It pays to be thankful as you work to get out of debt.

Calling all Consolidated Credit clients and alumni! We’re thankful for the opportunity to help you get out of debt. That’s why we’re giving you the opportunity to win $500 for helping us celebrate freedom from debt. All it takes is snapping a quick photo and sending it to us to enter our annual Thankful Photo Contest. Play this video for more details!

Consolidated Credit Clients & Alums: Enter Our Thankful Photo Contest!

Hey, Consolidated Credit Clients and Alumni! Need a little extra cash for the winter holidays? Enter Consolidated Credit’s Thankful Photo Contest and you’ll be automatically entered to win a $500 gift card.

[On-screen text] Getting out of debt is a good reason to be thankful

And our team is thankful for the chance to help you do it!

So help us celebrate freedom from debt!

By taking a photo showing how much debt you’re thankful to be paying off.

And to show our thanks, we’ll give one lucky participant $500

To enter, make a sign showing the debt we’re helping you pay off

Then snap a photo of you or your family holding it

Next email it to us at [email protected]

You’ll be automatically entered to win!

The drawing will be on December 9, 2022

And thanks again for letting us help you…

Because seeing clients & alumni happy is the best gift we get!

How to be thankful and win big

This contest is easy.

- Just make a sign showing how much debt you’re thankful to be paying off. It can be simple, or you can jazz it up but try to make the numbers and words stand out.

- Then either snap a selfie holding up the sign or have someone take the photo of you. If you want to add filters or effects, feel free to get creative!

- Now just email the photo to [email protected]. Photos must be received by 11:59 pm on 12/5/2022.

We’ll hold the drawing on Friday, December 9, 2022. The winner will be selected from the entries at random.

We’ll announce the winner on our social networks and email you to let you know you won. Then we’ll get your contact info, so we can send you the gift card.

This contest is only open to Consolidated Credit clients and alumni, who have or are paying off debt through a debt management program. You can find a full list of rules on our contest page.

Not a client yet? Don’t worry because you can still win! Just click here to take our Holiday Credit Survey and you’ll have a chance to win $150.

Clients and alumni can also take the holiday survey to double your chances of winning some extra cash for the holidays!

