Daily Finance and Company News (Page 7)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Budgeting for Christmas in July

The year is half over, it’s time to start budgeting for the holidays now! These days, with Amazon Prime Day…

Is Your Debt-to-Income Ratio Telling You It’s Time to Get Debt Help?

If your DTI is over 36 percent, then it’s time to act and find debt relief. It’s a question that…

Military Families: Learn to Take Control of Your Financial Life

Consolidated Credit Solutions is hosting a three-part seminar to teach military service members, veterans, and their families how to navigate…

Consumer Credit Card Debt Breaks Records… Again.

U.S. consumers owe credit card companies $870 billion. Here’s what you can do to eliminate your piece of that pie.…

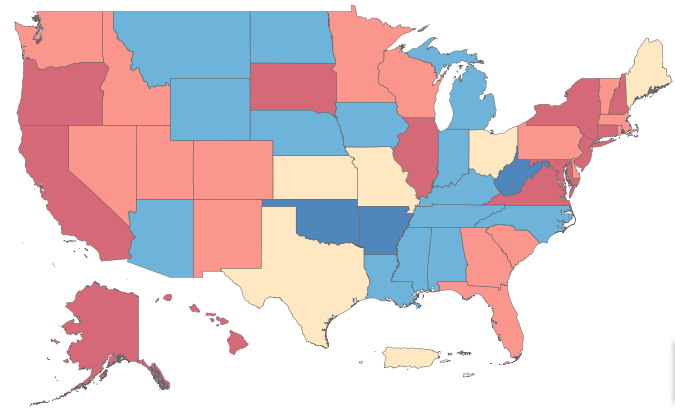

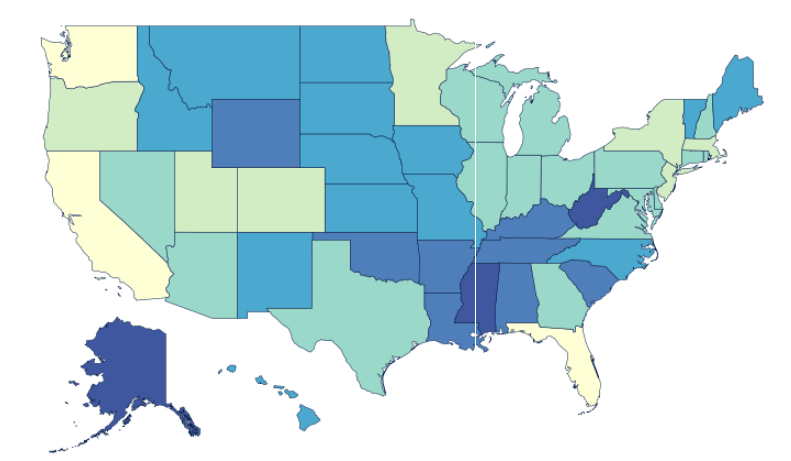

A Snapshot of Credit Card Debt by State in 2019

California has the most credit card debt in total, but Nevada had the biggest gains over a year. Consolidated Credit…

Attention Federal Employees: Free Help with Credit Card Debt During Government Shutdown

If you’re taking on credit card debt to cover expenses during your furlough, there are steps you can take to…

Figuring out the Finances of the Government Shutdown

Find out what the FDIC has to say about getting through the shutdown with your finances intact. Our government is,…

5 Good Reasons to Call Your Credit Card Company

Customer loyalty can be turned into cost-savings when the time is right. A financial expert named Matt Schulz shared an…

What to Do If You Receive an Unexpected Emergency Room Bill

Millions of Americans could face unexpected medical bills in January. Medical debt is now the leading cause of bankruptcy in…

Despite Economy, Employees are Struggling with Debt

The proven solution? Knowledge of Financial Education Last month, the world’s second-largest professional services company released a first-class study about…

Two Major Creditors Scale Back on Customer Credit Card Limits

Tougher lending standards may mean lower limits on new credit cards. Two of the biggest credit card companies in the…

Going into Debt After a Cancer Diagnosis

A new report finds 42% of cancer patients drain their life savings within two years. You always hear horror stories…

