Daily Finance and Company News (Page 10)

Consolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

-

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Fannie Mae Student Loan Solutions Offer Path to Homeownership

These new Fannie Mae student loan payment options help minimize the burden of student loan debt when buying a home.…

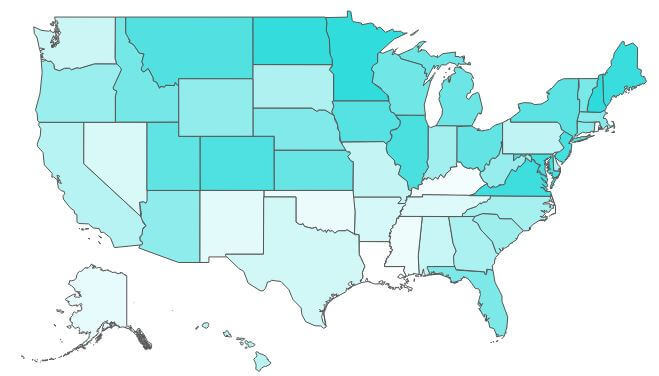

Are You and Your Neighbors Financially Literate?

Financial Literacy Month Map reveals the most and least literate consumers. Please click the map to view the interactive version,…

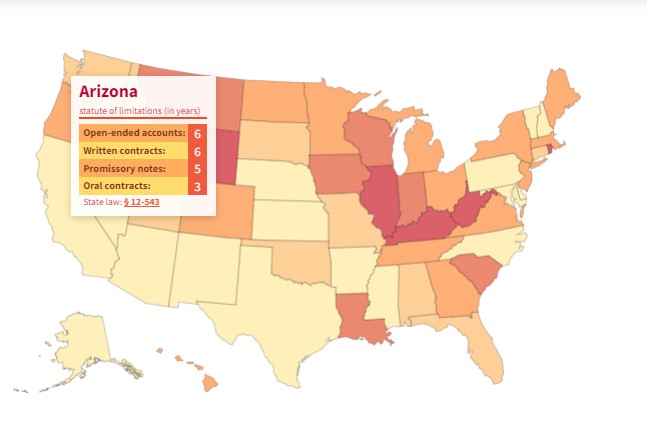

Statute of Limitations on Debt

Arizona just increased their statute. Will other states be soon to follow? If you’re one of those people who is…

Identity Theft Adapts around Smart Cards

Chip technology may curb in-store theft, but fraudsters are finding plenty of other ways to steal your data. Smart chip…

Do You Live Where It’s Easy to Repay Debt?

Where you live can have a major impact on how easy it is to get out of debt. Each week,…

Feeling the Threat of Debt Collectors

1 in 4 consumers report feeling threatened during a collection call. Nobody wants to get that call. Whether you knew…

From the Military to the Mediocre

Veterans are finding civilian jobs, but they aren’t happy with the work. Hiring a military veteran isn’t a hard sell…

Teaching Children about Money Can Be a Chore

But if you make them work for it, children can learn a lot about finances. Do you make your children…

Which Generation Has the Most Credit Card Debt?

Young Gen Xers are the most likely to have debt and hold high balances. When it comes to credit card…

Can Poor Credit Drive You Crazy?

If your credit score is low, your car insurance premiums are probably sky-high. If you have bad credit, don’t drive…

Military Families Transition after Deployment

Adjusting your family’s financial life to a “garrison environment.” If you’re a military family staring down reduced income challenges following…

Protecting Servicemembers from Financial Abuse at Home

Two big cases show the importance of the Servicemembers Civil Relief Act. When someone is risking their life to protect…

Good News in Personal Finance

Most polls about personal finance have been bleak this year. Not this one. Well, not totally. Each week, Consolidated Credit…

When Work Is a Total Disaster

Many employees say they’re not ready for a hurricane or other emergency – even though their bosses think they are…

Credit Card APR at 5-Year High

Higher rates won’t help families working to eliminate debt. Each week, Consolidated Credit searches for financial research that can help…

What Career Is Growing the Fastest?

You probably won’t believe it – and you definitely don’t want it. Talk about a growth industry: Identity thieves and…

The Mortgage Lending Paradox

Does a record-low default rate mean lending standards are too tough? Following the real estate market collapse in 2008, a…

HELOC Domino Effect

Study finds missed home equity payments are a sign of trouble to come. Each week, Consolidated Credit searches for financial…

Can You Read a Credit Card Agreement?

Over half of Americans don’t have the reading level necessary to understand most agreements. If you’re one of those people…

Parents Step Up College Savings

Giving your children their best chance for stability after graduation. While retirement savings may still be stuck in neutral for…

Sick of Retirement Studies

Yet another research project is depressing enough to make you ill. British comedian Spike Milligan’s famous tombstone reads, “I told…

A Cautionary Tale of Debt Settlement

One woman’s journey serves as a warning for others seeking debt relief. When NBC6 reached out to Consolidated Credit for…

What Parents Pay to Support Millennials

Is financial support keeping adult children from achieving independence? As a parent, you want to ensure your children have a…

The Stress of Debt

How much “financial anxiety” do you have? It’s no secret that owing money is stressful. But until now, no one…