Daily Finance and Company News (Page 12)

Consolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

-

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast

Now PlayingConsolidated Credit Honors Community Partners at 10th Annual Financial Literacy Breakfast -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

From the Military to the Mediocre

Veterans are finding civilian jobs, but they aren’t happy with the work. Hiring a military veteran isn’t a hard sell…

Teaching Children about Money Can Be a Chore

But if you make them work for it, children can learn a lot about finances. Do you make your children…

U.S. Takes the Bronze in Credit Card Fraud

More than 1/3 of the world’s credit card fraud comes from the U.S. It’s a dubious honor, but one the…

Savers, Spenders, and Love

Don’t let money ruin your relationships. Each week, Consolidated Credit searches for financial research that can help you deal with…

Credit Score Rebound

2.5 million consumers snap back to better credit as penalties expire. The end of this year and the start of…

Which Generation Has the Most Credit Card Debt?

Young Gen Xers are the most likely to have debt and hold high balances. When it comes to credit card…

Can Poor Credit Drive You Crazy?

If your credit score is low, your car insurance premiums are probably sky-high. If you have bad credit, don’t drive…

United We Stand in Debt

Regardless of your political leanings, we’re all in the same race with debt. Each week, Consolidated Credit searches for financial…

Not Out of the Woods with Student Loan Debt

CFPB predicts 1 in 3 rehabilitated borrowers will re-default within 2 years. If you’ve been working to catch up on…

The Biggest Barriers to Homeownership

High rent prices and too much student loan debt are holding buyers back. The American Dream of owning a home…

Will Traditional Banks Tank?

The brick-and-mortar bank may perish before you do. Each week, Consolidated Credit searches for financial research that can help you…

Subprime Auto Loans Hit a Ditch

Nearly 5 of every 100 subprime borrowers are now behind. News about consumer debt has not been pretty lately. From…

What Are Women Business Owners Worth?

The answer: Billions and billions of dollars. Small businesses owned by women are big business, according to a new report.…

Military Families Transition after Deployment

Adjusting your family’s financial life to a “garrison environment.” If you’re a military family staring down reduced income challenges following…

How Likely Are You to Default on Student Loan Debt?

A new interactive map shows default rates for U.S. borrowers by state. In case you’ve missed it, student loan debt…

Protecting Servicemembers from Financial Abuse at Home

Two big cases show the importance of the Servicemembers Civil Relief Act. When someone is risking their life to protect…

Good News in Personal Finance

Most polls about personal finance have been bleak this year. Not this one. Well, not totally. Each week, Consolidated Credit…

When Work Is a Total Disaster

Many employees say they’re not ready for a hurricane or other emergency – even though their bosses think they are…

Credit Card APR at 5-Year High

Higher rates won’t help families working to eliminate debt. Each week, Consolidated Credit searches for financial research that can help…

What Career Is Growing the Fastest?

You probably won’t believe it – and you definitely don’t want it. Talk about a growth industry: Identity thieves and…

The Mortgage Lending Paradox

Does a record-low default rate mean lending standards are too tough? Following the real estate market collapse in 2008, a…

HELOC Domino Effect

Study finds missed home equity payments are a sign of trouble to come. Each week, Consolidated Credit searches for financial…

Can You Read a Credit Card Agreement?

Over half of Americans don’t have the reading level necessary to understand most agreements. If you’re one of those people…

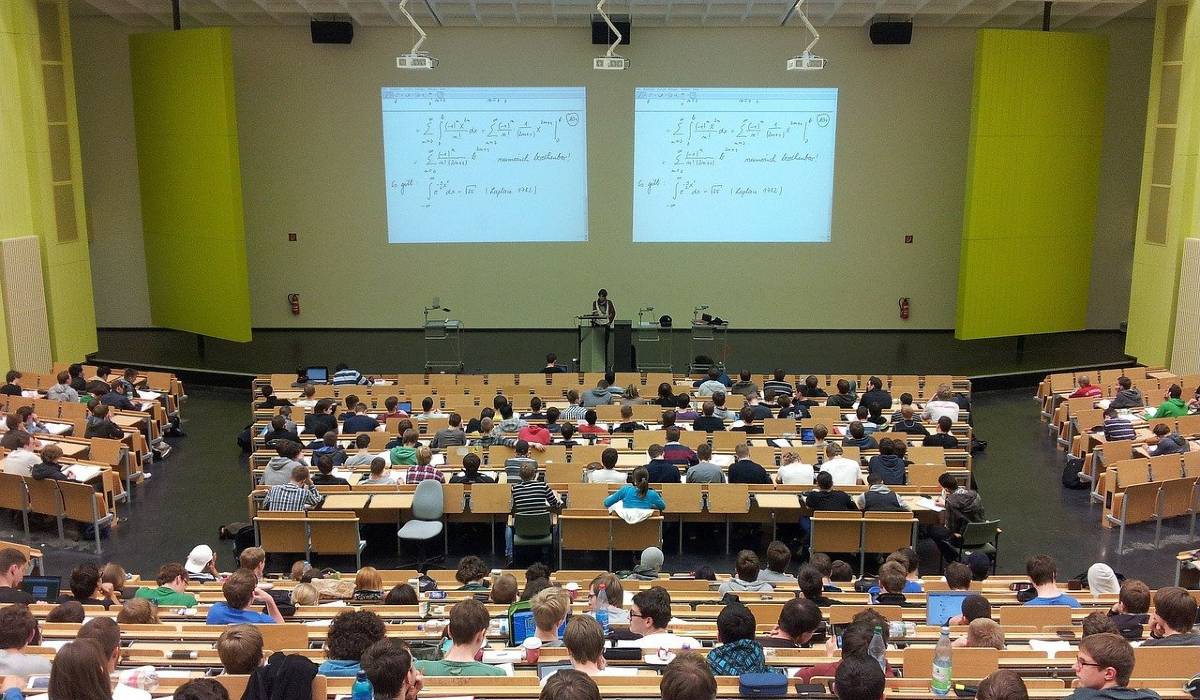

Parents Step Up College Savings

Giving your children their best chance for stability after graduation. While retirement savings may still be stuck in neutral for…