Daily Finance and Company News (Page 5)

Consolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

-

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts

Now PlayingConsolidated Credit and Debt.com Partnership with Junior Achievement to Stop Debt Before It Starts -

Up NextCelebrating 30 Years of Financial Education

Up NextCelebrating 30 Years of Financial Education -

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

Consolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity -

Homeownership: Your Path to Security & Stability

Homeownership: Your Path to Security & Stability -

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast -

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Supporting South Florida Veterans Through Mission United

Mission United of the United Way of Broward County highlights Consolidated Credit’s team In honor of Financial Literacy Month and…

April is Consolidated Credit Month in the City of Plantation!

Consolidated Credit is proud to be recognized for our work in expanding local financial literacy. On April 1st, Plantation’s City…

Be Prepared for Natural Disasters with Our Free Webinar

Learn to be better prepared for natural disasters before they hit your finances. Join us March 9 to learn how…

Share Your Thoughts About Online Shopping, Win $150

From in-store to on-line: e-Commerce is changing the way we shop. In 2022 alone, supply chain issues, ongoing inflation, and…

Understanding Common Credit Card Fees

Credit card fees are constantly changing. In order to judge them accurately, you need to know what the average credit…

Helping Gig Workers Get Ahead [Free Webinar]

Over one-third of Americans are shifting away from traditional, long-term employment. Instead, they’re turning to side hustles as a way…

Consolidated Credit Helps Veterans Connect with Useful Resources

Veterans Day is a time for Americans to pay their respects to those who have served the country. We stand…

Latinx is a Driving Force of Population and Economic Growth in the U.S.

There are big reasons to celebrate Hispanic Heritage, an increasingly indispensable powerhouse to the stability of the entire country. In…

Consolidated Credit Helps South Florida Renters Apply for Emergency Rental Assistance

In late August, the U.S. Treasury issued an update on the Emergency Rental Assistance Program (ERAP). The news was not…

Finding Work-Life Balance in the New Normal

Significant historical events, from the Great Depression to WW2, changed our society in unimaginable ways. The Great Depression gave us…

Adjusting Your Budget as You Return to Work

Now that the pandemic is (almost) over, the days of working from home should be coming to a close. Offices…

Learning to Avoid Common Money Mistakes

As our nation comes out of the pandemic, many of us are looking at our money habits and trying to…

What Parents Need to Know about the Advance Child Tax Credit [Updated July 2021]

Advance payments for the expanded Child Tax Credit started on July 15. Millions of eligible parents have already started to…

Should You Buy or Refinance Your Home?

Whether you’re buying a new home or refinancing your current one, your finances need to be in shape. Mortgage interest…

Are You Prepared for a Natural Disaster?

Storm season is almost upon us. It’s time to get prepped to avoid a financial disaster. After a record-breaking storm…

Overcoming the Unique Financial Challenges that Come with Military Service

April is Military Saves Month. It’s a month dedicated to raising awareness about the unique financial challenges that military personnel…

Consolidated Credit Announces a New Virtual Small Business Workshop Series

Teaching startups and entrepreneurs the ropes for running a small business Consolidated Credit and Comerica Bank will host a new…

Learning How to Survive Financial Stress

Even though life hasn’t entirely changed back to normal, Americans’ perspectives on their finances have changed—and in a good way.…

