A new survey finds Spanish-speaking Americans may have a harder time when it comes to shopping online.

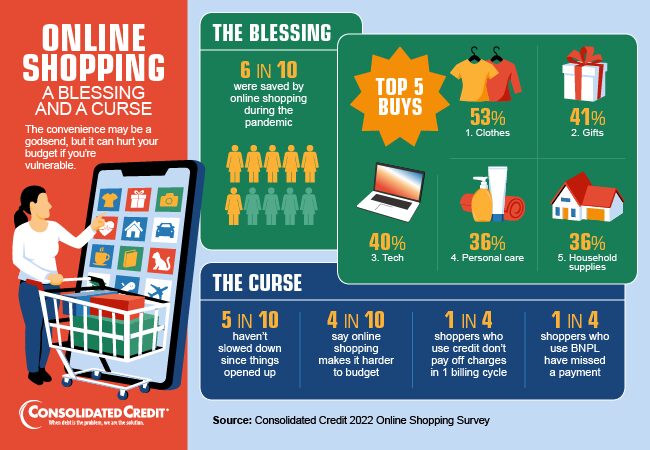

There’s little question that the pandemic accelerated how quickly consumers moved to shop online. According to Consolidated Credit’s 2022 Online Shopping Habits Survey, six out of ten consumers say they started shopping more during the pandemic. However, even with stores fully open now, more than half (52%) say they haven’t scaled back.

If online shopping is here to stay, what does that mean for people’s budgets? Does the convenience of online shopping make it harder to stick to a budget and avoid credit card debt?

More people shopping online more often

According to the survey, half of consumers (50%) shop online at least once per week. One in ten shoppers shops online almost every day or every day. But not everyone is migrating online so quickly. Spanish-speaking respondents reported a much lower frequency of online shopping. Amongst this population, four in ten shoppers purchase products online a few times per month. One in five say they shop online rarely or never at all.

The budgetary challenges of shopping online

Consolidated Credit’s survey also asked if increased use of online shopping services made it harder to budget. Among all survey respondents, more half of respondents (54%) said they had no trouble sticking to a budget while shopping online. However, among the Spanish-speaking population, a majority (57%) said online shopping did make it harder to budget.

Spanish speakers are also more likely to end up with credit card debt when shopping online. Of the general population that uses credit cards to shop online, 78% say they pay off any charges within one billing cycle. But among Spanish speakers, 57% don’t pay it off, meaning they face added interest charges on those purchases.

Spanish speakers are also more likely to use Buy Now Pay Later (BNPL) services that split online purchases up into payments, with 71% saying they’ve used BNPL. Among the general population, 54% said they have not tried BNPL.

The pandemic itself may play a role

The Hispanic community was also much harder hit by the pandemic. The Spanish-speaking population was two to three times more likely to face pandemic-related money problems. They had less emergency savings and were more likely to miss a credit card payment.

Infographic

Financially Surviving the Pandemic

A Consolidated Credit poll found that clients enrolled in a debt management program have more confidence in their personal finances….

Read moreThose types of challenges could also contribute to the lower uptick in online shopping in the wake of the pandemic. With lower savings and more budget issues at the start of the pandemic, the Spanish-speaking community would also have a longer road to recovery.

“Planning and saving for purchases, whether they’re online or in a brick-and-mortar store, is how you avoid challenges with credit card debt,” says Gary Herman, President of Consolidated Credit. “

Financial literacy access could be a bigger factor

These differences may also ultimately come down to a lack of financial literacy access. As Consolidated Credit has previously reported, financial literacy resources in Spanish are limited.

“It can be difficult for someone with a language barrier to find free financial education online or in their community,” explains Gary Herman, President of Consolidated Credit. “Financial literacy is the first step to financial stability. Without that access, it’s understandable that Spanish speakers often struggle more.”

It’s a challenge that Consolidated Credit and our community partners are actively working to address—both online and in our local communities in South Florida.

“Through partnerships with local government agencies, like the Hialeah Housing Authority and the Palm Beach Public Library System, we can provide free financial literacy education in Spanish to these underserved communities,” Herman says. “And it’s critical because providing financial education in the language they’re comfortable with gives people a path to achieve budget stability and a debt-free life.”

Get on the path to a debt-free life today.