Gaming the system to get a higher credit score usually just leads to more debt.

Finding financial advice online can be tricky. You always need to consider the source, as well as the intended audience. Otherwise, you can try something risky and land in a heap of trouble. Such is the case with a headline that we recently came across on The Motley Fool: 60% of Credit Card Accounts Carry a Balance. Here’s Why That Isn’t Necessarily a Bad Thing.

What the article says…

The reasoning behind the headline is actually technically sound. If you want to achieve the highest of high credit scores (800+) then there are steps you can take to “game the system.” The one they discuss in the article is that you take advantage of 0% APR introductory periods on new cards.

Basically, the advice is that you play a credit card balance shuffle game where you always keep balances on 0% APR accounts. That way, you can carry balances interest-free. In this case, carrying a balance isn’t bad because it doesn’t cost you anything. But that doesn’t make it good either.

The article clarifies that in order to make this strategy work, you have to pay balances off before the introductory period ends. However, even with the excellent credit score that they talk about, the best promotion periods typically only last 18 months.

By contrast, a recent study found that most people carry balances for at least two years. People trying to game the system often get into a constant cycle of balance transfers. But this means you end up with a bunch of accounts that you only opened for the intro period. What’s more, all those credit lines typically tempt cardholders into spending more.

So, what you really get out of the game is more debt, instead of better credit. Eventually, you can run into a balance transfer wall. For instance, many major credit issuers won’t transfer balances between their own cards. They’ll happily take other issuers’ balances, but they won’t let you transfer their balances to another of their cards. In other words, the creditors themselves have roadblocks in place to stop the credit card shuffle.

What you should really do to achieve good credit

Interestingly enough, if you download Motely Fool’s credit guide that they give you at the end of the article, the advice pretty much matches what you’ll hear from a credit counselor.

- Always make your payments on time.

- Keep credit utilization low (that’s the amount of credit in use relative to your total available credit limit).

- Don’t open too many new accounts at once

- Maintain a diverse range of debt (i.e. things like mortgages and auto loans are good).

- Don’t close old accounts

You can find those same five tips almost anywhere, because they coincide with the five factors used to calculate credit scores

Infographic

Credit Score Idol

Do you have what it takes to be a credit score superstar? Learn about the five credit score factors that determine credit score and how it’s calculated….

Read moreNone of the tips in the guide game the system – they’re just sound credit advice. What is dangerous is the idea that you can dance around 0% APR intro rates and won’t run into trouble. To be clear: There is no credit score benefit to carrying a balance. You don’t get a higher score because you carry balances over month to month; you get interest charges, which drain your budget.

Using less credit is always better

There’s a myth that paying off your balances in-full is bad for your credit. It’s not. As long as you don’t let your accounts close due to inactivity, there’s nothing bad about zero. This means that if you make a reasonable number of charges that you can pay off in-full each month it’s the best thing for your credit score.

Credit utilization is the second biggest factor in credit score calculations. It measures how much credit you use versus the total available limit you hold. So, if you add up all your credit limits for a total of $5,000 and you have $500 in debt, your utilization ratio is 10%. All credit experts will tell you that 10% or less is the best for your score. But that includes 0%, meaning you can pay off your balances every month and still be golden.

With that in mind, there’s no reasonable reason to carry a balance. That’s why Motley Fool’s article headline is a bit misleading, because it gives the impression that carrying balances is somehow good. It’s not.

Want to know how to play the credit game the right way without trying to game the system? We have some information that can help.

Game of Good Credit

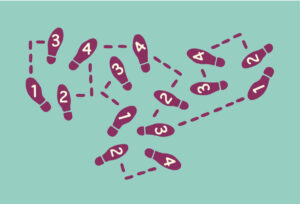

Achieving and maintaining a good credit score and a clean credit profile is a constant game of strategy. By knowing what moves to take to build credit and what moves to avoid so you don’t damage your score, you can develop an effective credit management strategy that helps you hit and keep up the high credit score you really want.

Come on down! You’re the next contestant on the Game of Good Credit!

Achieving good credit is a game of strategy. You have to play tactically if you want to win.

Let’s begin with the basic gameplay of how to go from the starting point to winning the game of good credit so you can maximize your credit score. The overall goal in the game is to move forward from the starting point, taking the right steps to reach your credit goal.

Each step you take can have a positive, negative or neutral effect. You want to make smart moves that boost your score, while avoiding traps that set you back. Positive actions like making payments on time and keeping your credit utilization low help move you forward. And doing things like paying off a credit card in full can give you a big jump up the board. But actions like paying late or allowing an account to go into collections can set you back and put you farther away from your credit score goal.

As you play the Game of Good Credit, keep in mind that even if you have to make a really bad move it doesn’t mean you’ll have bad credit forever. You may just have to start again to begin moving forward toward the score you want. Most negative actions set you back for 7 years. Although some things like Chapter 7 bankruptcy can set you back longer. But if you have a setback, you can start to move forward immediately!

The BEST move you can make is to pay your bills on time – this is the biggest factor in calculating your score. Each time you pay a credit card or loan on time it’s a positive action that lets you move forward. If you’ve had setbacks, start making payments on time to move forward again. But keep in mind that the amount of credit you use affects how quickly you can move up the board.

Credit utilization is the second biggest factor in calculating credit scores – that’s the amount of debt you have relative to your total available credit. The less debt you have, the faster you can advance towards better credit. So by keeping your debt low and making payments on time you can forward to get closer to your credit goal.

Length of credit history is the third biggest factor in your score – creditors believe people who have been playing the game longer are better at it. So don’t close your oldest accounts or let creditors close them due to inactivity, because this can actually set you back. Keep accounts in good standing and you’ll get an extra boost on your way to a winning credit score.

The number of times you apply for new credit within a six month period is a factor in your credit score. If you try to take too many new credit moves at once, you can actually get set back. Only draw a new loan or credit card when you really need it, and don’t apply for credit cards in quick succession. That way getting new credit will be a neutral action that doesn’t set you back.

The type of credit and number of accounts you have also has an impact on your ability to win the game. If you pick up a diverse variety of debts along the way like a mortgage and other loans along with a credit card or two, you’ll have an easier time reaching your goal.

We have a few tips that can help put the big win within reach. Be aware that you can be penalized paying late as well as for moves that you didn’t actually take. This happens when negative items appear in your credit report by mistake – the credit bureaus think you made a bad move when you really didn’t. If this occurs, you have the right to dispute the item to have it removed. If you’re successful with a dispute, you’ll move up the board.

Additionally, players often think asking for help will set them back from reaching a winning credit score. But using services like credit counseling if you’re having trouble can actually help you move forward faster instead of setting you back. Completing a debt management program helps you eliminate credit card debt and may aid in helping you build a positive payment history. It can also help you avoid major setbacks on the board like debt settlement and bankruptcy. So you can get the help you need and still reach your ultimate credit goal, allowing you to win at the game of good credit to improve your financial standing overall.

Make the move to Consolidated Credit and let us help you develop a winning strategy to help you eliminate debt so you can achieve your credit goals.

If the balance transfer shuffle has you turned around with credit card debt, we can help. Talk to a certified credit counselor now.