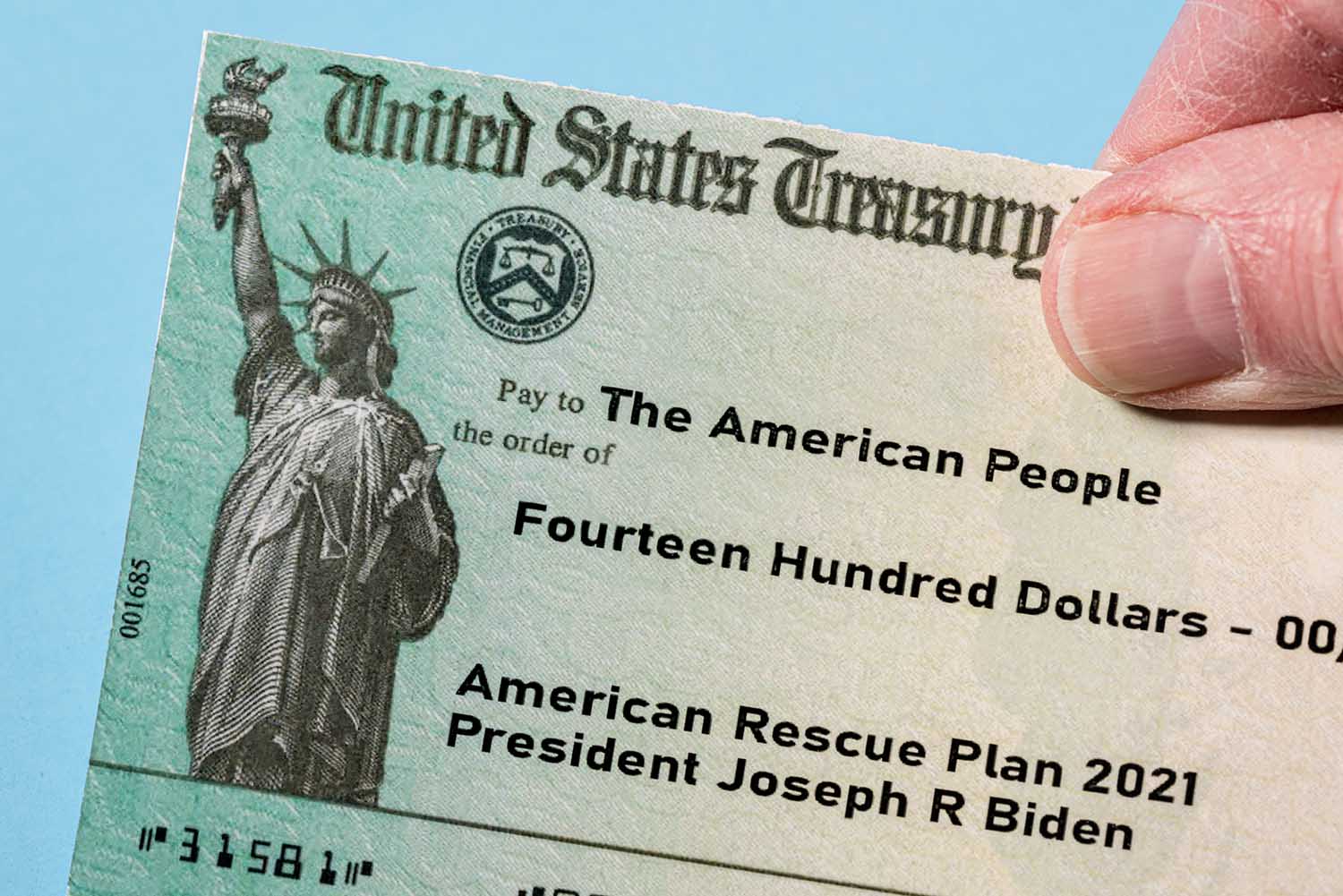

How to Get Your Stimulus Check if You Don’t File Taxes

You can still get your payments, but it may require filing taxes this year. Millions of Americans have already received…

Third Stimulus Leaves Americans Vulnerable to Garnishment

Congress has passed another landmark $1.9 trillion relief package to help Americans recover from this financial crisis. However, a technicality…

Overcoming Financial Infidelity: Couples Get Honest about Money

Between stay-at-home orders, more work from home hours, and school closures for kids, the pandemic has created plenty of new…

What’s the Best Debt Solution for You?

Finding the most effective method to get out of debt. If your goal this year is to pay off debt,…

Americans May Face a Crisis with Past Due Debt

Credit card defaults and delinquencies are expected to rise next year. If you focus solely on cold numbers, it looks…

Navigating the World of Credit Cards

This month, our free webinar will cover different types of credit cards, how to read your statement, and how to…

![Helping Gig Workers Get Ahead [Free Webinar]](https://www.consolidatedcredit.org/wp-content/uploads/2021/11/Making-the-most-of-the-gig-economy-video-preview.jpg)

![What Parents Need to Know about the Advance Child Tax Credit [Updated July 2021]](https://www.consolidatedcredit.org/wp-content/uploads/2020/01/Father-Teaches-Daughter-to-Save-thumbnail.jpg)