Consolidating Debt: How to Simplify Your Payments This Year

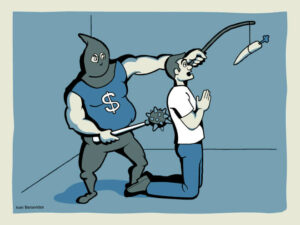

Mid-year can be a good time to pause and look at your financial picture. If you’re like many people, you might find yourself juggling several different credit card debts. Each… Read full article