Outreach and support programs that help build a better world for us all.

Helping clients overcome financial challenges is only half of what we do. Consolidated Credit is an active member of the community, providing support for national and local nonprofits, as well as partnering with organizations nationwide to provide critical financial education programs to help those in need.

$483,660

raised and donated in 2023

358

organizations supported

7,231

community members served

Latest Happenings

Causes We Support

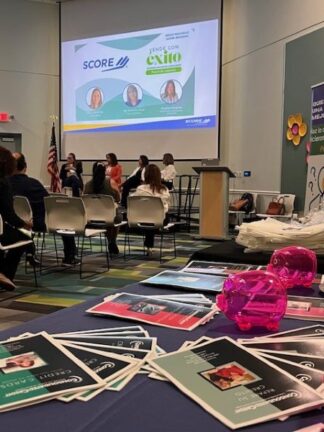

Consolidated Credit prides itself on meeting people where they are and making financial knowledge accessible. Over the past 31 years, we’ve had the privilege of working with a diverse group of entities—nonprofits, businesses, schools, churches, senior living facilities, and municipalities—and connecting to a diverse audience comprised of various age groups, demographics, and languages.

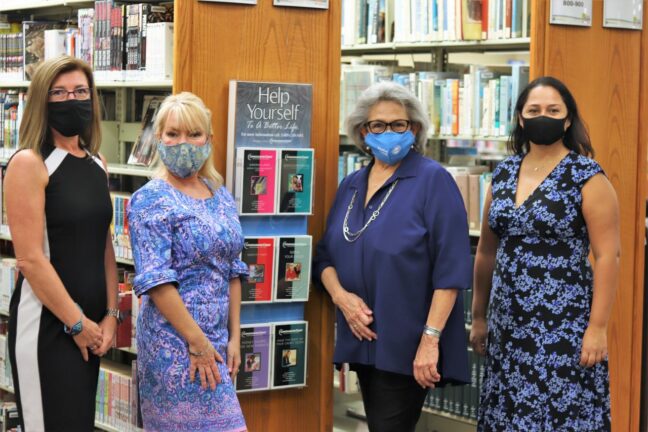

Online and in-person webinars have fostered impactful collaborations with organizations like the Securing Our Future Initiative Group (SOFI), the University of Miami, Big Brother Big Sister, Broward House, and Hispanic Unity of Florida. Partnerships with organizations like Broward College and the Palm Beach Country Library System to provide thousands of free physical financial education booklets.

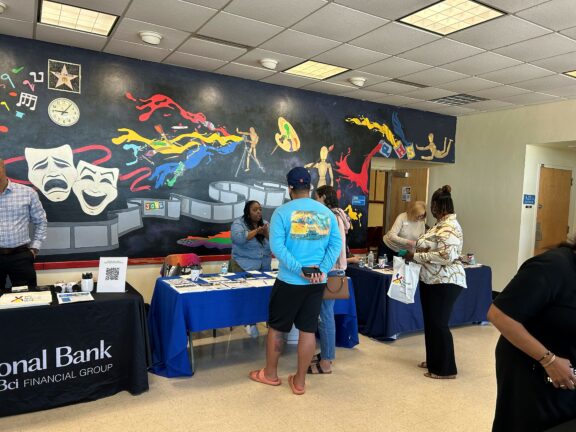

We’re are a familiar presence at local resource fairs and summits such as those organized by Nova Southeastern University, the City of Miramar, and U.S. Southern Command, to name a few, and have been honored to support South Florida entities such as Miami Lighthouse for the Blind and Visually Impaired and the Early Learning Coalition of Miami-Dade/Monroe.

Education, coaching, and counseling individuals don’t always resolve systemic issues which is why Consolidated Credit is a passionate advocate for financial equality. We collaborate with policymakers, experts, and community leaders to fight for economic opportunities and to improve financial stability for underserved communities.

In 2022, Consolidated Credit established the Financial Advisory Council which includes respected leaders in business and the community and Consolidated Credit leadership. Together, the collective experience, resources, and knowledge of our esteemed Financial Advisory Council promote financial education and equality and support relevant programs here in South Florida. The group meets quarterly to discuss local issues, exchange ideas, and propose solutions.

Consolidated Credit empowers time homebuyers through education, collaborates with organizations that address housing-specific issues, and advocates for housing affordability through policy.

We have partnered with housing authorities of Hialeah, Fort Lauderdale, Tamarac, Deerfield, and West Palm Beach to work directly with their residents to prepare them for homeownership. However, we know that getting into the home is only half of the battle. In our pilot program partnered with Habitat for Humanity of Broward County, we counseled 25 soon-to-be homeowners over 10 months to prepare them for the financial responsibilities of homeownership so that participants can keep their homes after they receive them.

