Daily Finance and Company News

Consolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

-

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

How To Create a Realistic Budget You’ll Actually Stick To

These 5 steps can help you master financial planning in the new year.

10 Valentine’s Day Money Do’s and Don’ts for Your Heart and Your Wallet

Spending decisions made for love often reveal money habits that affect relationships long after the celebration ends.

Your Tax Refund Could Help Your Debt Problem – If You Use It Strategically

Before spending your refund, consider how it could strengthen your financial safety net.

The 2026 Budget Blueprint: Systems That Actually Work

A practical guide to choosing a budgeting style that fits your personality and financial habits.

2026 Money Confidence Roadmap: January Reset

Why many money goals fade early in the year and how clarity helps people stick with them.

Set the Right Plan to Pay Off Holiday Debt

How to start the New Year on the right financial foot. It’s all too easy to overspend during the holidays.…

Your 2026 Debt Reset: The Smartest Ways to Start the Year Strong

With record-high credit card balances, here’s how Americans can lower interest, pay down debt faster, and rebuild confidence in the…

Understanding Financial Scams: How to Protect Yourself During the Holidays

The holiday season is a time for cheer and giving, but it’s also a peak season for financial scams. A…

Ready for a Financial Reset This New Year? Start Here

The start of a new year is the perfect moment to reset your habits, rethink your priorities, and build the…

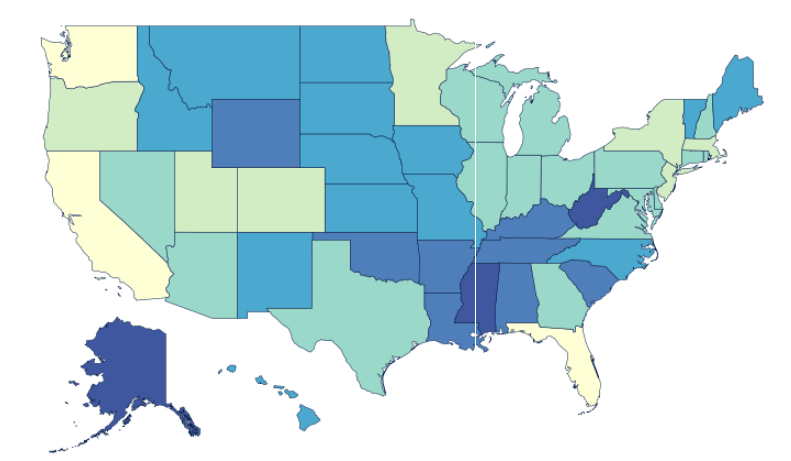

A Snapshot of Credit Card Debt by State – Updated With the Latest Data

Alaska leads the nation in average credit-card debt, and new Experian data shows balances rising in nearly every state. Experian…

Who Is the ‘Typical’ Consolidated Credit Client?

After decades, that’s hard to say. But their results are the same: They get out of debt.

Understanding Buy Now, Pay Later Plans: Pros and Cons

As the holiday season approaches, you might be hearing more about “Buy Now, Pay Later,” or BNPL. This payment method…

Avoiding Fraud During Holiday Shopping: Online Safety Tips

The holiday season is about to ramp up with black-friday and cyber monday about a month away. Holiday shopping online…

Holiday Spending Stress

Most Americans will add debt and stress to their gift lists this year.

Halloween Spending Statistics

Anticipation is high for the spookiest night of the year. About 73% of Americans say they plan to celebrate Halloween…

How to Monitor Your Credit Effectively

When was the last time you looked at your credit report? Having good credit impacts everything from the interest rates…

Budgeting for the Holidays: Avoid Debt This Festive Season

The holidays are coming! We know, we know, it’s barely October, and you’re probably still figuring out your Halloween costume.…

Understanding and Improving Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio simply shows how much of your income goes to debt each month, which is a big…

Financial Recovery After a Natural Disaster: Steps to Rebuild

As peak hurricane season arrives, many may be facing the difficult aftermath of a natural disaster. Beyond the immediate safety…

Life Insurance 101: Protecting Your Loved Ones’ Future

Imagine what would happen to your family’s dreams if you weren’t there to help make them a reality. Would they…

Emergency Fund vs. Savings Account: What’s the Difference?

September is National Preparedness Month, a perfect time to build your financial safety net. Having funds to fall back on…

Managing Medical Bills: How to Negotiate and Reduce Costs

More than half of Americans say they currently have outstanding medical bills or unpaid medical debt, according to a survey…

The National Housing Crisis Isn’t Really National

It depends on where you live – and what you do about it

Preparing Financially for Hurricane Season: Essential Steps

From insurance to an emergency fund, go through this checklist before peak storm season.