One more reason to take every step possible to keep federal student loan debts out of default.

Student loan debt can be tricky and frustrating. Unlike most debts like a mortgage, an auto loan or credit card debt, student loans are rarely discharged during bankruptcy. The debt can’t be settled or negotiated either – unless you qualify for loan forgiveness (which only applies to federal student loans) you’re essentially locked into paying back everything you owe.

What’s more, while making those payments can be tough right out of school when job opportunities are often limited, failing to make your monthly payments can lead to tax refund interception and wage garnishment up to 15% of your net wages. So there are already plenty of good reasons why it’s in your best interest to keep your loans current, but now two reports from the U.S. Department of Education and Treasury Department are adding another level of “encouragement.”

First there is a report from the Treasury Department that “gentler” collection practices on defaulted student loans have failed to yield results. The agency ran a test to see if handling collections for federal student loans in default themselves using gentler practices would yield better results than the aggressive, high-handed tactics used by third-party collectors working on behalf of the Treasury.

Unfortunately, the results were not positive:

“After 33,000 letters and 21,000 calls the Treasury only managed to restore about 4% of the 5,729 borrowers from default that had been assigned. Meanwhile, the control group, which is composed of several private agencies currently under contract with ED (Education Department) did better, recovering 5.5%. Private debt collections also got back more dollars.”

Basically, the Treasury limited collection tactics in two ways. First they only placed a maximum of one call per week to borrowers in default. They also did not threaten wage garnishment for the first 11 months of servicing the defaulted loans. Their conclusion: “People don’t pay back to gentle debt collectors.”

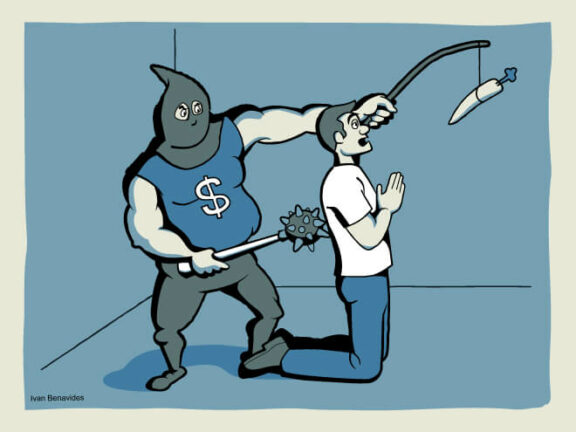

As a result, the Treasury will not be taking over defaulted student debt collection, nor will they begin requiring third-party collectors to be nice about attempting to collect on those debts. So if you owe federal student loan debt and it slips into default, expect the stick because they’re not going to be nice about it.

On the other hand, a separate report indicates that the Department of Education has begun to, “implement a new vision for student loan servicing that ensures the more than 40 million Americans with student loan debt get high-quality customer service and fair treatment as they repay their loans.”

The DOE plans to implement a new system that encourages student loan servicers (the companies you pay when you make your monthly payments on each loan) to work in more constructive ways with borrowers. They’re even incentivizing programs so servicers will be motivated to help borrowers with income challenges, where today’s fix-fee structures “create a disincentive to help struggling borrowers.”

The system will promote accuracy, consistency, accountability and transparency. The idea is that this new system will make it easier for borrowers to repay loans and stay out of default. So servicers will be taking a carrot-approach with borrowers who are not in default to help them eliminate their student debts effectively. With that in mind, if you want helpful, productive assistance with your student loans instead of unproductive aggression it’s imperative that you keep your loans out of default.

3 options to avoid student loan default, 1 to get out of it

The good news is that if you’re having trouble repaying your student loans, there are three options you can use to keep your loans out of default even if you can’t make the monthly payments.

- Deferment. This suspends the monthly payments on a student loan for a period of time so you don’t get penalized for not paying. If the loan is subsidized, even the interest will be suspended, otherwise you can choose to pay just the interest or add it on to the balance if you can’t afford to pay anything. To be eligible, you must show:

- You have a temporary disability or are in a rehabilitation program for the disabled

- You’re unemployed or facing some other type of financial hardship

- You’re on active duty serving in the armed forces

- You’re participating in a graduate fellowship

- Forbearance. This is where your monthly payments are temporarily reduced instead of cut completely. It’s generally easier to get forbearance over deferment, even though the latter is usually more preferable. To qualify for forbearance you must prove:

- The monthly payments are high relative to your income

- You have some type of medical hardship

- You’re experiencing unforeseen circumstances

- Hardship-based repayment plans. Three out of the five repayment plans available for federal student loans are designed for people facing financial hardship: income-based repayment (IBR), income-contingent repayment (ICR), pay as you earn (PayE). All of these programs calculate monthly payments based on your family size and adjusted gross income (AGI), so you only pay what you can afford. In fact, if your income is low enough below the federal poverty line in your states, the PayE plan may reduce your monthly payments to zero without penalties until your income improves. To qualify:

- Your income and family size will be compared to federal poverty guidelines in your state

- As long as you make no more than 150% of the federal poverty line in your state for your family size, you can qualify for at least an IBR or ICR

- To qualify for PayE, your loans have to be new – as in they were issued after 2008 with disbursements after 2011

One challenge with all of the above solutions is that you can only use them if your loans aren’t already in default. So hiding your head in the sand if you’re struggling with your payments instead of finding solutions can definitely hurt you. You need to be proactive.

Luckily, there is one trick you can use to get a defaulted federal student loan out of default – consolidate them with a federal Direct Consolidation Loan. This loan allows you to combine multiple student loan debts into one loan with one payment. You can even consolidate defaulted loans, which means you become current. You just need at least one Direct or FFEL loan within all of the loans you want to consolidate in order to qualify.

If you’re struggling with student debt and you need help, call Consolidated Credit today. We many not consolidate student loan debt, but we can direct you to the right resources to help you find student debt relief, including consolidation. Call us at (844) 276-1544 or complete an online application to request a confidential debt analysis from a certified credit counselor at no charge.