Free Financial Education Resources

Build your money skills with Consolidated Credit’s free financial resources.

Building financial literacy is essential if you want to achieve and maintain financial stability long-term. At Consolidated Credit, it’s our mission to provide free financial literacy education to consumers. People often lack the essential knowledge and skills they need to be successful, through no fault of their own. After all, most of us never received any personal finance education in school. As a result, it’s up to you to build financial literacy on your own.

With that in mind, Consolidated Credit has created a wide range of free financial education resources to help you learn. And we’ve made it easy to dive into a topic by arranging the resources we have into groups. Browse the topics below to begin building financial literacy. If you still have questions, visit our Ask the Expert section to ask your question to our team of certified financial coaches.

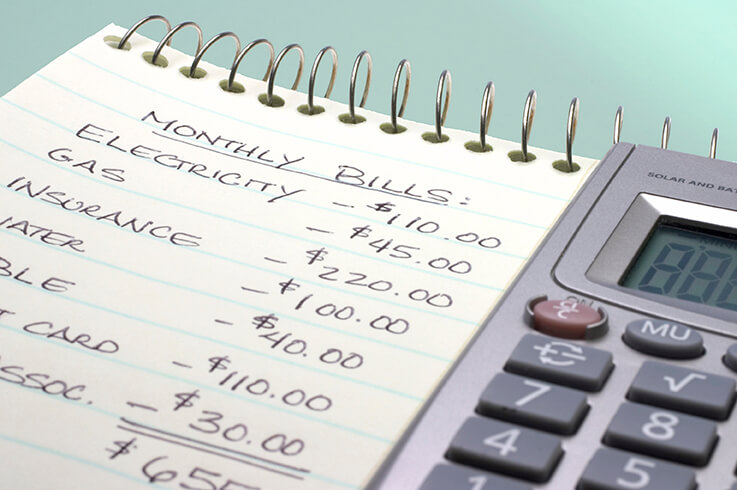

Budgeting Resources

Build and Maintain a Budget

A budget is the foundation of good personal finance. A well-built budget can help you stop overspending, manage debt, and save money to achieve goals faster. This set of resources teaches you how to create a budget that works and use it to overcome financial challenges.

Learn to Budget

Resources for Saving

Save Money to Reach Your Goals

Saving money is essential if you want to stop living paycheck-to-paycheck. Knowing how to save effectively helps you cut costs so you can avoid debt and achieve your goals faster. Learn how to save every day and how to make the best use of the funds you set aside.

Learn How to Save

Financial Planning Resources

Build Wealth and Plan for Retirement

Financial planning is necessary for maintaining long-term financial stability, particularly into retirement. You need to learn how to make the right investments and increase your net worth, so you can stop living paycheck to paycheck and start saving for your golden years.