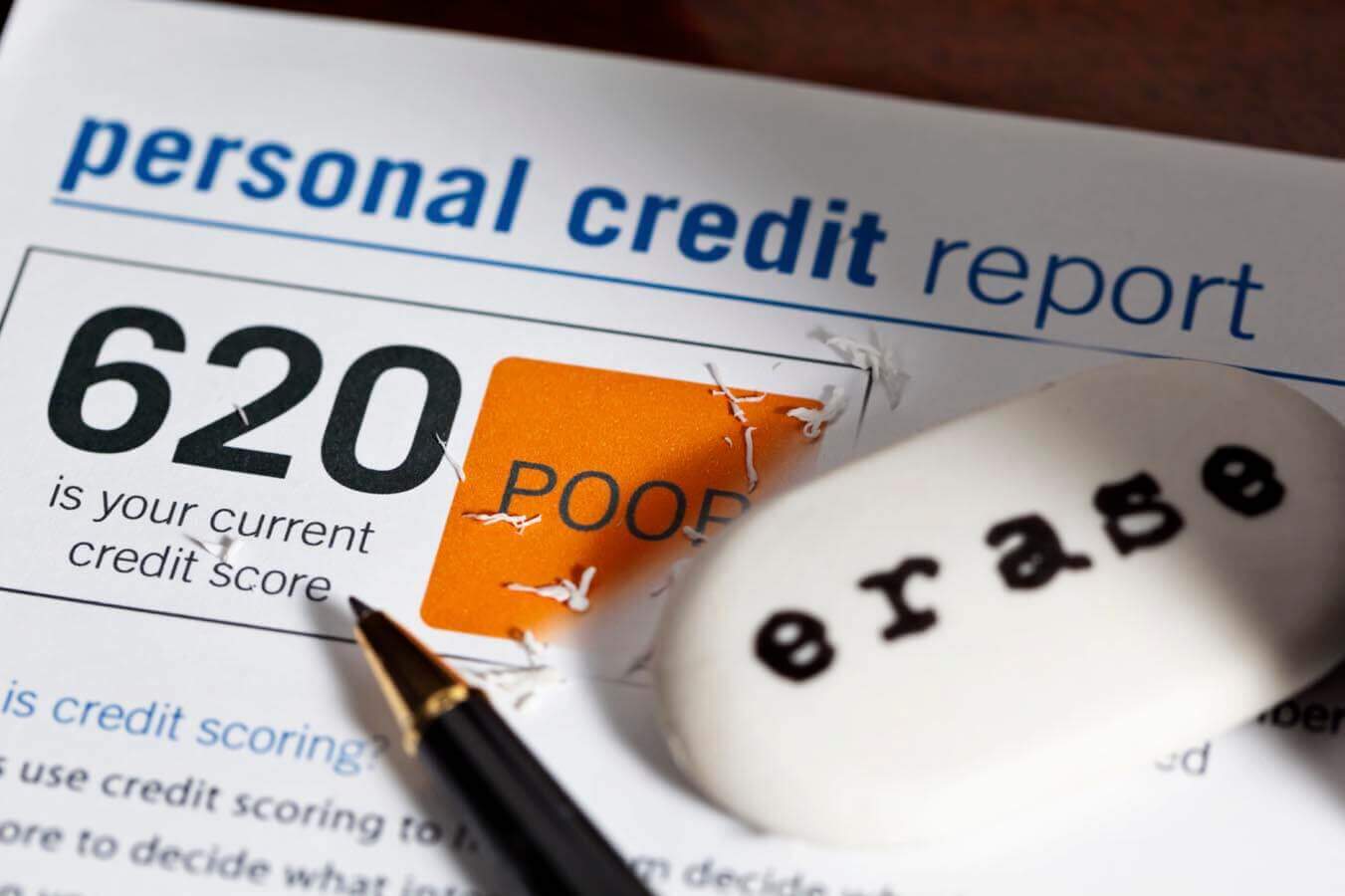

New UltraFICO™ Score Could Make Rebuilding Your Credit Easier

Specialized credit check option from FICO could make it easier to qualify for new credit. This month, FICO announced they…

Is Financial Anxiety Keeping You Up at Night?

Financial stress leads to depression, missed opportunities and fights with your loved ones. But there are things you can do…

Disaster Relief Hotline for Hurricane Victims

Hurricane Michael devastated the Florida panhandle and parts of Georgia, leaving 1.3 million people and business without power. Many families…

Will Universal Savings Accounts Really Be the Best Way to Save for Emergencies?

