Daily Finance and Company News (Page 8)

Consolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

-

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Are Store Credit Cards Bad?

Rising delinquencies suggest two reasons why you might want to stay away from an in-store credit card. The debate has…

One More Good Reason You Don’t Need Credit

As creditors scale back and banks scale up, it may be time to adjust your purchasing habits. For over two…

Half of Teens Don’t See Becoming Financially Independent as a Key Life Goal

Helping your teen learn how to become financially independent as they transition to adulthood. Each week, Consolidated Credit searches for…

Is There a Tie between Student Loans and Credit Health?

A new FICO study finds that credit health may be a slippery slope when you have student loans. Each week,…

Consolidated Credit Brings Free Financial Literacy Publications to NSU

Thinking Money exhibit at the Alvin Sherman Library features a range of free financial literacy publications. As we finish off…

When is the Right Time to Retire Old Credit Cards?

20 million Americans haven’t changed their primary credit card in over 10 years. When it comes to technology, consumers always…

Are Long Term Auto Loans the Best Commitment?

New data shows that borrowers are on-average extending terms to over 5 years. But are the benefits worth the cost?…

What States Can Revoke Professional Licenses for Defaulted Student Loans?

A teacher in Texas lost his dream job due to student loan default, and it’s not the only state where…

Military Families Face a Financial Confidence Gap

Service Members are more confident than their spouses about their ability to be financially stable in the short and long-term.…

Why Women Hold More Student Debt

5 reasons why women hold two thirds of all student loans in repayment. Student loan debt in the U.S. now…

Can You Afford the Cost of Debt?

The latest interest rate hike by the Federal Reserve means the cost of debt from your credit cards just increased.…

How Credit Smart Are You?

Take Consolidated Credit’s free Credit Smart test to see how much you really know. It’s National Financial Literacy Month! All…

Don’t Loan Credit Cards!

36 million Americans learned the consequences of loaning credit cards to a friend in need. Each week, Consolidated Credit searches…

Dealing with Medical Debt Collections and Accident Liens

NBC6 Miami reveals some of the traps you can face with medical debt collections. Despite ongoing changes and adjustments to…

Is Mobile Banking Better?

Millennials are the most likely to use mobile banking technology, but they’re also the first to drop it. Each week,…

12% of Americans Had a Credit Card Declined Last Year

As Americans hit record-high credit card debt levels, declined transactions may only get worse. Each week, Consolidated Credit searches for…

More Americans Right Size Emergency Savings

Almost 60% of Americans have more emergency savings than credit card debt. Each week, Consolidated Credit searches for financial research…

Past Due Debt Payments at an All-Time High

But only for consumers, as commercial businesses are managing to keep up. Each week, Consolidated Credit searches for financial research…

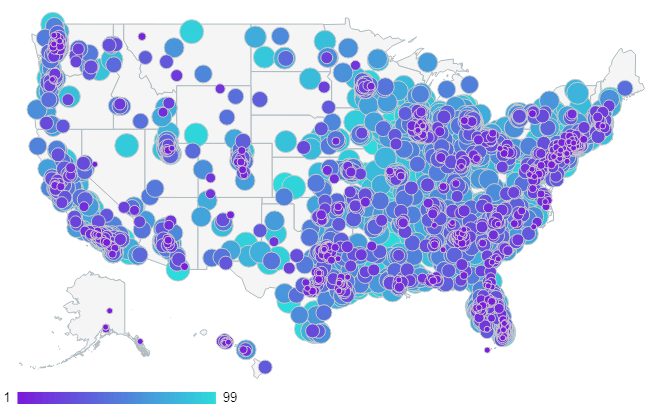

Which Cities are Home to the Highest Credit Card Debt?

A new study finds residents in the South may be struggling the most to pay off their credit cards. Each…

Big Changes Coming to Credit Cards Offering 0 Interest on Balance Transfers

Rising interest rates could mean shorter 0% APR promotion periods. In the past, credit cards offering 0 interest on balance…

What Causes America’s High Credit Card Balances?

A new survey finds most people go into debt trying to make ends meet. The interesting study Credit card debt…

Credit Card Skimmers Hidden in Plain Sight at Aldi Supermarkets

Aldi puts customer data at risk by failing to upgrade to chip readers at checkout. The discount supermarket chain Aldi…

Check Your Paychecks This Month

The tax reform bill could mean you enjoy more take-home pay, starting in February. A report on CNN Money explains…

Good Debt vs Bad Debt

Understanding the difference between good debt vs bad debt, so you can use credit the right way. Each week, Consolidated…