Even though life hasn’t entirely changed back to normal, Americans’ perspectives on their finances have changed—and in a good way.

Over half of Americans saved more because of the pandemic, according to a Bankrate survey. Americans also paid off the most debt they ever have: a whopping $108 billion, according to a New York Federal Reserve report.

But last year was far from a financially stress-free year. Millions of Americans were furloughed and laid off. Millions of others faced pay cuts, reduced income, and business closures. These kinds of events create significant financial stress in people’s lives and that stress can take a toll—physically, emotionally, and mentally.

With that in mind, Consolidated Credit is hosting a free webinar that will teach you how to deal with financial stress, and strategies to help you avoid it in the first place.

What causes financial stress?

There are two main causes of financial stress: one that you can’t change, and one that you can.

You can’t change an uncertain economy. Especially now, all any of us can do is weather the storm. Stay informed, but don’t let the news cycle scare you or dictate your financial decisions.

You can change how prepared you are for the future. Your budget, savings, and debt are all under your control.

A major source of financial stress is not having things like this figured out. We know budgeting isn’t always exciting, but the more you understand your cash flow, the better you will feel.

The damage stress can do

Stress—whether financial or otherwise—isn’t healthy. In fact, it can negatively impact your immune system. And a stressed immune system can’t battle COVID-19 as well as a healthy one.

Additionally, financial stress can make it difficult to focus in your everyday life. This could lead to poor performance at work, possibly compounding your money problems.

It can also make you fearful. You may be stressed about money, but scared to attack the problem for fear that it may be worse than you think. You must face this fear to attack the source of the stress.

How to save yourself from stress

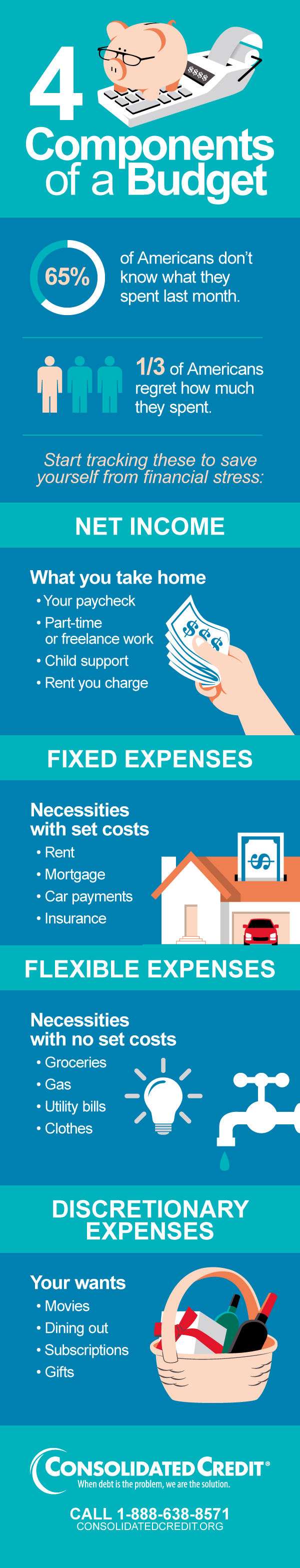

Creating a budget and following it can lift a great amount of weight from your shoulders. When you make yours, it’s important to know exactly what to track.

Review these components and some important stats in the infographic below. Then, sign up for our webinar to learn more details!