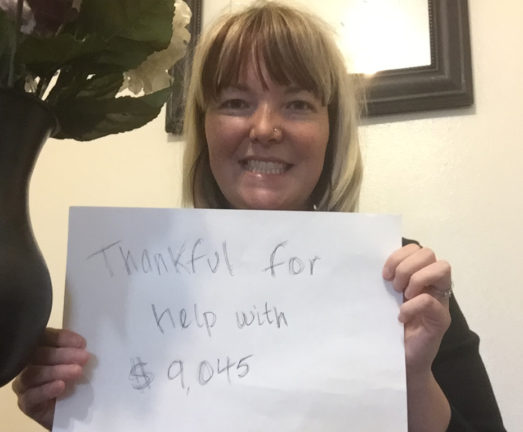

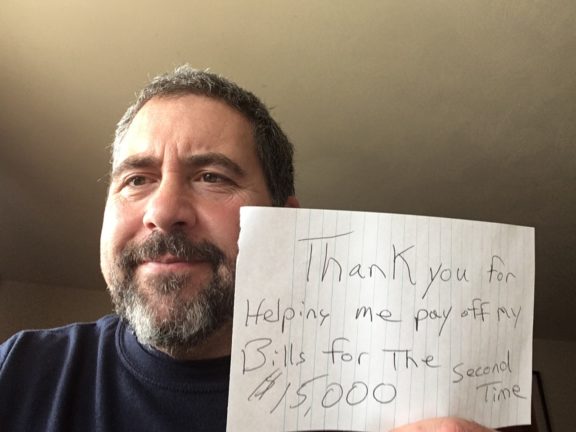

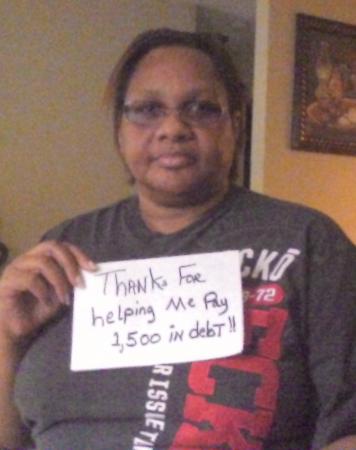

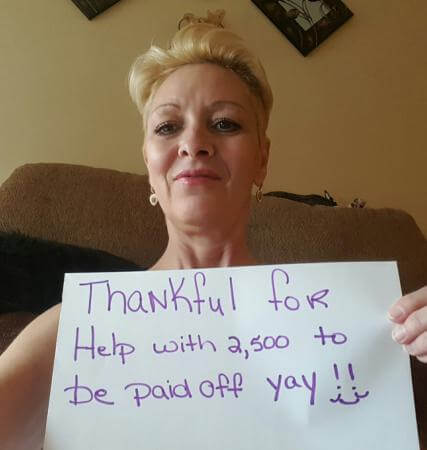

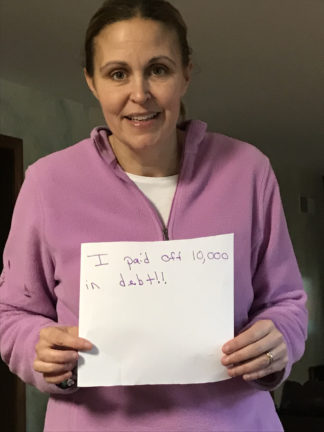

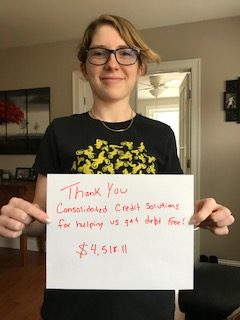

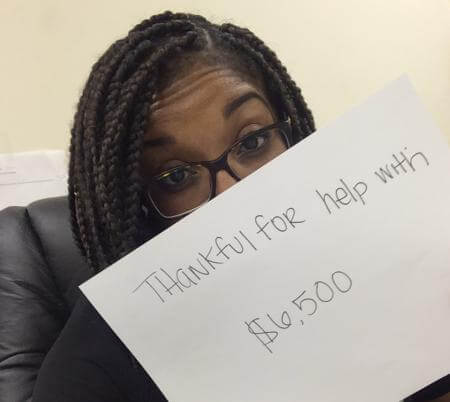

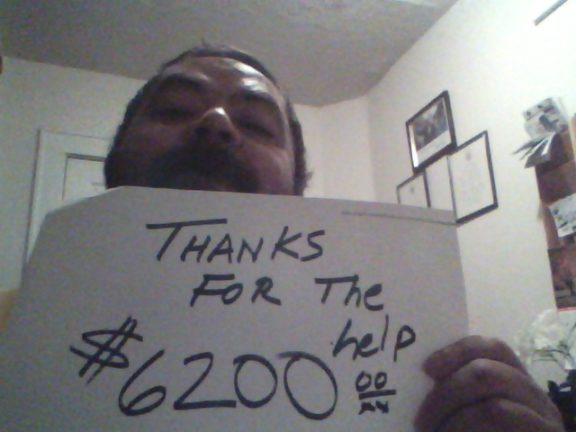

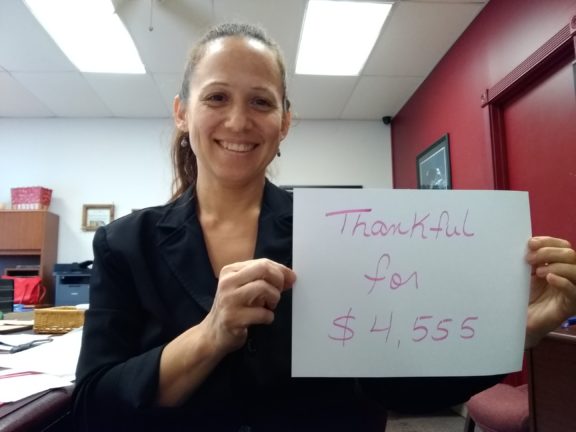

