments were made using ACH.

As a result, the number of payments versus the total value generates 2 pyramids that are almost the inverse of each other:

Another interesting part of the study compares how Americans preferred to make payments in 2015 versus three years prior in 2012.

| 2012 number | 2015 number | 2012 value | 2015 value | |

|---|---|---|---|---|

| Debit | 56.5 billion | 69.5 billion | $2.10 trillion | $2.56 trillion |

| Credit | 26.8 billion | 33.8 billion | $2.55 trillion | $3.16 trillion |

| ACH | 20.4 billion | 17.3 billion | $129.02 trillion | $145.30 trillion |

| Check | 19.7 billion | 17.3 billion | $27.21 trillion | $26.83 trillion |

As you can see from the numbers, overall Americans are much more active about payments in 2015. The only category that lost ground was payments made by check. As debit and credit cards become more convenient, checks are slowly becoming less relevant.

What you can do

“New payment methods definitely make life more convenient, but they can also make it more difficult to keep your accounts out of the red,” explains April Lewis-Parks, Director of Financial Education for Consolidated Credit. “This means household budgeters need to pay closer attention to daily account activity.”

That extra attention can help you keep checking in good standing so you can avoid hassles, such as overdraft fees.

“Know when automatic payments will be deducted,” Lewis-Parks encourages, “and check your accounts before that date to ensure you have sufficient funds. If your bank or credit union has a mobile app, sign up! This allows you to check account balances daily to ensure you can make payments and process transactions without an issue.”

The more you check account balances and take time to track payments and plan ahead for ACH, the less likely you are to overdraft. Of course, the other part to ensuring you keep up with payments you make is to ensure you’re managing the credit card debt effectively.

“Increasing use of credit cards is fine as long as you have the means to manage the debt effectively,” Lewis-Parks continues. “If you’re using credit cards strategically to make purchases within your budget, simply ensure you have the means pay your bills in-full each month. Doing so minimizes interest charges and makes credit use more effective.”

And remember, if credit card payments become too much for your budget, Consolidated Credit will be here to help. Call (844) 276-1544 or complete an online application to request a free debt and budget evaluation from a certified credit counselor. Together you can make a plan that balances your budget so you can get ahead of your debt.