Prepare for the Future

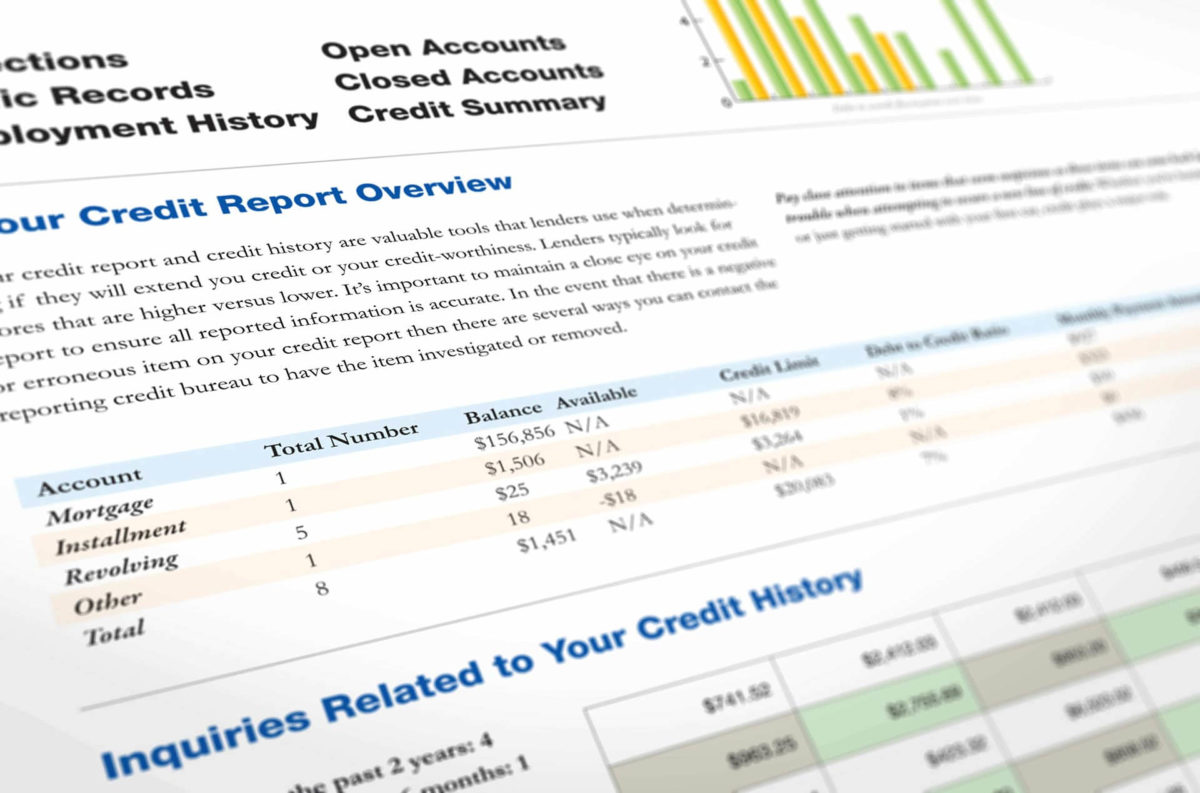

Resources for Rebuilding Credit

Recover from Bad Credit

If you’ve had some trouble with credit in the past because of challenges with debt, it’s important to take the right steps so you can recover quickly before your bad credit score starts to hold you back. This guide teaches you how to rebuild your credit score step-by-step.

Rebuild Your Credit

Debt Management Resources

Take Control of Your Debt

Being able to manage debt is crucial for financial stability. These resources teach you how to develop effective strategies for managing debt, so you can pay off balances faster and save money. Learn all the tricks for managing debt, from when to consolidate to why bi-weekly payments can be beneficial.

Learn How to Manage Debt

Seasonal Budget Resources

Navigate Expensive Times of Year

Certain times of the year can be particularly tough on your budget, creating a higher risk of increasing your credit card debt. These resources help you budget for specific events, including back to school, holiday shopping, vacation season, and disaster planning.

Set Seasonal Budgets

Youth Financial Resources

Teaching Kids and Teens

Teaching your children good financial habits is a gift that you can give them that will last a lifetime. These resources help teach kids and teens about budgeting, saving, and banking, as well as how to introduce credit the right way.

Teach Kids about Money

Financial Stability Resources

Overcome Common Challenges

Finding financial stability can be tough when you’re facing challenges like limited income or bad credit. But with the right financial strategy, you can avoid common money mistakes, minimize financial stress and find the right balance so you can become financially stable.

Achieve Stability

Money Management Resources

Become a Good Money Manager

Managing your money is easier with the right tools. Good money management starts with choosing the best financial institution and getting the accounts you need to be successful. Learn how to bank smarter to avoid costly fees and make your money work for you.

Manage Your Money

Credit Score Resources

Learn to Achieve Good Credit

Good credit is essential. You need it to qualify for the best rates and terms on credit. A bad score can make it harder to rent property or open accounts in your name. These resources teach you how credit scores work and what steps to take to achieve the score you want.

Start Improving Your Score

Credit Card Resources

The Right Way to Use Credit

Credit cards can be a useful financial tool when they are used correctly, but they can also get people into serious financial trouble. These resources help you learn the right way to use credit cards so you can enjoy all the benefits while managing your balances effectively.

Use Credit Cards Wisely

Identity Theft Resources

Protect Your Personal Data

The threats to your personal data and accounts just keep increasing. Learning how to protect your identity from both physical and digital threats is paramount. These resources can help you learn how to prevent identity theft, as well as how to recover quickly and minimize out-of-pocket costs if you’re a victim.

Protect Against ID Theft

Planning for Life Events

Prepare for the Future

Both expected and unexpected life events can lead to challenges with debt. These resources are designed to help you prepare for both. Learn how to prepare your finances to married and start a family, while also planning for things like unemployment.

Get Ready for Life Events