And when we aren’t working directly with residents, we’re advocating on their behalf. In 2014, we worked directly with the U.S. Treasury Department to launch a robust multi-session program to help homeowners understand and utilize the federal Home Affordable Modification Program. IN 2023, Consolidated Credit’s Director of Housing, Sandra Tobon, was elected to the Florida Board of the Community Reinvestment Alliance, a distinguished coalition of community leaders that aims to increase homeownership opportunities for low-to-moderate income and minority residents.

Consolidated Credit gives back to the local community by partnering with South Florida-specific organizations that benefit the lives of those in our community.

We are a proud, long-standing member of the United Way of Broward County which funds over 100 community-based programs and services, as well as a member of the Chairman’s Board. We also support organizations that focus on at-risk populations like Hispanic Unity of Florida, Red de Apoyo Humanitario, and the Advocate Program which helps ensure financial stability for the immigrant community, and Women in Distress, a full-service domestic violence center serving Broward County.

We also have deep ties to the city of Parkland, FL, the site of a shooting at Marjory Stoneman Douglas High School, and where our founder, Howard Dvorkin, CPA, is from. In response to this tragedy, Howard Dvorkin founded Parkland Cares, an organization providing funding and awareness for trauma care and mental health services in the South Florida community.

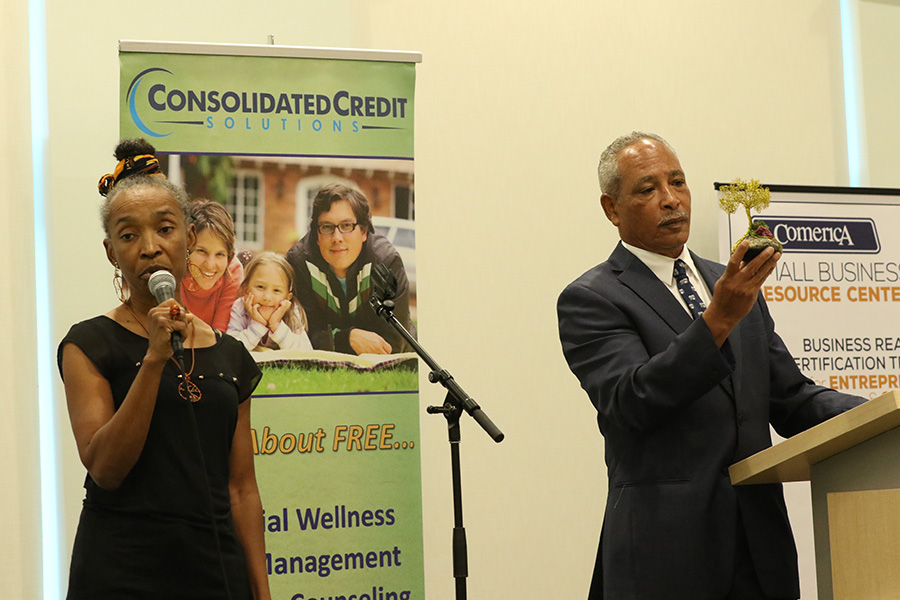

Uplifting the community also means investing in our communities. Consolidated Credit has worked with numerous municipalities (Riveria Beach, Palm Beach County, and the city of Plantation) to offer educational workshop series (Small Business $ense Readiness Training and Small Business $ense) to support small business owners.

Consolidated Credit is dedicated to supporting our South Florida neighbors, especially community members struggling with financial, housing, or food insecurity.

LifeNet4Families, an organization dedicated to helping residents of Broward County who are food or housing insecure, is one of our longest-running non-profit partnerships. For over a decade, we have been proud to support their initiatives by participating in donation drives, sponsorships, and charitable contributions.

In addition to financial support, we believe that education is also vital in breaking the cycle of poverty. In the past three decades, we’ve provided free housing and financial counseling to a multitude of organizations such as…

- Operation Hope, champions economic inequality, financial illiteracy, social injustice, and inequitable access to capital.

- Securing Our Future Initiative Group (SOFI), a powerful initiative that forges economic paths for families residing below the federal poverty level

- TOUCH Broward which aims to reduce health disparities in Broward County

- Jack & Jill Center which focuses on supporting families who are in the high-need category

- Tree of Life Ministries of Orlando in their efforts to serve the homeless population of Central Florida

Consolidated Credit is proud to join forces with our established nonprofit partners. Our positive impact on those in financial crisis helps us stand out as a beacon in the communities that we serve and inspires us to keep doing more for those who need it most.