Congress wants to make it easier for you to save for emergencies, but their solution may not help the working…

Millennials’ Biggest Source of Debt Might Surprise You

Your biggest source of debt matters when it comes to your repayment strategy. Each week, Consolidated Credit searches for financial…

How to Avoid Having an Application for Student Loan Forgiveness Denied

99% of Public Service Loan Forgiveness applications are rejected. Here’s why and here’s how you can ensure you get approved……

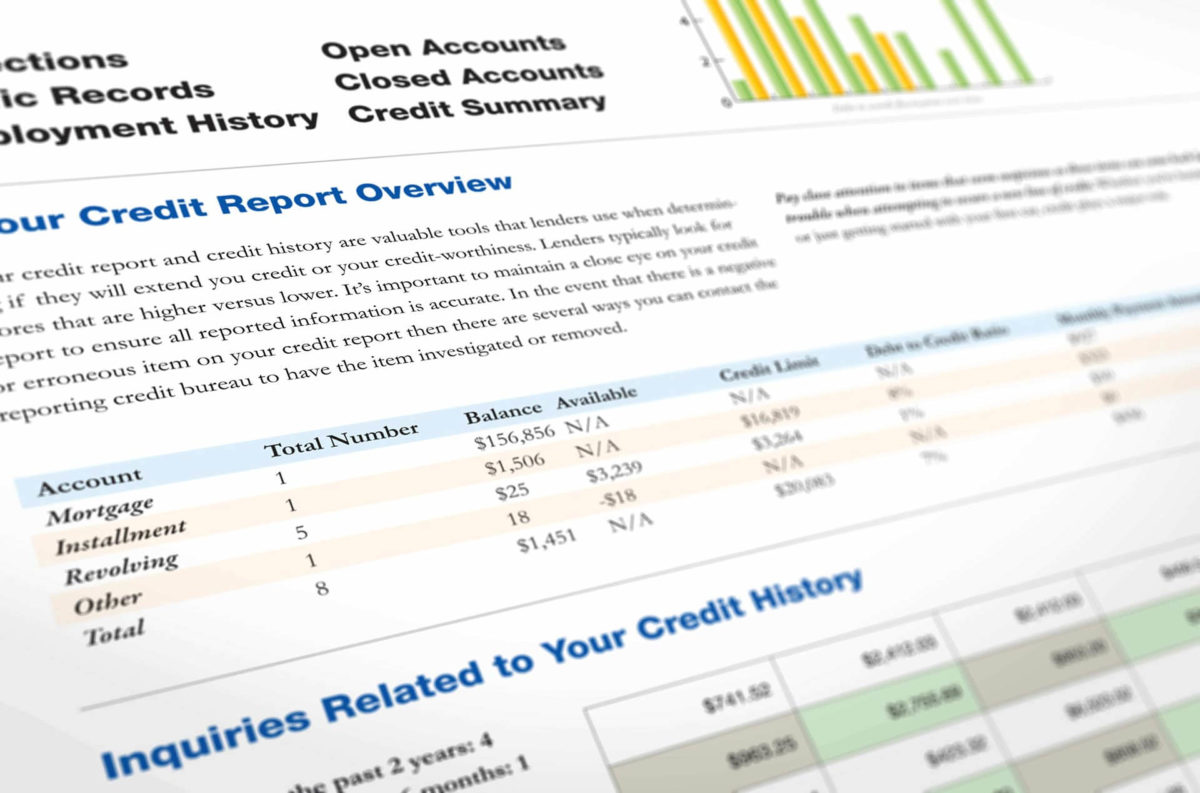

Should You Freeze Your Credit?

Now that credit freezes are free, it’s usually in your best interest to freeze your credit report to prevent ID…

Avoiding ID Theft in the New Age of Credit Card Fraud

Counterfeit credit card fraud is down 75% thanks to EMV chips, but that doesn’t reduce the need to protect your…

Are You on a Yo-Yo Diet of Debt Repayment?

Americans paid off $40.6 billion of credit card debt, then added $30 billion back. Each week, Consolidated Credit searches for…

Understanding the Effects of Missed Payments

Whether it’s from forgetfulness or sheer lack of funds missed credit card payments can affect your finances more than you…

How Security Clearance Credit Check Rules Impact Many Military Service Members

It’s more important than ever for Service Members to actively monitor their credit. Security clearances and who gets them have…

What’s Your Personal Saving Rate?

The saving rate hit 6.8 this summer, but many Americans still aren’t saving. Each week, Consolidated Credit searches for financial…