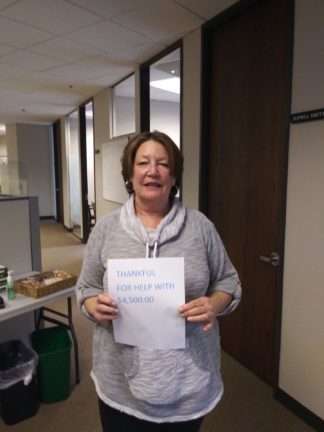

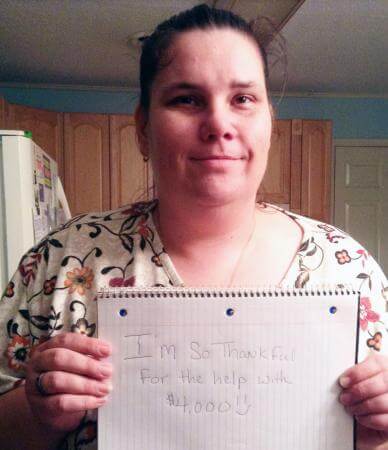

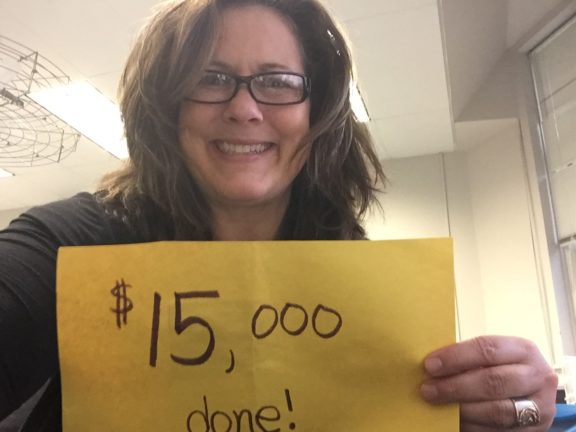

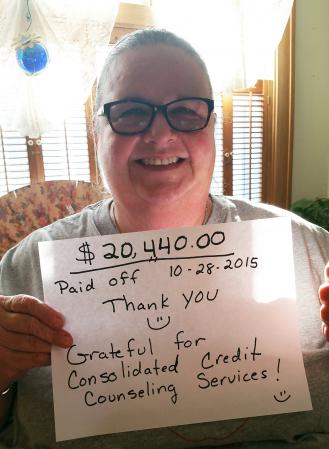

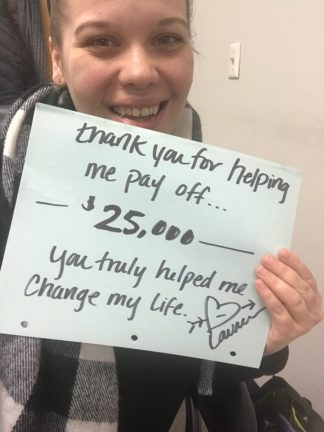

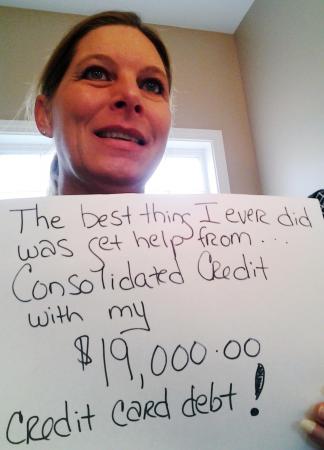

A look at past entries to inspire you

Here are some of our past entries to help you get inspired to take your photo this year.