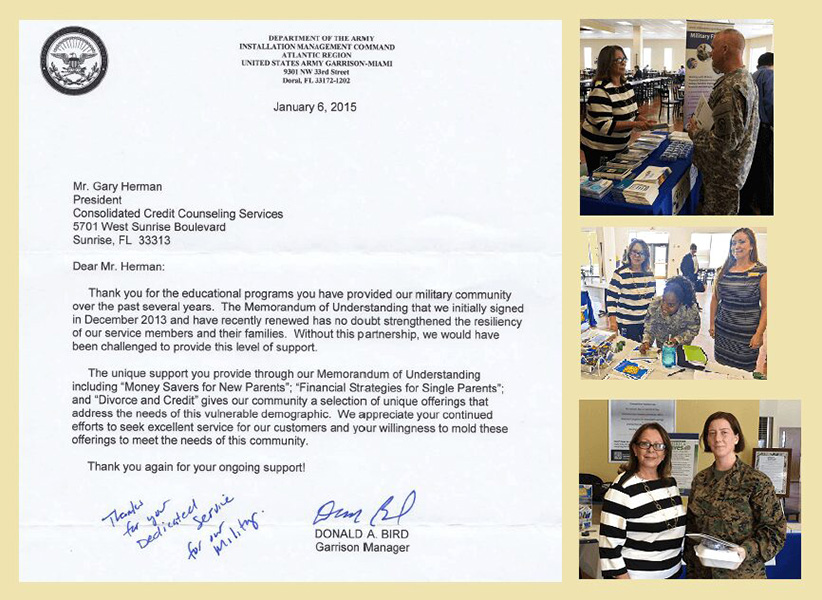

“We are committed to helping Americans who serve with dedication in our Armed Forces to get ahead here at home,” says Hilton Sher, former Chief Financial Officer of Consolidated Credit. “Whether an individual is actively serving, on reserve, or has already transitioned to civilian life as a veteran, they face unique financial challenges that require specialized assistance, education, and readily available resources for personal financial growth.”

Since our founding in 1993, Consolidated Credit has made a point to hire National Guard Soldiers, Reservists, and Veterans. We also provide ongoing veteran support by waiving fees for debt management programs, partnering with military support organizations to provide military-focused financial education, and the creation of our Military Financial Education Program for active-duty Service Members, Veterans, and their families.

Our efforts have been recognized by the U.S. Army Garrison-Miami, received a Certificate of Distinction from the U.S. Department of Defense for continued outreach and support of the men and women who serve in our Armed Forces, and invited to the Veterans Outreach Event organized by U.S. Senator Marco Rubio.

