During COVID, many consumers curtailed their spending and used stimulus checks to pay down their debt. But with the pandemic slowly coming to an end, consumers are back to shopping and charging. As a result, debt levels have rapidly increased. That’s especially concerning, heading into the winter holiday shopping season.

Where U.S. household debt stands now

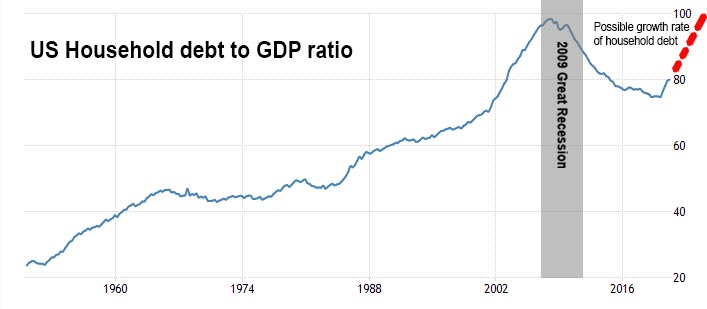

In the third quarter of 2021, total household debt has climbed to $15.24 trillion, far exceeding the $12.7 trillion before the pandemic. While this includes “good debt” such as mortgages, consumer credit card debt has also gone up for the past two quarters of 2021.[1] Household debt hasn’t been this high on an adjusted level since 2009. If consumer debt continues at this level, we may wind up with more debt than just before the Great Recession of 2009.[2]

“It’s concerning to see consumer debt levels increasing so quickly after the efforts people put in to pay off their debt last year,” says Gary Herman, President of Consolidated Credit. “Even though the economy seems to be strong, carrying consumer debt like credit card debt isn’t good for your household finances. It’s essential to keep debt minimized, even in a good economy.”

What’s increasing consumer debt?

Consumer debt is made up of all the different types of debt that a consumer can hold. That includes:

- Mortgages

- Auto loans

- Student loans

- Credit card debt

- Personal debt, such as loans

Most of those types of debt have increased since the start of 2021. Mortgages added the most to household debt, as home prices surged and consumers took advantage of mortgage rates that are at historic lows. Mortgage debt is up 6.7% from last year, totaling $10.4 trillion.[3] This figure includes original mortgage loans as well as refinances.

Credit card debt had the second-largest gain. Consumers have added $34 billion in credit card debt in just the past six months alone.

Auto loans were also up by $33 billion, although this reflects the increased prices of automobiles instead of more units sales.[4]

Credit card debt drives up household debt in a bad way

Some types of debt are considered “good” debt because they help you purchase tangible assets that increase in value over time. For instance, a mortgage is a “good” debt because it allows you to purchase a home. That home increases in value over time, helping increase your wealth.

By contrast, credit card debt is considered a “bad” debt. Most purchases made with a credit card won’t hold value over time. Credit cards also have much higher interest rates. Thus, they’re bad for your budget because balances that are left unpaid cost significant amounts of money over time.

Why rising consumer debt is dangerous at this time of year

The holidays trigger spending behavior that isn’t normal for most people. In 2021, households are expected to spend an average of $1,463 over the holiday season.[5]

This includes gifts, decorations, and travel.

What’s more, most of that price tag may end up on credit cards. This year 75% of holiday shoppers say they’ll use credit cards to pay for their gifts, but only 37% will pay that balance off within one billing cycle. Unfortunately, 22% said they would pay it off five months or later.[5]

“Americans have added so much debt already this year and now we’re heading into the holiday shopping season,” Herman explains. “Adding even more to those balances can be a recipe for disaster. At a certain point, credit card debt becomes unsustainable. You simply can’t keep up with the bills.”

How to get a handle on your household debt

If you’re concerned about how much debt you’ve added this year, now is the time to make a plan to get ahead of your debt.

“Don’t wait around for the next six weeks and just ignore your balances during the holiday season. Set a holiday budget that will allow you to avoid making new charges, even if that means scaling back your plans a bit. And then make a plan to pay down the balances you have.”

Gary Herman, president of Consolidated Credit

Herman and the team at Consolidated Credit recommend taking the following steps to craft an effective credit card debt payoff plan.

Step 1: Know what you owe

Use Consolidated Credit’s free credit card debt worksheet to detail exactly what you owe and what it’s costing you. This will allow you to see a few useful things, including how much you owe in total, which can factor into the best strategy for paying it off. You can also see how much income your monthly payments are currently using.

Step 2: Review your budget

If you don’t already have a written budget set, it’s time to set one. You need to know where your money is going each month to effectively understand and curb your spending. With debt to pay off and the holiday spending season upon us, now is the time to make some cuts. Anything that’s not a necessity should be temporarily cut until you’re done with both holiday spending and paying off your credit card balances.

Once you’ve cut everything you can cut, you will see how much additional money you can put towards your credit card bills to pay them off as quickly as possible. You can use our free fixed payment calculator to see how quickly you can pay off your debt with larger fixed monthly payments.

Step 3: if you owe more than $5,000 consider debt consolidation

Even with larger monthly payments, a high level of debt can take years to pay off. With $250 fixed monthly payments, it would still take 2 years (24 months) to pay off a $5,000 balance in full at an average interest rate of 17%.

In this case, you may be better off consolidating the debt so you can lower the interest rate applied. That allows you to focus on paying off the balance you owe, rather than spending so much money on accrued monthly interest charges. You can get out of debt faster and may even be able to lower your monthly payments.

Just be aware that do-it-yourself debt consolidation options like consolidation loans and balance transfer credit cards require you to have good credit. If you don’t have good credit, then you may need professional support to get out of debt.

Step 4: Talk to a credit counselor

A certified credit counselor can help you review your debt and budget. Then together you can talk about the options that you have to get out of debt as quickly as possible. They can help you evaluate options like debt consolidation loans, balance transfers, and payoff plans.

They can also help you understand options like a debt management program, which can help you consolidate debt even if you have bad credit.on average, the program reduces people’s interest rates to 0-10% and helps them get debt-free in as few as 36 months.

Get a free debt and budget evaluation from a certified credit counselor to find the best way to pay off household debt.

Sources:

[1] https://www.newyorkfed.org/newsevents/news/research/2021/20211109

[2] https://tradingeconomics.com/united-states/households-debt-to-gdp

[4] https://www.newyorkfed.org/newsevents/news/research/2021/20211109