Daily Finance and Company News (Page 8)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Is Facebook Guilty of Fair Housing Discrimination?

Even among all the other complaints about the social media networks, a new complaint from HUD stands out. Facebook hasn’t…

Reducing the High Cost of Credit Card Debt

Credit card debt costs Americans over $100 billion each year. Here’s what you can do to minimize the cost of…

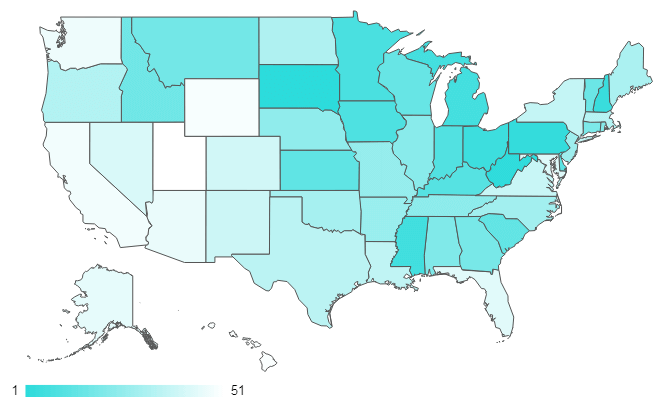

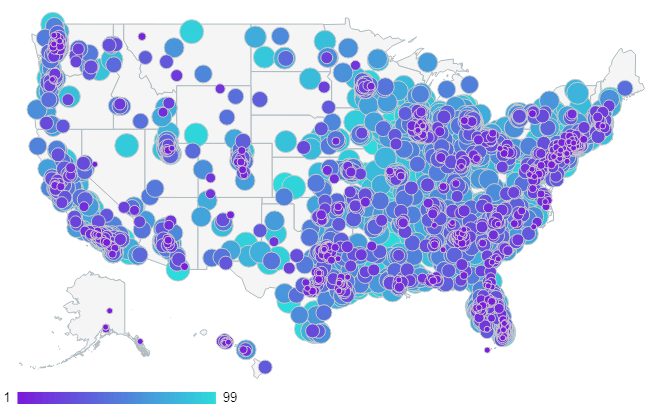

Which State Has the Highest Student Loan Debt?

A new WalletHub study ranks borrowers nationwide to see who really has the highest student loan debt burden. Each week,…

Dealing with Debt Caused by Domestic and Economic Abuse

Consolidated Credit is proud to help women find their power in financial freedom. There’s a common misconception that credit card…

Do You Know Your Annual Interest Rates?

Half of credit card users that currently have a balance don’t know their annual interest rates. Each week, Consolidated Credit…

How Much Should You Have in Emergency Savings?

Many Americans say they’re comfortable with their savings, even though they don’t have much of an emergency fund. Each week,…

Are Store Credit Cards Bad?

Rising delinquencies suggest two reasons why you might want to stay away from an in-store credit card. The debate has…

74% of Americans are Getting Married with Debt

And these couples aren’t doing themselves any favors starting their life together saddled with debt. Each week, Consolidated Credit searches…

One More Good Reason You Don’t Need Credit

As creditors scale back and banks scale up, it may be time to adjust your purchasing habits. For over two…

10 Money-Saving Summer Budget Tips

How to have fun in the sun this summer without taking on extra credit card debt. Summer has officially kicked…

Half of Teens Don’t See Becoming Financially Independent as a Key Life Goal

Helping your teen learn how to become financially independent as they transition to adulthood. Each week, Consolidated Credit searches for…

Is There a Tie between Student Loans and Credit Health?

A new FICO study finds that credit health may be a slippery slope when you have student loans. Each week,…

Consolidated Credit Brings Free Financial Literacy Publications to NSU

Thinking Money exhibit at the Alvin Sherman Library features a range of free financial literacy publications. As we finish off…

When is the Right Time to Retire Old Credit Cards?

20 million Americans haven’t changed their primary credit card in over 10 years. When it comes to technology, consumers always…

Are Long Term Auto Loans the Best Commitment?

New data shows that borrowers are on-average extending terms to over 5 years. But are the benefits worth the cost?…

What States Can Revoke Professional Licenses for Defaulted Student Loans?

A teacher in Texas lost his dream job due to student loan default, and it’s not the only state where…

Military Families Face a Financial Confidence Gap

Service Members are more confident than their spouses about their ability to be financially stable in the short and long-term.…

Why Women Hold More Student Debt

5 reasons why women hold two thirds of all student loans in repayment. Student loan debt in the U.S. now…

Can You Afford the Cost of Debt?

The latest interest rate hike by the Federal Reserve means the cost of debt from your credit cards just increased.…

How Credit Smart Are You?

Take Consolidated Credit’s free Credit Smart test to see how much you really know. It’s National Financial Literacy Month! All…

Don’t Loan Credit Cards!

36 million Americans learned the consequences of loaning credit cards to a friend in need. Each week, Consolidated Credit searches…

Dealing with Medical Debt Collections and Accident Liens

NBC6 Miami reveals some of the traps you can face with medical debt collections. Despite ongoing changes and adjustments to…

Is Mobile Banking Better?

Millennials are the most likely to use mobile banking technology, but they’re also the first to drop it. Each week,…

12% of Americans Had a Credit Card Declined Last Year

As Americans hit record-high credit card debt levels, declined transactions may only get worse. Each week, Consolidated Credit searches for…