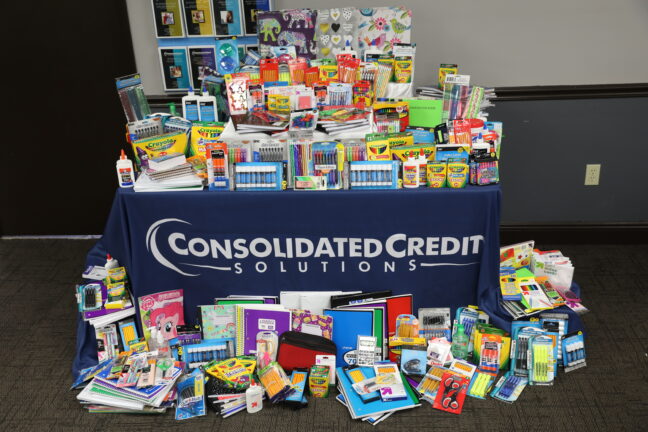

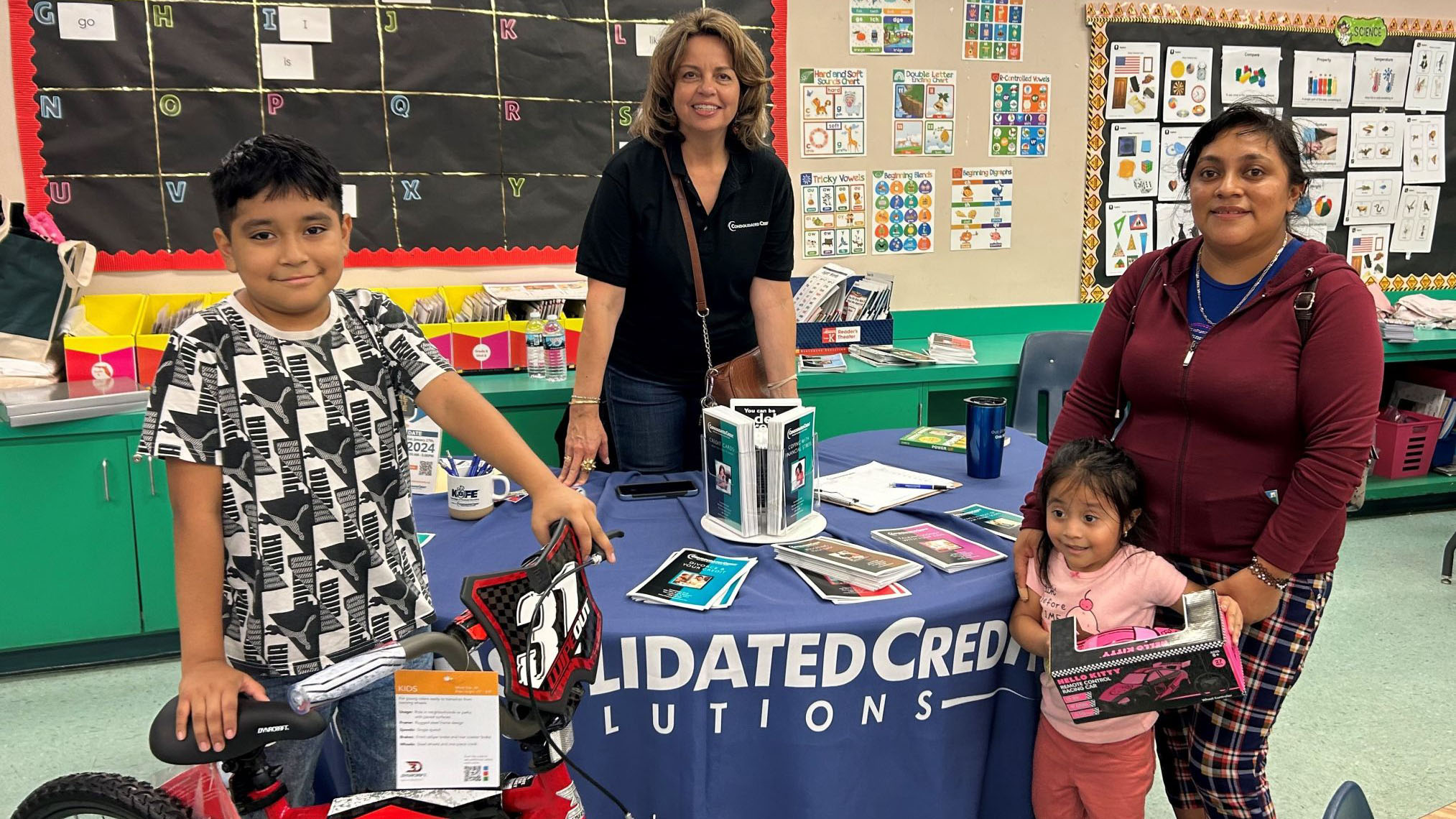

Consolidated Credit supports a range of charitable causes for children of all ages, from grade schoolers to high-school seniors, with a focus on youth financial education, safety, and happiness.

Collaborations with organizations like Big Brothers Big Sisters of Broward County and Girl Scouts of South Florida allowed us to connect with elementary-age children and instill the importance of financial wellness early on, while our ongoing partnership with Junior Achievement of South Florida enables us to educate and mentor over 20,000 middle schoolers with real-world financial experience.

But investing in our youth also means tending to their physical and emotional well-being. For over a decade, Consolidated Credit has supported organizations like the Children’s Services Council of Broward County (CSC) and Lauren’s Kids, to prevent child abuse and neglect. Our annual toy drives have generated hundreds of toys for SOS Children’s Village (a residential foster care community), Henderson Behavioral Health, and Markham Elementary School in Pompano Beach, FL.

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

-

Now PlayingConsolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

-

Up NextHomeownership: Your Path to Security & Stability

-

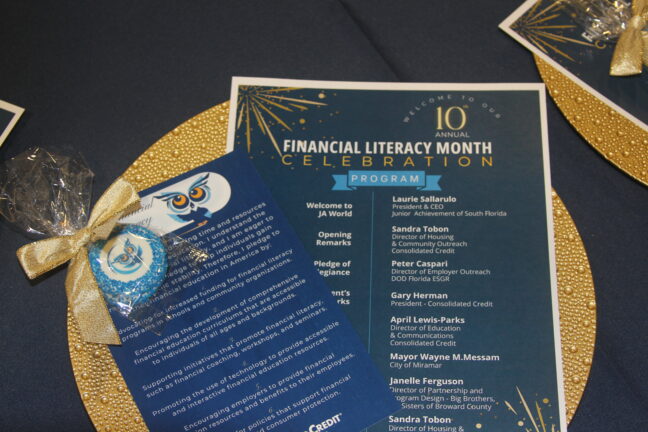

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

-

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

SOS Children’s Villages Florida

-

Providing Financial Literacy Resources through the Palm Beach County Public Library System

-

Consolidated Credit Proudly Supports the National Guard and Reservists

-

Consolidated Credit at The Martin Luther King Day Parade 2019

-

2019 Consolidated Credit Community Thanksgiving Food Drive

-

SMART Cookie

-

United Way Partners with Consolidated Credit to Provide Debt Help

-

Veterans Housing Summit

Community Service Photo Gallery