Daily Finance and Company News (Page 6)

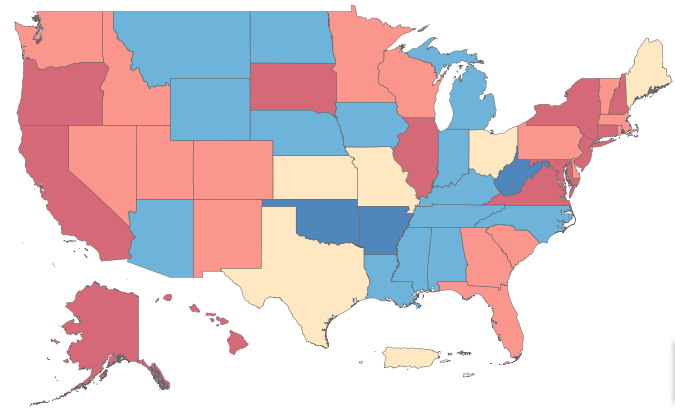

Consolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

-

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

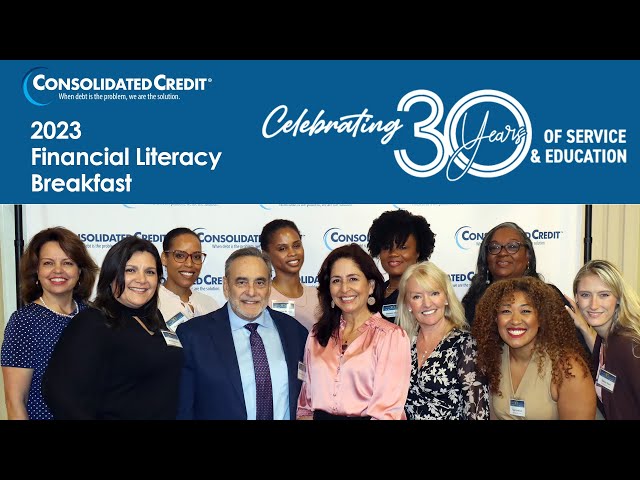

Credit Unions Help Hispanic Americans Access Key Financial Services

These member-focused financial institutions offer a practical alternative to traditional banks. Most Americans take access to banking and financial products…

This National Preparedness Month, Protect Your Wallet from the Weather

Here in Florida, hurricane season is upon us. Isaias barely missed us and Laura recently battered Louisiana. More storms are…

The Reality of Reverse Mortgages

As homeowners get older, they become eligible for a unique, low-risk borrowing option called a reverse mortgage. Yet, many don’t…

How to Avoid Imposter Scams

COVID-19 sets 2020 Military Consumer Month apart. July is National Military Consumer Month. It’s a month where the Federal Trade…

A Recession Guide for Recent Grads

The economic impact of COVID-19 means that, unfortunately, we are in a recession.[1] If you’re graduating soon, this can seem…

Overcoming the Pitfalls of Home Buying in the New Normal

Homebuyers face some new hurdles to take advantage of historically low rates. With interest rates at historic lows, you may…

Reverse Mortgage Guide for Navigating the COVID Crisis

The COVID-19 pandemic has hit seniors’ health the most, and it can do the same thing to their finances. For…

Homeowner’s Guide to Navigating the COVID Crisis

COVID-19 caused a crisis in more ways than one. MarketWatch recently reported over 4.1 million homeowners are now on forbearance…

Service Members Facing Increased Risk of Identity Theft

This Memorial Day, Consolidated Credit wants to take some time to address a pressing issue our Service Members face: identity…

What Happens After Forbearance or a Payment Deferral?

Here’s what you need to know to protect your credit and avoid financial issues moving forward. Getting forbearance or a…

Experts Respond: How Should People Handle Debt after a Loss of Income?

As millions of Americans try to deal with income losses amidst coronavirus shutdowns, we asked 21 experts for their tips…

Small Businesses Affected by COVID Know Money Never Sleeps

Originally, Consolidated Credit planned a normal small business webinar for the month of May. Then, circumstances became anything but normal.…

How to Use Your Stimulus Check Wisely

Making sure the money you receive helps you get through the crisis. On March 27, 2020, Congress and the White…

Overspending for Credit Card Rewards You Never Use

Credit users crave cards that offer rewards but often neglect them. Credit card rewards are designed to encourage consumers to…

How Can I Save Money While I’m in Debt?

Saving money can’t wait for you to be debt-free. We asked 18 experts for their tips on how to save…

New FICO Credit Score Changes: Some Will Soar, Other Will Crash

A handful of small tweaks will have a huge impact on Americans’ credit scores – some for the better. Including…

Hindsight is 2020: How to learn from money mistakes

Even experts make money mistakes. Learn from our panel about money missteps and how you can learn from them and…

Retirement Savings Updates: The Impact of the SECURES Act

On January 1, 2020, the Setting Every Community Up for Retirement Enhancement (SECURE) Act officially became law. This important legislation…

14 Single Parents and Financial Experts on Money Challenges

Managing finances as a single parent is no joke. You’re responsible for making money, budgeting, paying bills, and saving for…

19 Experts Respond: Teens, Money and Financial Independence

Sometimes school education comes up short when it comes to teaching young people real fiscal responsibility. That’s where parents come…

Veterans to Qualify Automatically for Permanent Disability Student Loan Forgiveness

The Department of Education and VA will now coordinate to eliminate all paperwork required for disabled Veterans to qualify student…

10 Experts Answer: Overcoming the Challenges Women Face with Money

Women face many challenges where money, financing, investing and earning are concerned. The pay gap, children, work-life balance, and having…

What Happens When the Fed Lowers Interest Rates?

Whether you’re focused on saving, paying off debt or both, the latest Federal Reserve rate announcement may impact your strategy.…

Is Your Debt-to-Income Ratio Telling You It’s Time to Get Debt Help?

If your DTI is over 36 percent, then it’s time to act and find debt relief. It’s a question that…